STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

CERT-120

(Rev. 11/97)

CERTIFICATE FOR MACHINERY, EQUIPMENT, TOOLS,

MATERIALS, AND SUPPLIES USED IN THE PRODUCTION OF

PRINTED MATERIAL OR IN PREPRESS PRODUCTION

CONN. GEN. STAT. §12-412(71) AND (72)

GENERAL PURPOSE: This certificate is to be used by the purchaser of machinery, equipment, tools, materials and supplies to establish that the item(s) being

purchased are to be used predominantly:

(a) in the production of printed material by a commercial printer or publisher; or

(b) in the typesetting, color separation, finished copy with type proofs and artwork or similar content mounted for photomechanical reproduction,

or other similar products to be sold for use in the production of printed materials (the “prepress production of printed material”).

If the machinery, equipment, tools, materials or supplies are not used in the manner described herein, a purchaser who claimed the exemption shall owe a use

tax on the total price of the item(s) purchased under the exemption.

INSTRUCTIONS FOR THE PURCHASER: This certificate is to be issued and signed by an owner or officer of a purchaser described above to advise the seller

of machinery, equipment, tools, materials, supplies or fuel that the sales and use taxes do not apply to the charges for the purchase. This certificate may be

issued only for machinery, equipment, tools, materials or supplies used predominantly in the production of printed material by a commercial printer or publisher

or by a person engaged in prepress production, as described in Conn. Gen. Stat. §12-412(71) and (72).

A copy of this certificate and records that substantiate the information entered on this certificate must be maintained for a period of at least six years from the

date of issuance. If no Connecticut tax registration number has been assigned to the purchaser, enter the tax registration number assigned by another state

and identify the state.

INSTRUCTIONS FOR THE SELLER: Acceptance of this certificate, when properly completed, shall relieve the seller from the burden of proving that the sale,

and the storage, use or other consumption, of machinery, equipment, tools, materials or supplies is not subject to sales and use taxes. This certificate is valid

only if taken in good faith from a person who is a commercial printer or publisher engaged in the production of printed material or prepress production of products

to be sold for use in the production of printed material. The good faith of the seller will be questioned if the seller has knowledge of facts that give rise to a

reasonable inference that the purchaser is not a commercial printer, publisher or engaged in prepress production.

This certificate and bills or invoices to the purchaser must be maintained for a period of at least six years from the date on which the items were purchased. The

bills, invoices or records covering all purchases made under this certificate must be appropriately marked to indicate that an exempt purchase has occurred. The

words “Exempt Under CERT-120” will satisfy the requirement.

This certificate may be used for individual exempt purchases, in which event the box marked “Certificate for one purchase only” must be checked. This certificate

may also be used for a continuing line of exempt purchases, in which event the box marked “Blanket Certificate” must be checked. A Blanket Certificate will

remain in effect for a three-year period, unless a written revocation is made by the purchaser prior to the expiration of the period.

FOR FURTHER INFORMATION: CALL TAXPAYER SERVICES AT 1-800-382-9463 (IN-STATE) OR 860-297-5962.

TELECOMMUNICATIONS DEVICE FOR THE DEAF (TDD/TT) USERS ONLY CALL 860-297-4911.

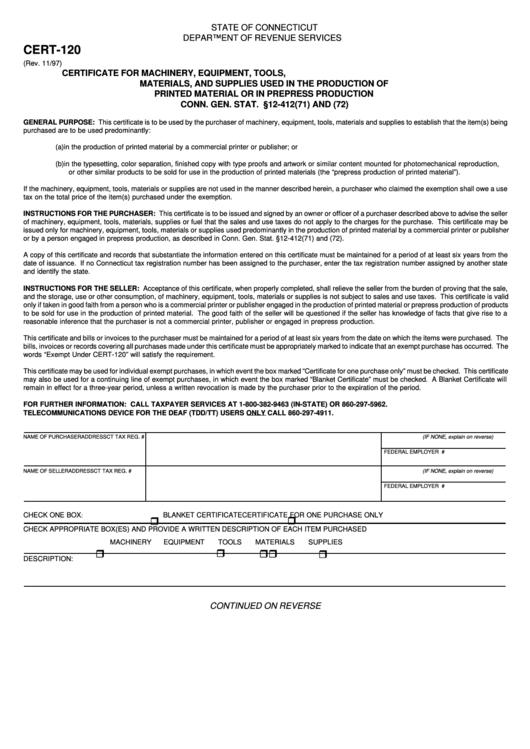

NAME OF PURCHASER

ADDRESS

CT TAX REG. # (IF NONE, explain on reverse)

FEDERAL EMPLOYER I.D. #

NAME OF SELLER

ADDRESS

CT TAX REG. # (IF NONE, explain on reverse)

FEDERAL EMPLOYER I.D. #

CHECK ONE BOX

BLANKET CERTIFICATE

CERTIFICATE FOR ONE PURCHASE ONLY

:

CHECK APPROPRIATE BOX(ES) AND PROVIDE A WRITTEN DESCRIPTION OF EACH ITEM PURCHASED

MACHINERY

EQUIPMENT

TOOLS

MATERIALS

SUPPLIES

DESCRIPTION:

CONTINUED ON REVERSE

1

1 2

2