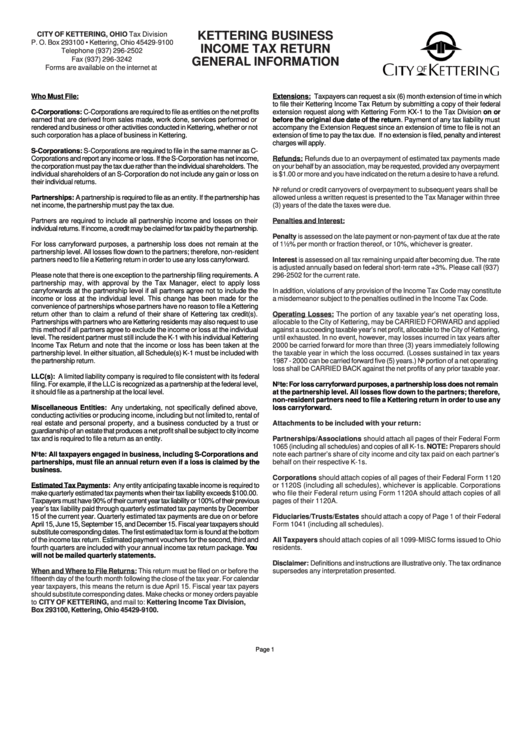

Kettering Business Income Tax Return General Information

ADVERTISEMENT

KETTERING BUSINESS

CITY OF KETTERING, OHIO Tax Division

P. O. Box 293100 • Kettering, Ohio 45429-9100

INCOME TAX RETURN

Telephone (937) 296-2502

Fax (937) 296-3242

GENERAL INFORMATION

Forms are available on the internet at

Who Must File:

Extensions: Taxpayers can request a six (6) month extension of time in which

to file their Kettering Income Tax Return by submitting a copy of their federal

C-Corporations: C-Corporations are required to file as entities on the net profits

extension request along with Kettering Form KX-1 to the Tax Division on or

earned that are derived from sales made, work done, services performed or

before the original due date of the return. Payment of any tax liability must

rendered and business or other activities conducted in Kettering, whether or not

accompany the Extension Request since an extension of time to file is not an

such corporation has a place of business in Kettering.

extension of time to pay the tax due. If no extension is filed, penalty and interest

charges will apply.

S-Corporations: S-Corporations are required to file in the same manner as C-

Corporations and report any income or loss. If the S-Corporation has net income,

Refunds: Refunds due to an overpayment of estimated tax payments made

the corporation must pay the tax due rather than the individual shareholders. The

on your behalf by an association, may be requested, provided any overpayment

individual shareholders of an S-Corporation do not include any gain or loss on

is $1.00 or more and you have indicated on the return a desire to have a refund.

their individual returns.

No refund or credit carryovers of overpayment to subsequent years shall be

Partnerships: A partnership is required to file as an entity. If the partnership has

allowed unless a written request is presented to the Tax Manager within three

net income, the partnership must pay the tax due.

(3) years of the date the taxes were due.

Partners are required to include all partnership income and losses on their

Penalties and Interest:

individual returns. If income, a credit may be claimed for tax paid by the partnership.

Penalty is assessed on the late payment or non-payment of tax due at the rate

For loss carryforward purposes, a partnership loss does not remain at the

of 1½% per month or fraction thereof, or 10%, whichever is greater.

partnership level. All losses flow down to the partners; therefore, non-resident

partners need to file a Kettering return in order to use any loss carryforward.

Interest is assessed on all tax remaining unpaid after becoming due. The rate

is adjusted annually based on federal short-term rate +3%. Please call (937)

Please note that there is one exception to the partnership filing requirements. A

296-2502 for the current rate.

partnership may, with approval by the Tax Manager, elect to apply loss

carryforwards at the partnership level if all partners agree not to include the

In addition, violations of any provision of the Income Tax Code may constitute

income or loss at the individual level. This change has been made for the

a misdemeanor subject to the penalties outlined in the Income Tax Code.

convenience of partnerships whose partners have no reason to file a Kettering

return other than to claim a refund of their share of Kettering tax credit(s).

Operating Losses: The portion of any taxable year’s net operating loss,

Partnerships with partners who are Kettering residents may also request to use

allocable to the City of Kettering, may be CARRIED FORWARD and applied

this method if all partners agree to exclude the income or loss at the individual

against a succeeding taxable year’s net profit, allocable to the City of Kettering,

level. The resident partner must still include the K-1 with his individual Kettering

until exhausted. In no event, however, may losses incurred in tax years after

Income Tax Return and note that the income or loss has been taken at the

2000 be carried forward for more than three (3) years immediately following

partnership level. In either situation, all Schedule(s) K-1 must be included with

the taxable year in which the loss occurred. (Losses sustained in tax years

the partnership return.

1987 - 2000 can be carried forward five (5) years.) No portion of a net operating

loss shall be CARRIED BACK against the net profits of any prior taxable year.

LLC(s): A limited liability company is required to file consistent with its federal

filing. For example, if the LLC is recognized as a partnership at the federal level,

Note: For loss carryforward purposes, a partnership loss does not remain

it should file as a partnership at the local level.

at the partnership level. All losses flow down to the partners; therefore,

non-resident partners need to file a Kettering return in order to use any

Miscellaneous Entities: Any undertaking, not specifically defined above,

loss carryforward.

conducting activities or producing income, including but not limited to, rental of

real estate and personal property, and a business conducted by a trust or

Attachments to be included with your return:

guardianship of an estate that produces a net profit shall be subject to city income

tax and is required to file a return as an entity.

Partnerships/Associations should attach all pages of their Federal Form

1065 (including all schedules) and copies of all K-1s. NOTE: Preparers should

Note: All taxpayers engaged in business, including S-Corporations and

note each partner’s share of city income and city tax paid on each partner’s

partnerships, must file an annual return even if a loss is claimed by the

behalf on their respective K-1s.

business.

Corporations should attach copies of all pages of their Federal Form 1120

Estimated Tax Payments: Any entity anticipating taxable income is required to

or 1120S (including all schedules), whichever is applicable. Corporations

make quarterly estimated tax payments when their tax liability exceeds $100.00.

who file their Federal return using Form 1120A should attach copies of all

Taxpayers must have 90% of their current year tax liability or 100% of their previous

pages of their 1120A.

year’s tax liability paid through quarterly estimated tax payments by December

15 of the current year. Quarterly estimated tax payments are due on or before

Fiduciaries/Trusts/Estates should attach a copy of Page 1 of their Federal

April 15, June 15, September 15, and December 15. Fiscal year taxpayers should

Form 1041 (including all schedules).

substitute corresponding dates. The first estimated tax form is found at the bottom

of the income tax return. Estimated payment vouchers for the second, third and

All Taxpayers should attach copies of all 1099-MISC forms issued to Ohio

fourth quarters are included with your annual income tax return package. You

residents.

will not be mailed quarterly statements.

Disclaimer: Definitions and instructions are illustrative only. The tax ordinance

When and Where to File Returns: This return must be filed on or before the

supersedes any interpretation presented.

fifteenth day of the fourth month following the close of the tax year. For calendar

year taxpayers, this means the return is due April 15. Fiscal year tax payers

should substitute corresponding dates. Make checks or money orders payable

to CITY OF KETTERING, and mail to: Kettering Income Tax Division, P.O.

Box 293100, Kettering, Ohio 45429-9100.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2