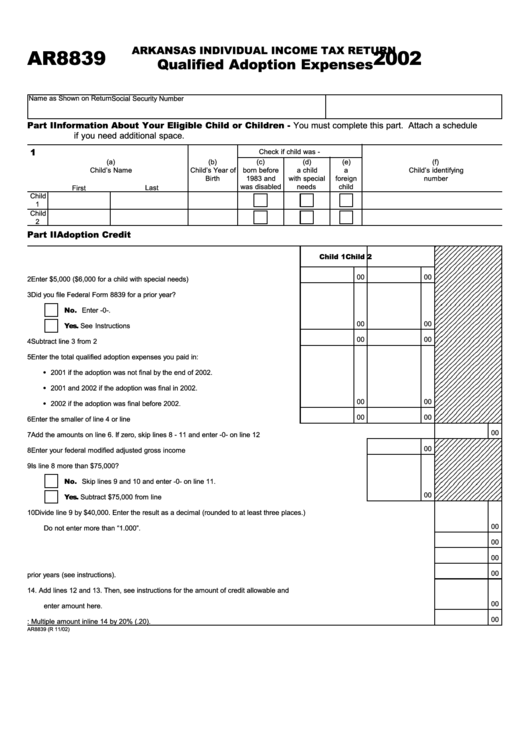

Form Ar8839 - Qualified Adoption Expenses -2002

ADVERTISEMENT

ARKANSAS INDIVIDUAL INCOME TAX RETURN

AR8839

2002

Qualified Adoption Expenses

Name as Shown on Return

Social Security Number

Part I

Information About Your Eligible Child or Children - You must complete this part. Attach a schedule

if you need additional space.

1

Check if child was -

(a)

(b)

(c)

(d)

(e)

(f)

Child’s Name

Child’s Year of

born before

a child

a

Child’s identifying

1983 and

Birth

with special

foreign

number

was disabled

needs

child

First

Last

Child

1

Child

2

Part II

Adoption Credit

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

Child 1

Child 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

00

00

2

Enter $5,000 ($6,000 for a child with special needs) ............................................. 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3

Did you file Federal Form 8839 for a prior year?

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

No. Enter -0-.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

00

00

Yes. See Instructions ................................................................................. 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

00

00

4

Subtract line 3 from 2 ............................................................................................ 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

5

Enter the total qualified adoption expenses you paid in:

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

• 2001 if the adoption was not final by the end of 2002.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

• 2001 and 2002 if the adoption was final in 2002.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

00

00

• 2002 if the adoption was final before 2002. ....................................................... 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

00

00

6

Enter the smaller of line 4 or line 5 ........................................................................ 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

00

7

Add the amounts on line 6. If zero, skip lines 8 - 11 and enter -0- on line 12 ................................................................................ 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

00

8

Enter your federal modified adjusted gross income .................................................................................. 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

9

Is line 8 more than $75,000?

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

No. Skip lines 9 and 10 and enter -0- on line 11.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

00

Yes. Subtract $75,000 from line 8. ................................................................................................ 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

10

Divide line 9 by $40,000. Enter the result as a decimal (rounded to at least three places.)

00

Do not enter more than “1.000”. .................................................................................................................................................. 10

00

11.

Multipy line 7 by line 10. .............................................................................................................................................................. 11

00

12. Subtract line 11 from line 7. ......................................................................................................................................................... 12

00

13. Carryforward of adoption credit from prior years (see instructions). ............................................................................................ 13

14.

Add lines 12 and 13. Then, see instructions for the amount of credit allowable and

00

enter amount here. ...................................................................................................................................................................... 14

00

15. Arkansas credit: Multiple amount in line 14 by 20% (.20). ........................................................................................................... 15

AR8839 (R 11/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2