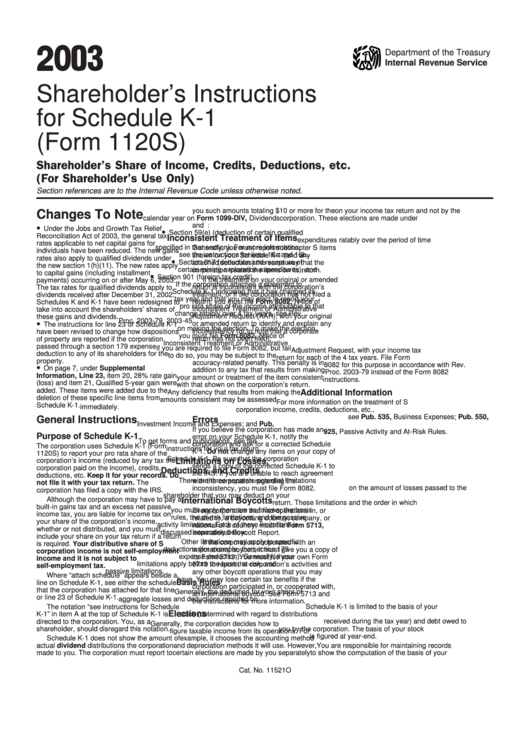

Shareholder'S Instructions For Schedule K-1 (Form 1120s) - 2003

ADVERTISEMENT

03

2 0

Department of the Treasury

Internal Revenue Service

Shareholder’s Instructions

for Schedule K-1

(Form 1120S)

Shareholder’s Share of Income, Credits, Deductions, etc.

(For Shareholder’s Use Only)

Section references are to the Internal Revenue Code unless otherwise noted.

you such amounts totaling $10 or more for the

on your income tax return and not by the

Changes To Note

calendar year on Form 1099-DIV, Dividends

corporation. These elections are made under

•

and Distributions.

the following code sections:

Under the Jobs and Growth Tax Relief

•

Section 59(e) (deduction of certain qualified

Reconciliation Act of 2003, the general tax

Inconsistent Treatment of Items

expenditures ratably over the period of time

rates applicable to net capital gains for

specified in that section). For more information,

Generally, you must report subchapter S items

individuals have been reduced. The new gains

shown on your Schedule K-1 (and any

see the instructions for lines 16a and 16b.

rates also apply to qualified dividends under

•

Section 617 (deduction and recapture of

attached schedules) the same way that the

the new section 1(h)(11). The new rates apply

certain mining exploration expenditures), and

corporation treated the items on its return.

to capital gains (including installment

•

Section 901 (foreign tax credit).

If the treatment on your original or amended

payments) occurring on or after May 6, 2003.

If the corporation attaches a statement to

return is inconsistent with the corporation’s

The tax rates for qualified dividends apply to

Schedule K-1 indicating that it has changed its

treatment, or if the corporation has not filed a

dividends received after December 31, 2002.

tax year and that you may elect to report your

return, you must file Form 8082, Notice of

Schedules K and K-1 have been redesigned to

pro rata share of the income attributable to that

Inconsistent Treatment or Administrative

take into account the shareholders’ shares of

change ratably over 4 tax years, see Rev.

Adjustment Request (AAR), with your original

these gains and dividends.

•

Proc. 2003-79, 2003-45 I.R.B. 1036 for details

or amended return to identify and explain any

The instructions for line 23 of Schedule K-1

on making the election. To make the election,

inconsistency (or to note that a corporate

have been revised to change how dispositions

you must file Form 8082, Notice of

return has not been filed).

of property are reported if the corporation

Inconsistent Treatment or Administrative

passed through a section 179 expense

If you are required to file Form 8082, but fail

Adjustment Request, with your income tax

deduction to any of its shareholders for the

to do so, you may be subject to the

return for each of the 4 tax years. File Form

property.

accuracy-related penalty. This penalty is in

•

8082 for this purpose in accordance with Rev.

On page 7, under Supplemental

addition to any tax that results from making

Proc. 2003-79 instead of the Form 8082

Information, Line 23, item 20, 28% rate gain

your amount or treatment of the item consistent

instructions.

(loss) and item 21, Qualified 5-year gain were

with that shown on the corporation’s return.

added. These items were added due to the

Additional Information

Any deficiency that results from making the

deletion of these specific line items from

amounts consistent may be assessed

For more information on the treatment of S

Schedule K-1.

immediately.

corporation income, credits, deductions, etc.,

see Pub. 535, Business Expenses; Pub. 550,

General Instructions

Errors

Investment Income and Expenses; and Pub.

If you believe the corporation has made an

925, Passive Activity and At-Risk Rules.

Purpose of Schedule K-1

error on your Schedule K-1, notify the

To get forms and publications, see the

corporation and ask for a corrected Schedule

The corporation uses Schedule K-1 (Form

instructions for your tax return.

K-1. Do not change any items on your copy of

1120S) to report your pro rata share of the

Schedule K-1. Be sure that the corporation

corporation’s income (reduced by any tax the

Limitations on Losses,

sends a copy of the corrected Schedule K-1 to

corporation paid on the income), credits,

Deductions, and Credits

the IRS. If you are unable to reach agreement

deductions, etc. Keep it for your records. Do

There are three separate potential limitations

with the corporation regarding the

not file it with your tax return. The

inconsistency, you must file Form 8082.

on the amount of losses passed to the

corporation has filed a copy with the IRS.

shareholder that you may deduct on your

Although the corporation may have to pay a

International Boycotts

return. These limitations and the order in which

built-in gains tax and an excess net passive

you must apply them are as follows: the basis

Every corporation that had operations in, or

income tax, you are liable for income tax on

rules, the at-risk limitations, and the passive

related to, a boycotting country, company, or

your share of the corporation’s income,

activity limitations. Each of these limitations is

national of a country, must file Form 5713,

whether or not distributed, and you must

discussed separately below.

International Boycott Report.

include your share on your tax return if a return

Other limitations may apply to specific

If the corporation cooperated with an

is required. Your distributive share of S

deductions (for example, the section 179

international boycott, it must give you a copy of

corporation income is not self-employment

expense deduction). Generally, these

its Form 5713. You must file your own Form

income and it is not subject to

limitations apply before the basis, at-risk, and

5713 to report the corporation’s activities and

self-employment tax.

passive limitations.

any other boycott operations that you may

Where “attach schedule” appears beside a

have. You may lose certain tax benefits if the

Basis Rules

line on Schedule K-1, see either the schedule

corporation participated in, or cooperated with,

that the corporation has attached for that line

Generally, the deduction for your share of

an international boycott. See Form 5713 and

or line 23 of Schedule K-1.

aggregate losses and deductions reported on

the instructions for more information.

The notation “see instructions for Schedule

Schedule K-1 is limited to the basis of your

Elections

stock (determined with regard to distributions

K-1” in item A at the top of Schedule K-1 is

directed to the corporation. You, as a

received during the tax year) and debt owed to

Generally, the corporation decides how to

you by the corporation. The basis of your stock

shareholder, should disregard this notation.

figure taxable income from its operations. For

is figured at year-end.

Schedule K-1 does not show the amount of

example, it chooses the accounting method

actual dividend distributions the corporation

and depreciation methods it will use. However,

You are responsible for maintaining records

made to you. The corporation must report to

certain elections are made by you separately

to show the computation of the basis of your

Cat. No. 11521O

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8