Form Ia 1040es - Individual Income Estimate Payment Voucher - 2014, Form 45-009 - Estimated Income Tax For Individuals

ADVERTISEMENT

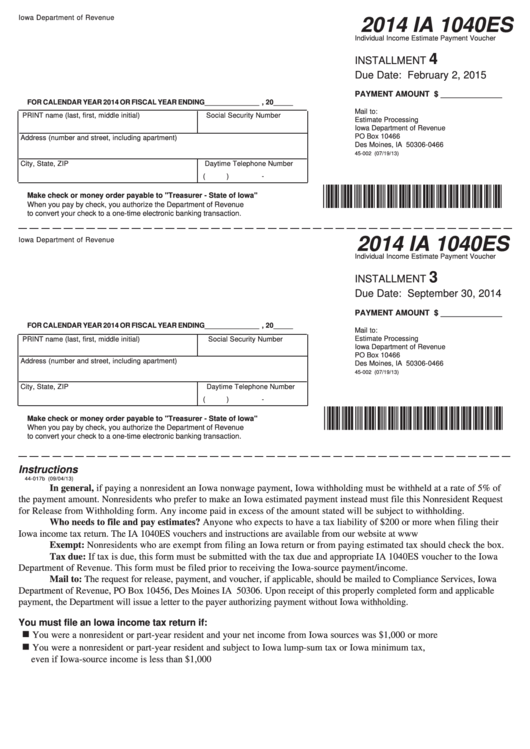

Iowa Department of Revenue

2014 IA 1040ES

Individual Income Estimate Payment Voucher

4

INSTALLMENT

Due Date: February 2, 2015

PAYMENT AMOUNT $ ______________

FOR CALENDAR YEAR 2014 OR FISCAL YEAR ENDING ______________ , 20 _____

Mail to:

PRINT name (last, first, middle initial)

Social Security Number

Estimate Processing

Iowa Department of Revenue

PO Box 10466

Address (number and street, including apartment)

Des Moines, IA 50306-0466

45-002 (07/19/13)

City, State, ZIP

Daytime Telephone Number

(

)

-

*1345002019999*

Make check or money order payable to "Treasurer - State of Iowa"

When you pay by check, you authorize the Department of Revenue

to convert your check to a one-time electronic banking transaction.

2014 IA 1040ES

Iowa Department of Revenue

Individual Income Estimate Payment Voucher

3

INSTALLMENT

Due Date: September 30, 2014

PAYMENT AMOUNT $ ______________

FOR CALENDAR YEAR 2014 OR FISCAL YEAR ENDING ______________ , 20 _____

Mail to:

Estimate Processing

PRINT name (last, first, middle initial)

Social Security Number

Iowa Department of Revenue

PO Box 10466

Address (number and street, including apartment)

Des Moines, IA 50306-0466

45-002 (07/19/13)

City, State, ZIP

Daytime Telephone Number

(

)

-

*1345002019999*

Make check or money order payable to "Treasurer - State of Iowa"

When you pay by check, you authorize the Department of Revenue

to convert your check to a one-time electronic banking transaction.

Instructions

44-017b (09/04/13)

In general, if paying a nonresident an Iowa nonwage payment, Iowa withholding must be withheld at a rate of 5% of

the payment amount. Nonresidents who prefer to make an Iowa estimated payment instead must file this Nonresident Request

for Release from Withholding form. Any income paid in excess of the amount stated will be subject to withholding.

Who needs to file and pay estimates? Anyone who expects to have a tax liability of $200 or more when filing their

Iowa income tax return. The IA 1040ES vouchers and instructions are available from our website at

Exempt: Nonresidents who are exempt from filing an Iowa return or from paying estimated tax should check the box.

Tax due: If tax is due, this form must be submitted with the tax due and appropriate IA 1040ES voucher to the Iowa

Department of Revenue. This form must be filed prior to receiving the Iowa-source payment/income.

Mail to: The request for release, payment, and voucher, if applicable, should be mailed to Compliance Services, Iowa

Department of Revenue, PO Box 10456, Des Moines IA 50306. Upon receipt of this properly completed form and applicable

payment, the Department will issue a letter to the payer authorizing payment without Iowa withholding.

You must file an Iowa income tax return if:

You were a nonresident or part-year resident and your net income from Iowa sources was $1,000 or more

You were a nonresident or part-year resident and subject to Iowa lump-sum tax or Iowa minimum tax,

even if Iowa-source income is less than $1,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3