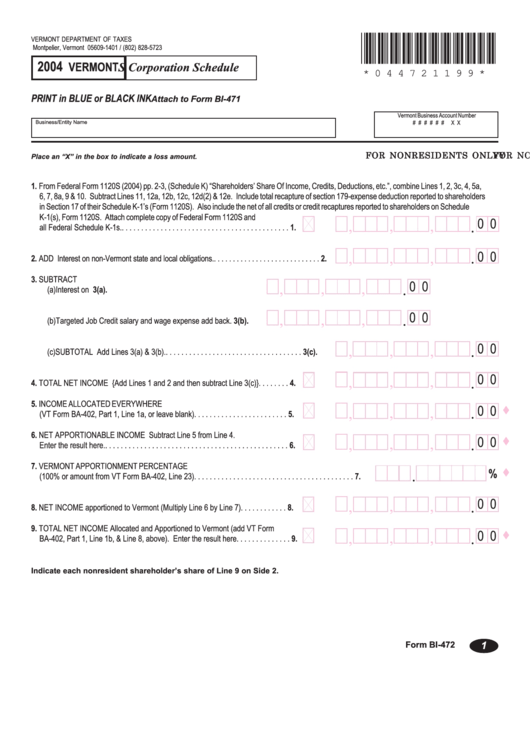

Vermont Form Bi-472 - S Corporation Schedule - 2004

ADVERTISEMENT

*044721199*

VERMONT DEPARTMENT OF TAXES

Montpelier, Vermont 05609-1401 / (802) 828-5723

2004

VERMONT S Corporation Schedule

* 0 4 4 7 2 1 1 9 9 *

PRINT in BLUE or BLACK INK

Attach to Form BI-471

Vermont Business Account Number

Business/Entity Name

# # # # # #

X X

FOR NONRESIDENTS ONL

FOR NONRESIDENTS ONL

FOR NONRESIDENTS ONL

FOR NONRESIDENTS ONL

FOR NONRESIDENTS ONLY Y Y Y Y

Place an “X” in the box to indicate a loss amount.

1. From Federal Form 1120S (2004) pp. 2-3, (Schedule K) “Shareholders’ Share Of Income, Credits, Deductions, etc.”, combine Lines 1, 2, 3c, 4, 5a,

6, 7, 8a, 9 & 10. Subtract Lines 11, 12a, 12b, 12c, 12d(2) & 12e. Include total recapture of section 179-expense deduction reported to shareholders

in Section 17 of their Schedule K-1’s (Form 1120S). Also include the net of all credits or credit recaptures reported to shareholders on Schedule

K-1(s), Form 1120S. Attach complete copy of Federal Form 1120S and

0 0

,

,

,

.

all Federal Schedule K-1s. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

0 0

,

,

,

.

2. ADD Interest on non-Vermont state and local obligations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. SUBTRACT

0 0

,

,

,

.

(a) Interest on U.S. Government obligations . . . . . . . . . . . . . . 3(a).

0 0

,

,

,

.

(b) Targeted Job Credit salary and wage expense add back . 3(b).

0 0

,

,

,

.

(c) SUBTOTAL Add Lines 3(a) & 3(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3(c).

0 0

,

,

,

.

4. TOTAL NET INCOME {Add Lines 1 and 2 and then subtract Line 3(c)} . . . . . . . .

4.

5. INCOME ALLOCATED EVERYWHERE

0 0

,

,

,

.

(VT Form BA-402, Part 1, Line 1a, or leave blank) . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. NET APPORTIONABLE INCOME Subtract Line 5 from Line 4.

0 0

,

,

,

.

Enter the result here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. VERMONT APPORTIONMENT PERCENTAGE

%

.

(100% or amount from VT Form BA-402, Line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

0 0

,

,

,

.

8. NET INCOME apportioned to Vermont (Multiply Line 6 by Line 7) . . . . . . . . . . . .

8.

9. TOTAL NET INCOME Allocated and Apportioned to Vermont (add VT Form

0 0

,

,

,

.

BA-402, Part 1, Line 1b, & Line 8, above). Enter the result here. . . . . . . . . . . . . .

9.

Indicate each nonresident shareholder’s share of Line 9 on Side 2.

Form BI-472

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2