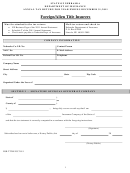

NAIC NUMBER:

COMPANY NAME:

Schedule C: Schedule of Retaliatory Tax Calculation – Foreign Companies Must Complete - (L.R.S. 22§836)

Part 1: Premium Taxes and Fees Paid by your Company in Louisiana

Premiums

Taxes and Fees

1. Louisiana Premium for Life, Accident and Health from Item B, Line 1, Page 1; and Tax from Item B, Line

$

$

2, Page 1.

2. Louisiana Premium for Fire, Marine, Transportation, Casualty, Surety, Title and Miscellaneous from Item

A, Line 1, Page 1; and Tax from Item A, Line 2, Page 1.

$

$

3. Premium subject to Fire Marshal, Fire Department and Firemen Training Program Tax from Item C Line

1, Page 1; and Tax from Item C, Line 5, Page 1.

$

$

4. Premiums subject to Municipal Tax. Premium and Tax must agree with Municipal Tax Statement Form

1076.

$

$

5. 2011 Louisiana Insurance Fraud Assessment on 2010 business. Premium basis & assessment under

Act 1312 of 1999. (L.R.S. 40§1428)

$

$

$

6. 2011 Louisiana Insurance Rating Commission assessment on 2010 business.

$

7. 2011 Louisiana HIPAA assessment on 2010 business. Premium basis and assessment under Act 1138

of 1997. (L.R.S. 22:1071)

$

$

8. Annual Financial Regulation Fee (not applicable to risk retention groups)

$1,000.00

$

9. Property Insurance Association of Louisiana membership fees.

$

10. Agent’s fees (if applicable)

$

11. Total Taxes and Fees payable to the State of Louisiana before any credits, add Lines 1 through 10.

Part 2: Premium Taxes and Fees which a Louisiana Company would have Paid in your State with Identical Part 1 Premium Base

$

12. Premium subject to Life, Accident and Health Tax per Line 1 above

The deductions under Parts 11a through 11c are included only if allowed under the Statutes of Domiciliary State of Reporting Company.

$

a. Dividends to Louisiana Policyholders

$

b. Other (identify)

$

c. Other (identify)

Premiums

Rate

Taxes and Fees

d.

Total {Line 11 minus (a+b+c)}

$

%

$

13. Premiums subject to Fire, Marine, Transportation, Casualty, Surety, Title, and Miscellaneous

%

Tax per Line 2 above.

$

$

14. Premiums subject to Fire Marshal, Fire Department and Firemen Training Program Tax per

%

Line 3 above.

$

$

15. Premiums subject to Municipal Tax

$

%

$

16. Filing Fee for Annual Statement and Certificate of Authority

$

17. Agents’ fees (if applicable)

$

18. Other (identify)

$

%

$

19. Other (identify)

$

%

$

20. Total Taxes and Fees due from a Louisiana Company in your Domiciliary State before any credits, add Lines 12d through 19.

$

A. Retaliatory Tax Due (Excess of Line 20 over Line 11). If greater than zero (0), enter total here and on Item D, Line 1, Page 1. If

result is less than zero (0), enter 0 here and on Item D, Line 1, Page 1.

$

Form 1061 (Revised 10-11)

THIS DOCUMENT IS EXEMPT FROM PUBLIC RECORDS LAW UNDER L.R.S. 44§4

Page 4 of 6

1

1 2

2 3

3 4

4 5

5 6

6