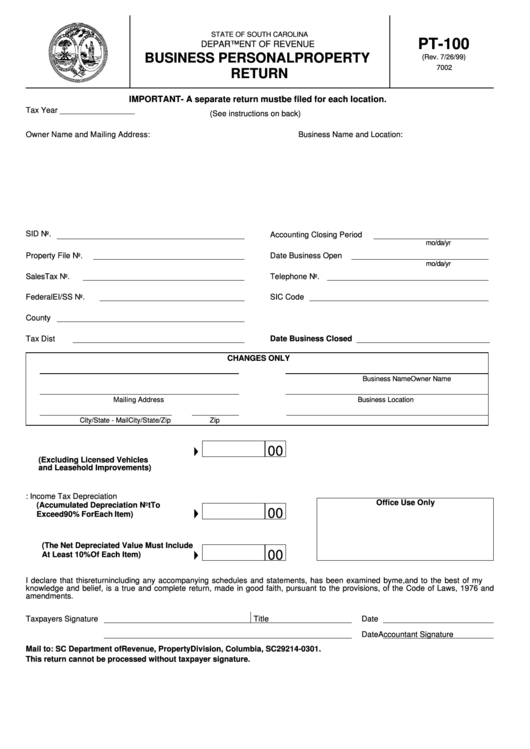

Form Pt-100 - Business Personal Property Return

ADVERTISEMENT

STATE OF SOUTH CAROLINA

PT-100

DEPARTMENT OF REVENUE

BUSINESS PERSONAL PROPERTY

(Rev. 7/26/99)

7002

RETURN

IMPORTANT - A separate return must be filed for each location.

Tax Year _________________

(See instructions on back)

Owner Name and Mailing Address:

Business Name and Location:

SID No.

Accounting Closing Period

mo/da/yr

Property File No.

Date Business Open

mo/da/yr

Sales Tax No.

Telephone No.

Federal EI/SS No.

SIC Code

County

Tax Dist

Date Business Closed

CHANGES ONLY

Owner Name

Business Name

Mailing Address

Business Location

City/State - Mail

Zip

City/State/Zip

00

1. Total Acquisition Cost .................................

(Excluding Licensed Vehicles

and Leasehold Improvements)

2. Less: Income Tax Depreciation

Office Use Only

(Accumulated Depreciation Not To

00

Exceed 90% For Each Item) ......................

3.

Net Depreciated Value

(The Net Depreciated Value Must Include

00

At Least 10% Of Each Item) ..................

I declare that this return including any accompanying schedules and statements, has been examined by me, and to the best of my

knowledge and belief, is a true and complete return, made in good faith, pursuant to the provisions, of the Code of Laws, 1976 and

amendments.

Taxpayers Signature

Title

Date

Accountant Signature

Date

Mail to: SC Department of Revenue, Property Division, Columbia, SC 29214-0301.

This return cannot be processed without taxpayer signature.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1