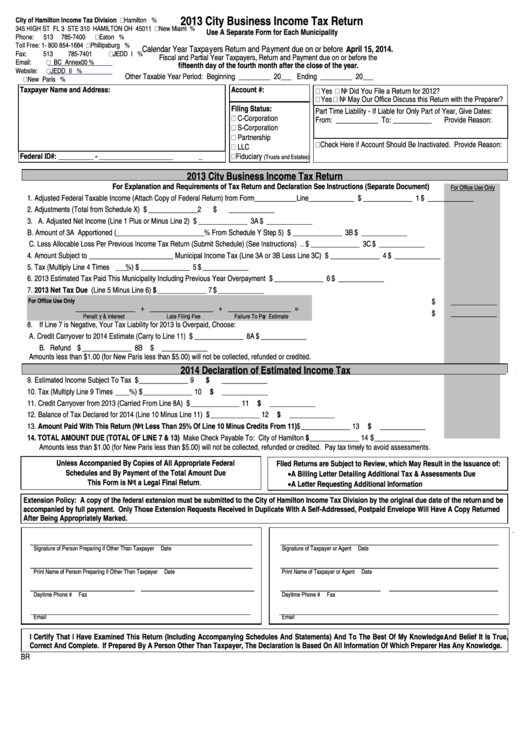

City Business Income Tax Return Form - City Of Hamilton - 2013

ADVERTISEMENT

2013 City Business Income Tax Return

City of Hamilton Income Tax Division

Hamilton .................. 2.00 %

345 HIGH ST FL 3 STE 310 HAMILTON OH 45011

New Miami .............. 1.75 %

Use A Separate Form for Each Municipality

Phone:

513 785-7400

Eaton ....................... 1.50 %

Toll Free: 1- 800 854-1684

Phillipsburg .............. 1.50 %

Calendar Year Taxpayers Return and Payment due on or before April 15, 2014.

Fax:

513 785-7401

JEDD I ..................... 2.00 %

Fiscal and Partial Year Taxpayers, Return and Payment due on or before the

Email:

citytax@ci.hamilton.oh.us

BC Annex ................ 2.00 %

fifteenth day of the fourth month after the close of the year.

Website:

JEDD II .................... 2.00 %

Other Taxable Year Period: Beginning _________

20___

Ending _________ 20___

New Paris ................ 1.00 %

Taxpayer Name and Address:

Account #:

Yes

No Did You File a Return for 2012?

Yes

No May Our Office Discuss this Return with the Preparer?

Filing Status:

Part Time Liability - If Liable for Only Part of Year, Give Dates:

C-Corporation

From: ____________ To: ___________

Provide Reason:

S-Corporation

Partnership

Check Here if Account Should Be Inactivated. Provide Reason:

LLC

Federal ID#:

__________ - ______________________

Fiduciary

(Trusts and Estates)

2013 City Business Income Tax Return

For Explanation and Requirements of Tax Return and Declaration See Instructions (Separate Document)

For Office Use Only

1. Adjusted Federal Taxable Income (Attach Copy of Federal Return) from Form____________Line_____________ ....... $ ______________ 1

$ _____________

2. Adjustments (Total from Schedule X) ................................................................................................................................. $ ______________ 2

$ _____________

3. A. Adjusted Net Income (Line 1 Plus or Minus Line 2) ...................................................................................................... $ ______________ 3A $ _____________

B. Amount of 3A Apportioned (_________________________% From Schedule Y Step 5) ......................................... $ ______________ 3B $ _____________

C. Less Allocable Loss Per Previous Income Tax Return (Submit Schedule) (See Instructions) ..................................... $ ______________ 3C $ _____________

4. Amount Subject to ________________________ Municipal Income Tax (Line 3A or 3B Less Line 3C) .......................... $ ______________ 4

$ _____________

5. Tax (Multiply Line 4 Times

%) ..................................................................................................................................... $ ______________ 5

$ _____________

6. 2013 Estimated Tax Paid This Municipality Including Previous Year Overpayment .......................................................... $ ______________ 6

$ _____________

7. 2013 Net Tax Due (Line 5 Minus Line 6)......................................................................................................................... $ ______________ 7

$ _____________

For Office Use Only

$ _____________

_________________ + __________________ + __________________ =

$ _____________

Penalty & Interest

Late Filing Fee

Failure To Pay Estimate

8. If Line 7 is Negative, Your Tax Liability for 2013 Is Overpaid, Choose:

A. Credit Carryover to 2014 Estimate (Carry to Line 11) .................................................................................................. $ ______________ 8A $ _____________

B. Refund ........................................................................................................................................................................... $ ______________ 8B $ _____________

Amounts less than $1.00 (for New Paris less than $5.00) will not be collected, refunded or credited.

2014 Declaration of Estimated Income Tax

9. Estimated Income Subject To Tax ...................................................................................................................................... $ ______________ 9

$ _____________

10. Tax (Multiply Line 9 Times

%) ..................................................................................................................................... $ ______________ 10

$ _____________

11. Credit Carryover from 2013 (Carried From Line 8A) .......................................................................................................... $ ______________ 11

$ _____________

12. Balance of Tax Declared for 2014 (Line 10 Minus Line 11) ................................................................................................ $ ______________ 12

$ _____________

13. Amount Paid With This Return (Not Less Than 25% Of Line 10 Minus Credits From 11) ......................................... $ ______________ 13

$ _____________

14. TOTAL AMOUNT DUE (TOTAL OF LINE 7 & 13) ...................................... Make Check Payable To: City of Hamilton $ ______________ 14

$ _____________

Amounts less than $1.00 (for New Paris less than $5.00) will not be collected, refunded or credited. Pay tax timely to avoid assessments.

Unless Accompanied By Copies of All Appropriate Federal

Filed Returns are Subject to Review, which May Result in the Issuance of:

Schedules and By Payment of the Total Amount Due

A Billing Letter Detailing Additional Tax & Assessments Due

This Form is Not a Legal Final Return.

A Letter Requesting Additional Information

Extension Policy: A copy of the federal extension must be submitted to the City of Hamilton Income Tax Division by the original due date of the return and be

accompanied by full payment. Only Those Extension Requests Received In Duplicate With A Self-Addressed, Postpaid Envelope Will Have A Copy Returned

After Being Appropriately Marked.

.

___________________________________________________

__________________________________________________

Signature of Person Preparing if Other Than Taxpayer

Date

Signature of Taxpayer or Agent

Date

___________________________________________________

__________________________________________________

Print Name of Person Preparing if Other Than Taxpayer

Date

Print Name of Taxpayer or Agent

Date

________________________ __________________________

_______________________ _________________________

Daytime Phone #

Fax

Daytime Phone #

Fax

_______________________________________________________________________________

_______________________________________________________________________________

Email

Email

I Certify That I Have Examined This Return (Including Accompanying Schedules And Statements) And To The Best Of My Knowledge And Belief It Is True,

Correct And Complete. If Prepared By A Person Other Than Taxpayer, The Declaration Is Based On All Information Of Which Preparer Has Any Knowledge.

BR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2