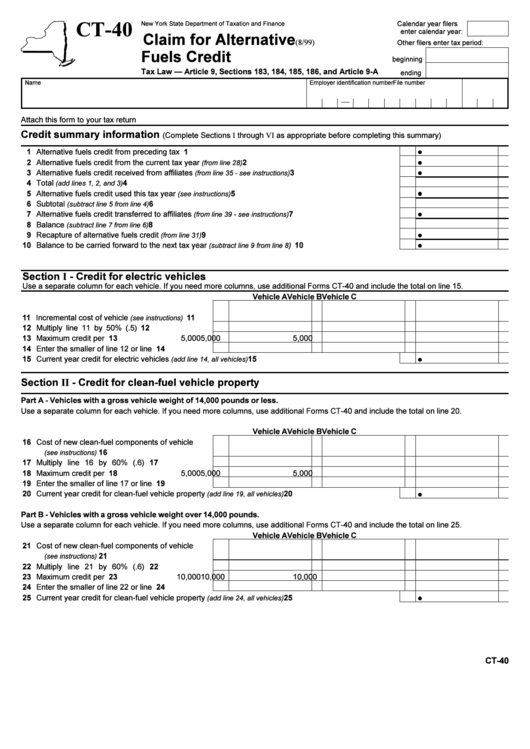

Form Ct-40 - Claim For Alternative Fuels Credit - New York State Department Of Taxation And Finance

ADVERTISEMENT

CT-40

Calendar year filers

New York State Department of Taxation and Finance

enter calendar year:

Claim for Alternative

(8/99)

Other filers enter tax period:

Fuels Credit

beginning

Tax Law — Article 9, Sections 183, 184, 185, 186, and Article 9-A

ending

Name

Employer identification number

File number

Attach this form to your tax return

Credit summary information

(Complete Sections I through VI as appropriate before completing this summary)

1 Alternative fuels credit from preceding tax years ..........................................................................................

1

2 Alternative fuels credit from the current tax year

.....................................................................

2

(from line 28)

3 Alternative fuels credit received from affiliates

...............................................

3

(from line 35 - see instructions)

4 Total

.............................................................................................................................

4

(add lines 1, 2, and 3)

5 Alternative fuels credit used this tax year

..........................................................................

5

(see instructions)

6 Subtotal

.................................................................................................................

6

(subtract line 5 from line 4)

7 Alternative fuels credit transferred to affiliates

...............................................

7

(from line 39 - see instructions)

8 Balance

.................................................................................................................

8

(subtract line 7 from line 6)

9 Recapture of alternative fuels credit

........................................................................................

9

(from line 31)

10 Balance to be carried forward to the next tax year

) ............................................... 10

(subtract line 9 from line 8

Section I - Credit for electric vehicles

Use a separate column for each vehicle. If you need more columns, use additional Forms CT-40 and include the total on line 15.

Vehicle A

Vehicle B

Vehicle C

11 Incremental cost of vehicle

11

(see instructions) .............

12 Multiply line 11 by 50% (.5) ..................................... 12

13 Maximum credit per vehicle .................................... 13

5,000

5,000

5,000

14 Enter the smaller of line 12 or line 13 ..................... 14

15 Current year credit for electric vehicles

................................................................... 15

(add line 14, all vehicles)

Section II - Credit for clean-fuel vehicle property

Part A - Vehicles with a gross vehicle weight of 14,000 pounds or less.

Use a separate column for each vehicle. If you need more columns, use additional Forms CT-40 and include the total on line 20.

Vehicle A

Vehicle B

Vehicle C

16 Cost of new clean-fuel components of vehicle

16

(see instructions) ...........................................................

17 Multiply line 16 by 60% (.6) .................................... 17

18 Maximum credit per vehicle .................................... 18

5,000

5,000

5,000

19 Enter the smaller of line 17 or line 18 ..................... 19

20 Current year credit for clean-fuel vehicle property

.................................................. 20

(add line 19, all vehicles)

Part B - Vehicles with a gross vehicle weight over 14,000 pounds.

Use a separate column for each vehicle. If you need more columns, use additional Forms CT-40 and include the total on line 25.

Vehicle A

Vehicle B

Vehicle C

21 Cost of new clean-fuel components of vehicle

21

(see instructions) ...........................................................

22 Multiply line 21 by 60% (.6) .................................... 22

23 Maximum credit per vehicle .................................... 23

10,000

10,000

10,000

24 Enter the smaller of line 22 or line 23 ..................... 24

25 Current year credit for clean-fuel vehicle property

.................................................. 25

(add line 24, all vehicles)

CT-40

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4