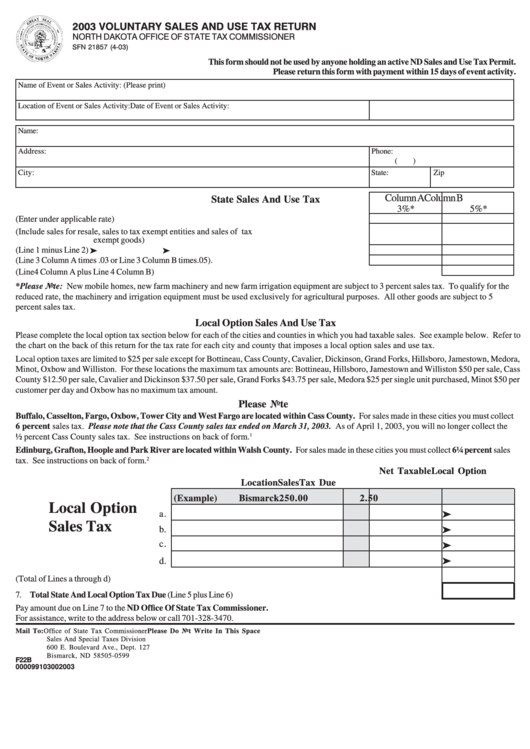

2003 VOLUNTARY SALES AND USE TAX RETURN

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 21857 (4-03)

This form should not be used by anyone holding an active ND Sales and Use Tax Permit.

Please return this form with payment within 15 days of event activity.

Name of Event or Sales Activity: (Please print)

Location of Event or Sales Activity:

Date of Event or Sales Activity:

Name:

Address:

Phone:

(

)

City:

State:

Zip

Column A

Column B

State Sales And Use Tax

3%*

5%*

1. Total Sales (Enter under applicable rate) ........................................................................................

2. Nontaxable Sales (Include sales for resale, sales to tax exempt entities and sales of tax

exempt goods) ....................................................................................................

³

³

3. Net Taxable Sales (Line 1 minus Line 2) ...........................................................................................

4. State Tax Due (Line 3 Column A times .03 or Line 3 Column B times .05) .........................................

5. Total State Tax Due (Line 4 Column A plus Line 4 Column B) ...........................................................................................

*Please Note: New mobile homes, new farm machinery and new farm irrigation equipment are subject to 3 percent sales tax. To qualify for the

reduced rate, the machinery and irrigation equipment must be used exclusively for agricultural purposes. All other goods are subject to 5

percent sales tax.

Local Option Sales And Use Tax

Please complete the local option tax section below for each of the cities and counties in which you had taxable sales. See example below. Refer to

the chart on the back of this return for the tax rate for each city and county that imposes a local option sales and use tax.

Local option taxes are limited to $25 per sale except for Bottineau, Cass County, Cavalier, Dickinson, Grand Forks, Hillsboro, Jamestown, Medora,

Minot, Oxbow and Williston. For these locations the maximum tax amounts are: Bottineau, Hillsboro, Jamestown and Williston $50 per sale, Cass

County $12.50 per sale, Cavalier and Dickinson $37.50 per sale, Grand Forks $43.75 per sale, Medora $25 per single unit purchased, Minot $50 per

customer per day and Oxbow has no maximum tax amount.

Please Note

Buffalo, Casselton, Fargo, Oxbow, Tower City and West Fargo are located within Cass County. For sales made in these cities you must collect

6 percent sales tax. Please note that the Cass County sales tax ended on March 31, 2003. As of April 1, 2003, you will no longer collect the

½ percent Cass County sales tax. See instructions on back of form.

1

Edinburg, Grafton, Hoople and Park River are located within Walsh County. For sales made in these cities you must collect 6¼ percent sales

2

tax. See instructions on back of form.

Net Taxable

Local Option

Location

Sales

Tax Due

(Example)

Bismarck

250.00

2.50

Local Option

³

a.

Sales Tax

³

b.

³

c.

³

d.

6. Total Local Option Tax Due (Total of Lines a through d) ..................................................................................................

7. Total State And Local Option Tax Due (Line 5 plus Line 6) ..............................................................................................

Pay amount due on Line 7 to the ND Office Of State Tax Commissioner.

For assistance, write to the address below or call 701-328-3470.

Mail To: Office of State Tax Commissioner

Please Do Not Write In This Space

Sales And Special Taxes Division

600 E. Boulevard Ave., Dept. 127

Bismarck, ND 58505-0599

F22B

000099103002003

1

1