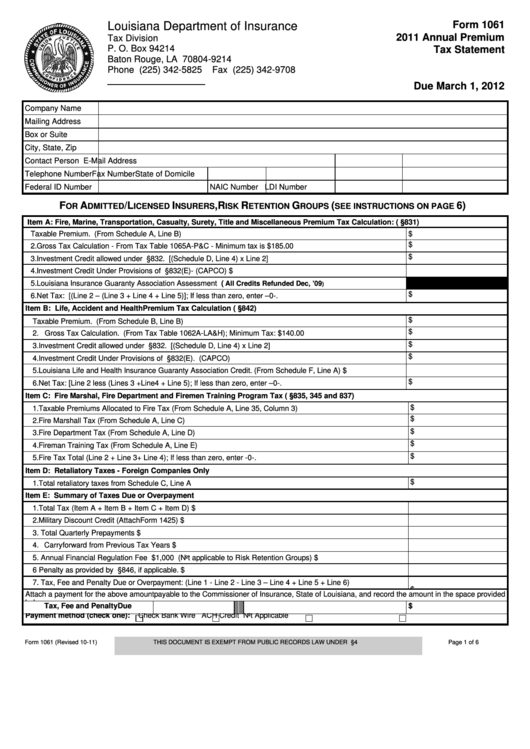

Louisiana Department of Insurance

Form 1061

2011 Annual Premium

Tax Division

P. O. Box 94214

Tax Statement

Baton Rouge, LA 70804-9214

Phone (225) 342-5825

Fax (225) 342-9708

Due March 1, 2012

Company Name

Mailing Address

Box or Suite

City, State, Zip

Contact Person

E-Mail Address

Telephone Number

Fax Number

State of Domicile

Federal ID Number

NAIC Number

LDI Number

F

A

/L

I

, R

R

G

(

6)

OR

DMITTED

ICENSED

NSURERS

ISK

ETENTION

ROUPS

SEE INSTRUCTIONS ON PAGE

Item A: Fire, Marine, Transportation, Casualty, Surety, Title and Miscellaneous Premium Tax Calculation: (L.R.S. 22§831)

1. Net Taxable Premium. (From Schedule A, Line B)

$

$

2. Gross Tax Calculation - From Tax Table 1065A-P&C - Minimum tax is $185.00

$

3. Investment Credit allowed under L.R.S. 22§832. [(Schedule D, Line 4) x Line 2]

4. Investment Credit Under Provisions of L.R.S. 22§832(E)- (CAPCO)

$

5. Louisiana Insurance Guaranty Association Assessment (

All Credits Refunded Dec, ’09

)

$

6. Net Tax: [(Line 2 – (Line 3 + Line 4 + Line 5)]; If less than zero, enter –0-.

Item B: Life, Accident and Health Premium Tax Calculation (L.R.S. 22§842)

$

1. Net Taxable Premium. (From Schedule B, Line B)

$

2. Gross Tax Calculation. (From Tax Table 1062A-LA&H); Minimum Tax: $140.00

$

3. Investment Credit allowed under L.R.S. 22§832. [(Schedule D, Line 4) x Line 2]

$

4. Investment Credit Under Provisions of L.R.S. 22§832(E). (CAPCO)

5. Louisiana Life and Health Insurance Guaranty Association Credit. (From Schedule F, Line A)

$

$

6. Net Tax: [Line 2 less (Lines 3 +Line 4 + Line 5); If less than zero, enter –0-.

Item C: Fire Marshal, Fire Department and Firemen Training Program Tax (L.R.S. 22§835, 345 and 837)

$

1.

Taxable Premiums Allocated to Fire Tax (From Schedule A, Line 35, Column 3)

$

2.

Fire Marshall Tax (From Schedule A, Line C)

$

3.

Fire Department Tax (From Schedule A, Line D)

$

4.

Fireman Training Tax (From Schedule A, Line E)

$

5.

Fire Tax Total (Line 2 + Line 3+ Line 4); If less than zero, enter -0-.

Item D: Retaliatory Taxes - Foreign Companies Only

$

1. Total retaliatory taxes from Schedule C, Line A

Item E: Summary of Taxes Due or Overpayment

1. Total Tax (Item A + Item B + Item C + Item D)

$

2. Military Discount Credit (Attach Form 1425)

$

3. Total Quarterly Prepayments

$

4. Carry forward from Previous Tax Years

$

5. Annual Financial Regulation Fee $1,000 (Not applicable to Risk Retention Groups)

$

6 Penalty as provided by L.R.S. 22§846, if applicable.

$

7. Tax, Fee and Penalty Due or Overpayment: (Line 1 - Line 2 - Line 3 – Line 4 + Line 5 + Line 6)

$

Attach a payment for the above amount payable to the Commissioner of Insurance, State of Louisiana, and record the amount in the space provided

b l

Tax, Fee and Penalty Due

$

Payment method (check one):

Check

Bank Wire

ACH Credit

Not Applicable

Form 1061 (Revised 10-11)

THIS DOCUMENT IS EXEMPT FROM PUBLIC RECORDS LAW UNDER L.R.S. 44§4

Page 1 of 6

1

1 2

2 3

3 4

4 5

5 6

6