Reset Form

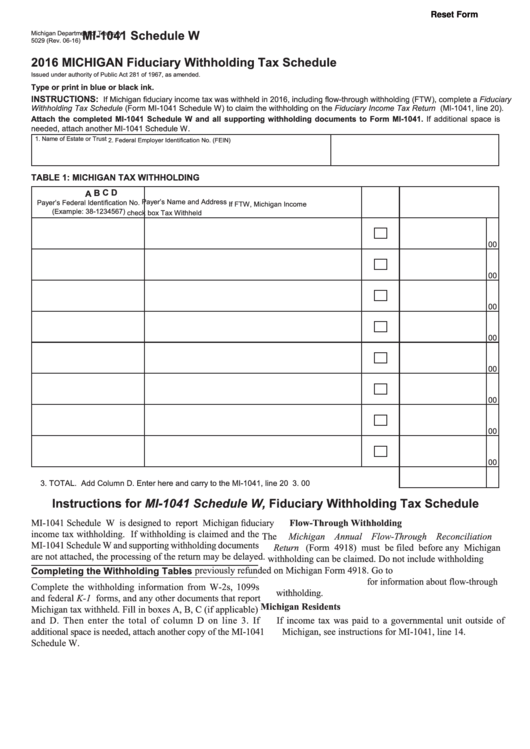

MI-1041 Schedule W

Michigan Department of Treasury

5029 (Rev. 06-16)

2016 MICHIGAN Fiduciary Withholding Tax Schedule

Issued under authority of Public Act 281 of 1967, as amended.

Type or print in blue or black ink.

INSTRUCTIONS:

If Michigan fiduciary income tax was withheld in 2016, including flow-through withholding (FTW), complete a Fiduciary

Withholding Tax Schedule (Form MI-1041 Schedule W) to claim the withholding on the Fiduciary Income Tax Return (MI-1041, line 20).

Attach the completed MI-1041 Schedule W and all supporting withholding documents to Form MI-1041. If additional space is

needed, attach another MI-1041 Schedule W.

1. Name of Estate or Trust

2. Federal Employer Identification No. (FEIN)

TABLE 1: MICHIGAN TAX WITHHOLDING

B

C

D

A

Payer’s Name and Address

Payer’s Federal Identification No.

If FTW,

Michigan Income

(Example: 38-1234567)

check box

Tax Withheld

00

00

00

00

00

00

00

00

3. TOTAL. Add Column D. Enter here and carry to the MI-1041, line 20 ........................................... 3.

00

Instructions for MI-1041 Schedule W, Fiduciary Withholding Tax Schedule

Flow-Through Withholding

MI-1041 Schedule W is designed to report Michigan fiduciary

income tax withholding. If withholding is claimed and the

The Michigan Annual Flow-Through Reconciliation

MI-1041 Schedule W and supporting withholding documents

Return (Form 4918) must be filed before any Michigan

are not attached, the processing of the return may be delayed.

withholding can be claimed. Do not include withholding

previously refunded on Michigan Form 4918. Go to

Completing the Withholding Tables

for information about flow-through

Complete the withholding information from W-2s, 1099s

withholding.

and federal K-1 forms, and any other documents that report

Michigan Residents

Michigan tax withheld. Fill in boxes A, B, C (if applicable)

and D. Then enter the total of column D on line 3. If

If income tax was paid to a governmental unit outside of

Michigan, see instructions for MI-1041, line 14.

additional space is needed, attach another copy of the MI-1041

Schedule W.

1

1