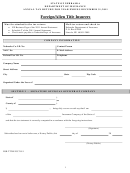

Form 1076 - Annual Municipal Premium & Tax Report - Louisiana Department Of Insurance - 2011 Page 6

ADVERTISEMENT

(c) 3rd Class:

When the gross receipts are more than four thousand dollars, and not more than six thousand

dollars, the license shall not exceed eighty dollars;

(d) 4th Class:

When the gross receipts exceed six thousand dollars, the additional license thereafter shall not

be more than seventy dollars for each ten thousand dollars, or fraction thereof, in excess of six

thousand dollars.

B.

The maximum license tax on such businesses, payable to such municipality or parochial corporation by any insurer, shall not

exceed nine thousand dollars. Provided, that:

(1)

Plate glass and steam boiler inspection insurers shall pay only one-third of the above rates provided in Paragraph A(2).

(2)

The amount of license payable to any municipal or parochial corporation as fixed in this Section shall be one-third of the

amount so fixed if the payer shall file a sworn statement with the annual report required by this Part, showing that at

least one-sixth of the total admitted assets of the payer, are invested and maintained in qualifying Louisiana investments

as defined in R.S. 22:832(C).

(3)

The total license tax payable by an insurer to a parish shall be calculated on the total direct premiums written by such

insurer for risks located within unincorporated areas of such parish. The total license tax payable by an insurer to a

municipality shall be calculated on the total direct premiums written by such insurer for risks located within such

municipality. Such premiums shall not be subject to taxation by both the parish and the municipality. Such premiums

shall not be subject to taxation by more than one parish or municipality

C.

(1) In case of any failure to make a report or to make payment of license tax as required by this Section, before June first of any

year in which it is due, a penalty of five percent per month shall be added to the amount of tax due and payable to the municipal

or parochial corporation along with the tax due. The municipal or parochial corporation may waive the payment of the penalty if it

finds that failure to pay was due to some unforeseen or unavoidable reason, other than mere neglect.

(2) The amount of any monetary penalty assessed pursuant to this Section shall not be greater than twenty-five percent of the

total amount of the tax due.

(3) When a payment is more than six months delinquent, the municipal or parochial corporation may send a written

recommendation to the commissioner of insurance requesting the commissioner to revoke the authority of the delinquent

taxpayer and all of the taxpayer's agents to do business in this state. Upon receiving such a recommendation and finding that the

local tax assessment is correct and the insurer was duly notified of the assessment after the payment thereof is delinquent, the

commissioner, after due notice to all affected parties and hearing, may revoke the authority of the taxpayer and all the taxpayer's

agents to do business in this state.

SEE ATTORNEY GENERAL OPINION # 80-403, DATED MAY 16, 1980.

NOTE:

The amounts payable for the parish and municipal licenses are payable

to the local political subdivisions and not to the State of Louisiana. Do

not include with your remittance for State Premium Taxes.

The allocation of the premium to the various municipalities and/or parishes on this Form must be completed or your

Louisiana filing will be returned to you for completion. THIS IS AN ANNUAL FILING REQUIREMENT PER L.R.S.

22§792.

Form 1076 (Revised 01/12)

THIS DOCUMENT IS EXEMPT FROM PUBLIC RECORDS LAW UNDER R.S. 44§4

Page 6 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6