Form 31-004 - Iowa Registration Services

ADVERTISEMENT

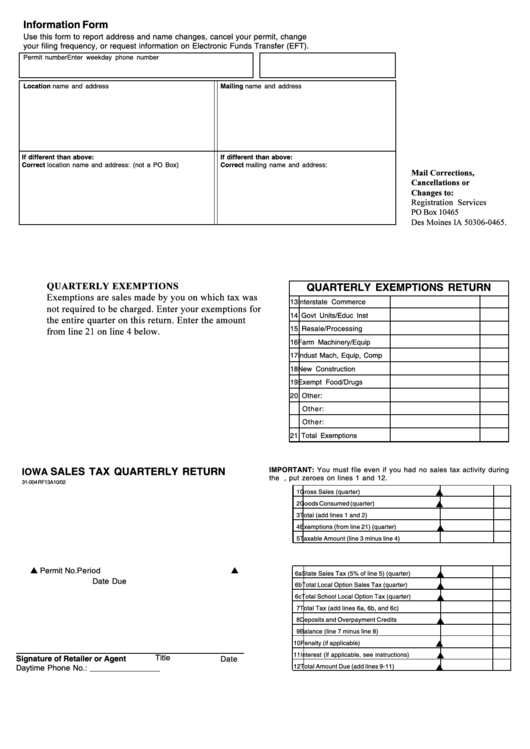

Information Form

Use this form to report address and name changes, cancel your permit, change

your filing frequency, or request information on Electronic Funds Transfer (EFT).

Permit number

Enter weekday phone number

Location name and address

Mailing name and address

If different than above:

If different than above:

Correct location name and address: (not a PO Box)

Correct mailing name and address:

Mail Corrections,

Cancellations or

Changes to:

Registration Services

PO Box 10465

Des Moines IA 50306-0465.

QUARTERLY EXEMPTIONS

QUARTERLY EXEMPTIONS RETURN

Exemptions are sales made by you on which tax was

13 Interstate Commerce

not required to be charged. Enter your exemptions for

14 Govt Units/Educ Inst

the entire quarter on this return. Enter the amount

15 Resale/Processing

from line 21 on line 4 below.

16 Farm Machinery/Equip

17 Indust Mach, Equip, Comp

18 New Construction

19 Exempt Food/Drugs

20 Other:

Other:

Other:

21 Total Exemptions

SALES TAX QUARTERLY RETURN

IMPORTANT: You must file even if you had no sales tax activity during

IOWA

the quarter.If you had no sales, put zeroes on lines 1 and 12.

31-004 RF13A 10/02

s

1 Gross Sales (quarter)

s

2 Goods Consumed (quarter)

3 Total (add lines 1 and 2)

s

4 Exemptions (from line 21) (quarter)

5 Taxable Amount (line 3 minus line 4)

s

s

Permit No.

Period

s

6a State Sales Tax (5% of line 5) (quarter)

Date Due

s

6b Total Local Option Sales Tax (quarter)

s

6c Total School Local Option Tax (quarter)

7 Total Tax (add lines 6a, 6b, and 6c)

s

8 Deposits and Overpayment Credits

9 Balance (line 7 minus line 8)

s

10 Penalty (if applicable)

s

11 Interest (if applicable, see instructions)

Title

Signature of Retailer or Agent

Date

s

12 Total Amount Due (add lines 9-11)

Daytime Phone No.: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2