Tax Information - City Of Buenaventura

ADVERTISEMENT

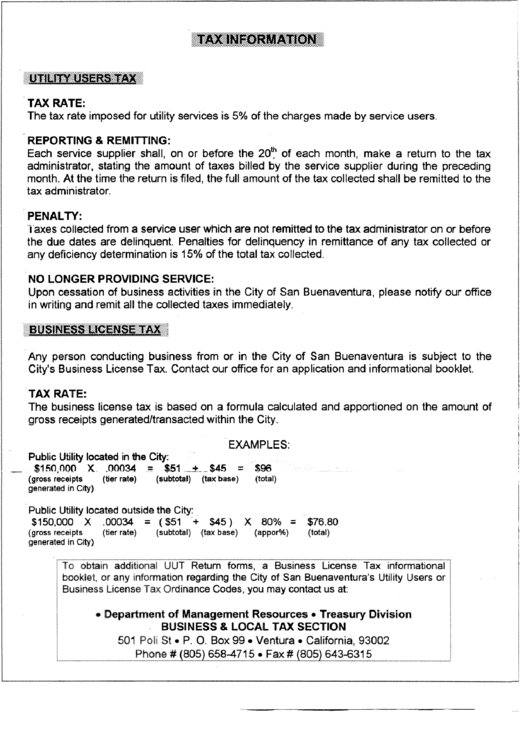

TAX RATE:

The tax rate imposed for utility services is 5% of the charges made by service users.

REPORTING & REMITTING:

Each service supplier shall, on or before the 20 th. of each month, make a return to the tax

administrator, stating the amount of taxes billed by the service supplier during the preceding

month. At the time the return is filed, the full amount of the tax collected shall be remitted to the

tax administrator.

PENALTY:

Taxes collected from a service user which are not remitted to the tax administrator on or before

the due dates are delinquent. Penalties for delinquency in remittance of any tax collected or

any deficiency determination is 15% of the total tax collected.

NO LONGER PROVIDING SERVICE:

Upon cessation of business activities in the City of San Buenaventura, please notify our office

in writing and remit all the collected taxes immediately.

Any person conducting business from or in the City of San Buenaventura is subject to the

City's Business License Tax. Contact our office for an application and informational booklet.

TAX RATE:

The business license tax is based on a formula calculated and apportioned on the amount of

gross receipts generated/transacted within the City.

EXAMPLES:

Public Utility located in the City:

$15o,000

X_ .000.34 -

$51.__+__ $4S

= :$96

(gross receipts

(tier rate)

(subtotal)

(tax base)

(total)

generated in City)

Public Utility located outside the City:

$150,000

X

.00034

= ($51

+ $45)

X

80% =

$76.80

(gross receipts

(tier rate)

(subtotal)

(tax base)

(appor%)

(total)

generated in City)

To obtain additionaJ UUT Retum forms, a Business License Tax informational I

• Department of Management Resources • Treasury Division

BUSINESS & LOCAL TAX SECTION

501 Poli St = P. O. Box 99 • Ventura * California, 93002

booklet, or any information regarding the City of San Buenaventura's Utility Users or

Business License

Tax

Ordinance Codes, you may contact us at:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1