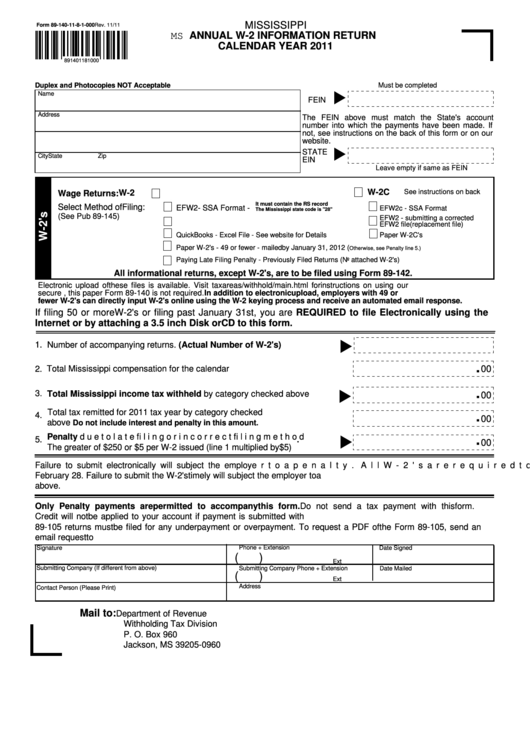

Form 89-140-11-8-1-000 - Annual W-2 Information Return Calendar Year 2011 - Mississippi Department Of Revenue

ADVERTISEMENT

MISSISSIPPI

Form 89-140-11-8-1-000 Rev. 11/11

ANNUAL W-2 INFORMATION RETURN

MS

CALENDAR YEAR 2011

891401181000

Duplex and Photocopies NOT Acceptable

Must be completed

Name

FEIN

Address

The FEIN above must match the State's account

number into which the payments have been made. If

not, see instructions on the back of this form or on our

website.

STATE

City

State

Zip

EIN

Leave empty if same as FEIN

W-2C

W-2

See instructions on back

Wage Returns:

It must contain the RS record

Select Method of Filing:

EFW2 - SSA Format -

EFW2c - SSA Format

The Mississippi state code is "28"

(See Pub 89-145)

EFW2 - submitting a corrected

W2REPORT-11.xls - Located on website shown below

EFW2 file (replacement file)

QuickBooks - Excel File - See website for Details

Paper W-2C's

Paper W-2's - 49 or fewer - mailed by January 31, 2012 (

Otherwise, see Penalty line 5.)

Paying Late Filing Penalty - Previously Filed Returns (No attached W-2's)

All informational returns, except W-2's, are to be filed using Form 89-142.

Electronic upload of these files is available. Visit for instructions on using our

secure portal. If you upload a file, this paper Form 89-140 is not required. In addition to electronic upload, employers with 49 or

fewer W-2's can directly input W-2's online using the W-2 keying process and receive an automated email response.

If filing 50 or more W-2's or filing past January 31st, you are REQUIRED to file Electronically using the

Internet or by attaching a 3.5 inch Disk or CD to this form.

1.

Number of accompanying returns. (Actual Number of W-2's) .....................

.

00

2. Total Mississippi compensation for the calendar year...........................................

.

3.

Total Mississippi income tax withheld by category checked above ...........

00

.

4. Total tax remitted for 2011 tax year by category checked

.....................................

00

above

Do not include interest and penalty in this amount.

.

Penalty due to late filing or incorrect filing method

5.

. .................

00

The greater of $250 or $5 per W-2 issued (line 1 multiplied by $5)

Failure to submit electronically will subject the employer to a penalty. All W-2's are required to be submitted by

February 28. Failure to submit the W-2's timely will subject the employer to a penalty. This penalty is provided on line 5

above.

Only Penalty payments are permitted to accompany this form. Do not send a tax payment with this form.

Credit will not be applied to your account if payment is submitted with this form. Amended or additional paper Form

89-105 returns must be filed for any underpayment or overpayment. To request a PDF of the Form 89-105, send an

email request to withholding@dor.ms.gov.

Signature

Phone + Extension

Date Signed

(

)

Ext

Submitting Company (If different from above)

Submitting Company Phone + Extension

Date Mailed

(

)

Ext

Address

Contact Person (Please Print)

Mail to:

Department of Revenue

Withholding Tax Division

P. O. Box 960

Jackson, MS 39205-0960

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1