Form Uct-6 - Florida Division Of Unemployment Compensation Employer'S Quarterly Report

ADVERTISEMENT

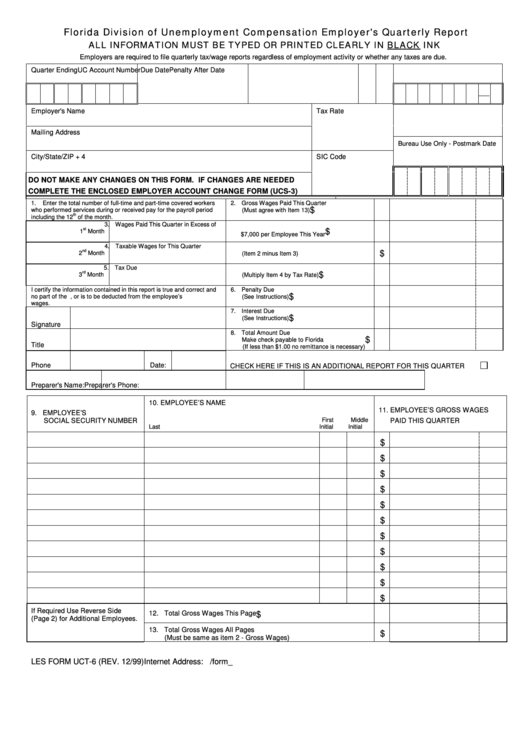

Florida Division of Unemployment Compensation Employer's Quarterly Report

ALL INFORMATION MUST BE TYPED OR PRINTED CLEARLY IN BLACK INK

Employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

Quarter Ending

Due Date

Penalty After Date

UC Account Number

Employer's Name

Tax Rate

F.E.I. Number

Mailing Address

Bureau Use Only - Postmark Date

City/State/ZIP + 4

SIC Code

DO NOT MAKE ANY CHANGES ON THIS FORM. IF CHANGES ARE NEEDED

COMPLETE THE ENCLOSED EMPLOYER ACCOUNT CHANGE FORM (UCS-3)

1.

Enter the total number of full-time and part-time covered workers

2. Gross Wages Paid This Quarter

$

who performed services during or received pay for the payroll period

(Must agree with Item 13)

th

including the 12

of the month.

3. Wages Paid This Quarter in Excess of

st

$

1

Month

$7,000 per Employee This Year

4. Taxable Wages for This Quarter

nd

$

2

Month

(Item 2 minus Item 3)

5. Tax Due

rd

$

3

Month

(Multiply Item 4 by Tax Rate)

I certify the information contained in this report is true and correct and

6. Penalty Due

$

no part of the U.C. tax was, or is to be deducted from the employee’ s

(See Instructions)

wages.

7. Interest Due

$

(See Instructions)

Signature

8. Total Amount Due

$

Make check payable to Florida U.C. Fund

Title

(If less than $1.00 no remittance is necessary)

Phone

Date:

CHECK HERE IF THIS IS AN ADDITIONAL REPORT FOR THIS QUARTER

Preparer's Name:

Preparer's Phone:

10. EMPLOYEE’ S NAME

11. EMPLOYEE’ S GROSS WAGES

9. EMPLOYEE’ S

First

Middle

SOCIAL SECURITY NUMBER

PAID THIS QUARTER

Last

Initial

Initial

$

$

$

$

$

$

$

$

$

$

$

If Required Use Reverse Side

12. Total Gross Wages This Page

$

(Page 2) for Additional Employees.

13. Total Gross Wages All Pages

$

(Must be same as item 2 - Gross Wages)

LES FORM UCT-6 (REV. 12/99)

Internet Address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3