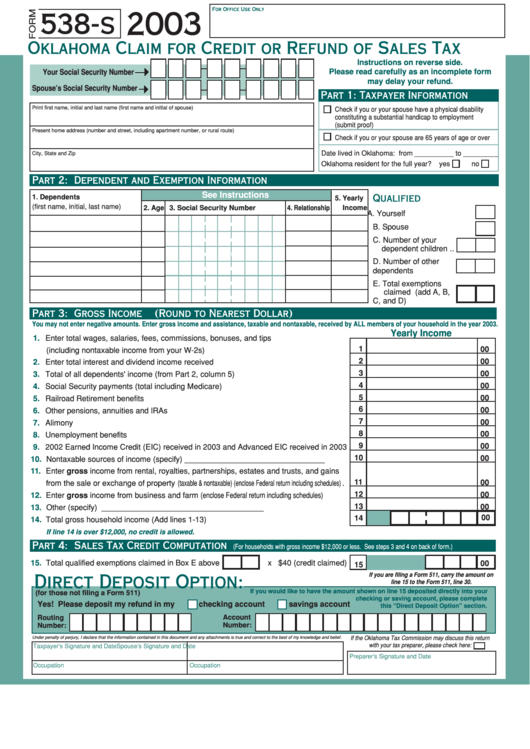

For Office Use Only

2003

538-s

Oklahoma Claim for Credit or Refund of Sales Tax

Instructions on reverse side.

Please read carefully as an incomplete form

Your Social Security Number

may delay your refund.

Spouse’s Social Security Number

Part 1: Taxpayer Information

Print first name, initial and last name (first name and initial of spouse)

Check if you or your spouse have a physical disability

constituting a substantial handicap to employment

(submit proof)

Present home address (number and street, including apartment number, or rural route)

Check if you or your spouse are 65 years of age or over

Date lived in Oklahoma: from __________ to _________

City, State and Zip

Oklahoma resident for the full year?

yes

no

Part 2: Dependent and Exemption Information

See Instructions

1. Dependents

Qualified Exemptions...

5. Yearly

(first name, initial, last name)

2. Age 3. Social Security Number

4. Relationship

Income

A. Yourself ............................

B. Spouse ............................

C. Number of your

dependent children ..

D. Number of other

dependents .............

E. Total exemptions

claimed (add A, B,

C, and D) .................

Part 3: Gross Income

(Round to Nearest Dollar)

You may not enter negative amounts. Enter gross income and assistance, taxable and nontaxable, received by ALL members of your household in the year 2003.

Yearly Income

1.

Enter total wages, salaries, fees, commissions, bonuses, and tips

1

00

(including nontaxable income from your W-2s) .................................................................

2

00

2.

Enter total interest and dividend income received ............................................................

3

00

3.

Total of all dependents' income (from Part 2, column 5) ....................................................

4

00

4.

Social Security payments (total including Medicare) .........................................................

5

00

5.

Railroad Retirement benefits .............................................................................................

6

00

6.

Other pensions, annuities and IRAs ..................................................................................

7

00

7.

Alimony .............................................................................................................................

8

00

8.

Unemployment benefits ....................................................................................................

9

00

9.

2002 Earned Income Credit (EIC) received in 2003 and Advanced EIC received in 2003

10

00

10.

Nontaxable sources of income (specify) ________________________________ .........

11.

Enter gross income from rental, royalties, partnerships, estates and trusts, and gains

11

00

from the sale or exchange of property (taxable & nontaxable) (enclose Federal return including schedules) .

12

00

12.

Enter gross income from business and farm (enclose Federal return including schedules) .........

13

00

13.

Other (specify) _____________________________________ .....................................

00

14

14.

Total gross household income (Add lines 1-13) ...............................................................

If line 14 is over $12,000, no credit is allowed.

Part 4: Sales Tax Credit Computation

(For households with gross income $12,000 or less. See steps 3 and 4 on back of form.)

15.

Total qualified exemptions claimed in Box E above

x $40 (credit claimed)

00

15

If you are filing a Form 511, carry the amount on

Direct Deposit Option:

line 15 to the Form 511, line 30.

If you would like to have the amount shown on line 15 deposited directly into your

(for those not filing a Form 511)

checking or saving account, please complete

Yes! Please deposit my refund in my

checking account

savings account

this “Direct Deposit Option” section.

Account

Routing

Number:

Number:

Under penalty of perjury, I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief.

If the Oklahoma Tax Commission may discuss this return

with your tax preparer, please check here:

Taxpayer’s Signature and Date

Spouse’s Signature and Date

Preparer’s Signature and Date

Occupation

Occupation

1

1