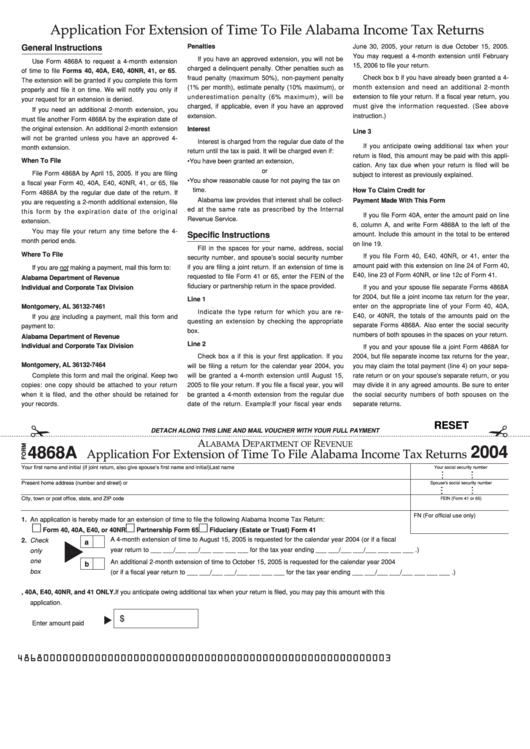

Application For Extension of Time To File Alabama Income Tax Returns

General Instructions

Penalties

June 30, 2005, your return is due October 15, 2005.

You may request a 4-month extension until February

If you have an approved extension, you will not be

Use Form 4868A to request a 4-month extension

15, 2006 to file your return.

charged a delinquent penalty. Other penalties such as

of time to file Forms 40, 40A, E40, 40NR, 41, or 65.

fraud penalty (maximum 50%), non-payment penalty

Check box b if you have already been granted a 4-

The extension will be granted if you complete this form

(1% per month), estimate penalty (10% maximum), or

month extension and need an additional 2-month

properly and file it on time. We will notify you only if

extension to file your return. If a fiscal year return, you

underestimation penalty (6% maximum), will be

your request for an extension is denied.

must give the information requested. (See above

charged, if applicable, even if you have an approved

If you need an additional 2-month extension, you

instruction.)

extension.

must file another Form 4868A by the expiration date of

the original extension. An additional 2-month extension

Interest

Line 3

will not be granted unless you have an approved 4-

Interest is charged from the regular due date of the

If you anticipate owing additional tax when your

month extension.

return until the tax is paid. It will be charged even if:

return is filed, this amount may be paid with this appli-

When To File

• You have been granted an extension,

cation. Any tax due when your return is filed will be

or

File Form 4868A by April 15, 2005. If you are filing

subject to interest as previously explained.

• You show reasonable cause for not paying the tax on

a fiscal year Form 40, 40A, E40, 40NR, 41, or 65, file

time.

How To Claim Credit for

Form 4868A by the regular due date of the return. If

Alabama law provides that interest shall be collect-

Payment Made With This Form

you are requesting a 2-month additional extension, file

ed at the same rate as prescribed by the Internal

this form by the expiration date of the original

If you file Form 40A, enter the amount paid on line

Revenue Service.

extension.

6, column A, and write Form 4868A to the left of the

You may file your return any time before the 4-

Specific Instructions

amount. Include this amount in the total to be entered

month period ends.

on line 19.

Fill in the spaces for your name, address, social

Where To File

If you file Form 40, E40, 40NR, or 41, enter the

security number, and spouse’s social security number

amount paid with this extension on line 24 of Form 40,

if you are filing a joint return. If an extension of time is

If you are not making a payment, mail this form to:

E40, line 23 of Form 40NR, or line 12c of Form 41.

requested to file Form 41 or 65, enter the FEIN of the

Alabama Department of Revenue

fiduciary or partnership return in the space provided.

If you and your spouse file separate Forms 4868A

Individual and Corporate Tax Division

for 2004, but file a joint income tax return for the year,

P.O. Box 327461

Line 1

enter on the appropriate line of your Form 40, 40A,

Montgomery, AL 36132-7461

Indicate the type return for which you are re-

E40, or 40NR, the totals of the amounts paid on the

If you are including a payment, mail this form and

questing an extension by checking the appropriate

separate Forms 4868A. Also enter the social security

payment to:

box.

numbers of both spouses in the spaces on your return.

Alabama Department of Revenue

Line 2

Individual and Corporate Tax Division

If you and your spouse file a joint Form 4868A for

P.O. Box 327464

Check box a if this is your first application. If you

2004, but file separate income tax returns for the year,

Montgomery, AL 36132-7464

will be filing a return for the calendar year 2004, you

you may claim the total payment (line 4) on your sepa-

Complete this form and mail the original. Keep two

will be granted a 4-month extension until August 15,

rate return or on your spouse’s separate return, or you

copies: one copy should be attached to your return

2005 to file your return. If you file a fiscal year, you will

may divide it in any agreed amounts. Be sure to enter

when it is filed, and the other should be retained for

be granted a 4-month extension from the regular due

the social security numbers of both spouses on the

your records.

date of the return. Example: If your fiscal year ends

separate returns.

RESET

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

A

D

R

LABAMA

EPARTMENT OF

EVENUE

2004

4868A

Application For Extension of Time To File Alabama Income Tax Returns

Your first name and initial (if joint return, also give spouse’s first name and initial)

Last name

Your social security number

Present home address (number and street) or P.O. Box

Spouse’s social security number

City, town or post office, state, and ZIP code

FEIN (Form 41 or 65)

FN

(For official use only)

1. An application is hereby made for an extension of time to file the following Alabama Income Tax Return:

Form 40, 40A, E40, or 40NR

Partnership Form 65

Fiduciary (Estate or Trust) Form 41

A 4-month extension of time to August 15, 2005 is requested for the calendar year 2004 (or if a fiscal

2. Check

a

year return to ___ ___/___ ___/___ ___ ___ ___ for the tax year ending ___ ___/___ ___/___ ___ ___ ___ .)

only

one

An additional 2-month extension of time to October 15, 2005 is requested for the calendar year 2004

b

box

(or if a fiscal year return to ___ ___/___ ___/___ ___ ___ ___ for the tax year ending ___ ___/___ ___/___ ___ ___ ___ .)

3. APPLICABLE TO FORMS 40, 40A, E40, 40NR, and 41 ONLY. If you anticipate owing additional tax when your return is filed, you may pay this amount with this

application.

$

Enter amount paid here.

Full payment of the amount entered must be paid with this application. Partial payments will not be accepted.

4868000000000000000000000000000000000000000000000000000003

1

1