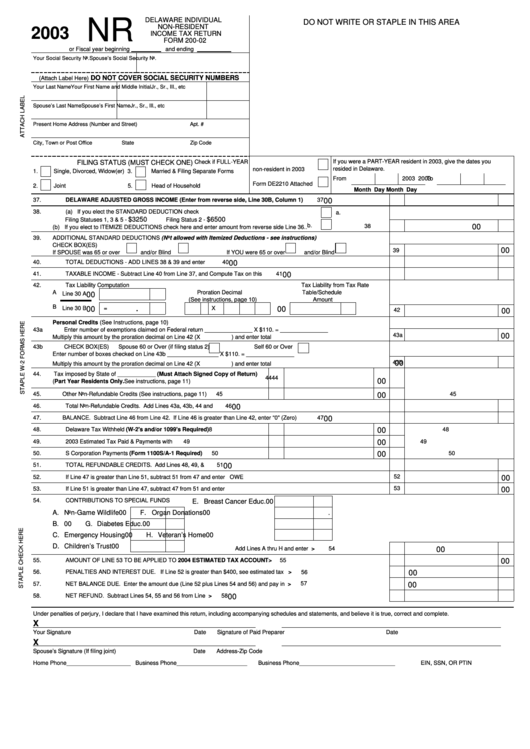

Form Nr - Delaware Individual Non-Resident Income Tax Return - 2003

ADVERTISEMENT

DELAWARE INDIVIDUAL

NR

DO NOT WRITE OR STAPLE IN THIS AREA

NON-RESIDENT

2003

INCOME TAX RETURN

FORM 200-02

or Fiscal year beginning

and ending

Your Social Security No.

Spouse’s Social Security No.

DO NOT COVER SOCIAL SECURITY NUMBERS

(Attach Label Here)

Your Last Name

Your First Name and Middle Initial

Jr., Sr., III., etc

Spouse’s Last Name

Spouse’s First Name

Jr., Sr., III., etc

Present Home Address (Number and Street)

Apt. #

City, Town or Post Office

State

Zip Code

If you were a PART-YEAR resident in 2003, give the dates you

Check if FULL-YEAR

FILING STATUS (MUST CHECK ONE)

resided in Delaware.

non-resident in 2003

1.

Single, Divorced, Widow(er) 3.

Married & Filing Separate Forms

From

2003

To

2003

Form DE2210 Attached

2.

Joint

5.

Head of Household

Month

Day

Month

Day

37.

DELAWARE ADJUSTED GROSS INCOME (Enter from reverse side, Line 30B, Column 1) .......................................... . ..............

37

00

38.

(a) If you elect the STANDARD DEDUCTION check here..........................................................................

a.

$3250

$6500

Filing Statuses 1, 3 & 5 -

Filing Status 2 -

b.

38

00

(b) If you elect to ITEMIZE DEDUCTIONS check here and enter amount from reverse side Line 36..

39.

ADDITIONAL STANDARD DEDUCTIONS (Not allowed with Itemized Deductions - see instructions)

CHECK BOX(ES)

00

39

If SPOUSE was 65 or over

and/or Blind

If YOU were 65 or over

and/or Blind

40.

TOTAL DEDUCTIONS - ADD LINES 38 & 39 and enter here...............................................................................................................

40

00

41.

TAXABLE INCOME - Subtract Line 40 from Line 37, and Compute Tax on this Amount............................................... . ......................

41

00

42.

Tax Liability Computation

Tax Liability from Tax Rate

A

Proration Decimal

Table/Schedule

Line 30 A

00

(See instructions, page 10)

Amount

B

Line 30 B

00

=

.

X

00

42

00

Personal Credits (See Instructions, page 10)

43a

Enter number of exemptions claimed on Federal return _______________ X $110. = _______________

43a

00

Multiply this amount by the proration decimal on Line 42 (X

) and enter total here............................................................

43b

CHECK BOX(ES)

Spouse 60 or Over (if filing status 2)

Self 60 or Over

Enter number of boxes checked on Line 43b ________________ X $110. = _______________

43b

00

Multiply this amount by the proration decimal on Line 42 (X

) and enter total here............................................................

44.

Tax imposed by State of ____________ (Must Attach Signed Copy of Return)

44

44

00

(Part Year Residents Only. See instructions, page 11)............................................

45.

Other Non-Refundable Credits (See instructions, page 11)..........................................

45

45

00

46.

Total Non-Refundable Credits. Add Lines 43a, 43b, 44 and 45..........................................................................................................

46

00

47.

BALANCE. Subtract Line 46 from Line 42. If Line 46 is greater than Line 42, enter “0" (Zero)........................................................

47

00

48.

Delaware Tax Withheld (W-2's and/or 1099's Required)...........................................

48

00

48

49.

2003 Estimated Tax Paid & Payments with Extensions..............................................

49

00

49

50.

S Corporation Payments (Form 1100S/A-1 Required)..............................................

50

00

50

51.

TOTAL REFUNDABLE CREDITS. Add Lines 48, 49, & 50.....................................................................................................................

51

00

52

52.

If Line 47 is greater than Line 51, subtract 51 from 47 and enter here..................................................................AMOUNT YOU OWE

00

53.

If Line 51 is greater than Line 47, subtract 47 from 51 and enter here.........................................................................OVERPAYMENT

53

00

54.

CONTRIBUTIONS TO SPECIAL FUNDS

E. Breast Cancer Educ.

00

A. Non-Game Wildlife

00

F. Organ Donations

00

.

B. U.S. Olympics

00

G. Diabetes Educ.

00

C. Emergency Housing

00

H. Veteran’s Home

00

D. Children’s Trust

00

Add Lines A thru H and enter here....................................... >

54

00

55.

AMOUNT OF LINE 53 TO BE APPLIED TO 2004 ESTIMATED TAX ACCOUNT.....................................................................ENTER >

55

00

56.

PENALTIES AND INTEREST DUE. If Line 52 is greater than $400, see estimated tax instructions......................................ENTER >

56

00

57

57.

NET BALANCE DUE. Enter the amount due (Line 52 plus Lines 54 and 56) and pay in full...........................................PAY IN FULL>

00

58.

NET REFUND. Subtract Lines 54, 55 and 56 from Line 53................................................................ZERO DUE/TO BE REFUNDED>

58

00

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and believe it is true, correct and complete.

X

Your Signature

Date

Signature of Paid Preparer

Date

X

Spouse’s Signature (If filing joint)

Date

Address-Zip Code

Home Phone____________________ Business Phone______________________

Business Phone______________________________

EIN, SSN, OR PTIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2