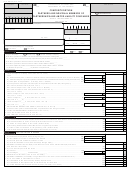

Form 482.0(C) - Composite Return Partners And Individual Members Of Partnerships And Limited Liability Companies Page 3

ADVERTISEMENT

INDIVIDUAL PARTNER OR MEMBER

Schedule I (C)

COMPOSITE RETURN

Rev. 05.13

2012

Affidavit

(To be filed with Form 482(C) or Form 480.20(C))

Taxable year beginning on ______________________, ________ and ending on _____________________, ________

Social Security Number

Name

Personal Circumstances

Address

Citizen of the United States:

Yes

No

If yes:

Personal Exemptions (1 if single, 2 if married) _____

Number of dependents .................................. _____

The undersigned taxpayer under oath, being duly sworn, hereby certifies and agrees as follows:

1.

My name, social security number, address and personal circumstances are as stated above.

2.

I was not a resident of Puerto Rico during any part of the captioned taxable year.

3.

I am a partner or member of the pass-through entity described in Item 4.

4.

Name of Entity: ______________________________________________________________________________________________________

Entity’s Employer Identification Number: ____________________________________________________________________________________

Entity’s address: ______________________________________________________________________________________________________

___________________________________________________________________________________________________

Type of Entity:

Partnership engaged in trade or business in Puerto Rico

Limited liability company (LLC)

Pass-thru entity member of a Partnership engaged in trade or business in Puerto Rico (Resident Partnership)

Name of the Resident Partnership ___________________________________________________

Employer Identification Number (EIN) of the Resident Partnership __________________________

Taxpayer’s participation in the entity’s income, gains or losses: _____________%

5.

The type of income for which this affidavit and agreement applies is:

Distributed or undistributed Puerto Rico income from a partnership

Distributed or undistributed Puerto Rico income from an LLC taxed as a partnership

I have no other Puerto Rico source income or source of income taxable in Puerto Rico other than from the entity described in item 4.

6.

7.

I agree to be included in the composite return to be filed by the entity described in item 4, and that any refund resulting thereof be disbursed to said entity.

8

This affidavit applies for the captioned taxable year.

The undersigned understands that any false statement contained herein could be punished by fine, imprisonment or both.

Under penalties of perjury, I declare that I have examined this affidavit and agreement and, to the best of my knowledge and belief, it is true, correct

and complete.

Signature of partner or member

Date

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3