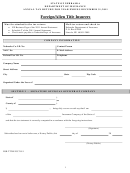

NAIC NUMBER:

COMPANY NAME:

Schedule D: Schedule of Investment Tax Credit (L.R.S. 22§832)

L.R.S. 22§832 provides that any admitted insurer investing in qualifying Louisiana securities listed in that section may take a reduction

in premium taxes as listed in Table 1 below. Effective July 1, 2010 per Act 478 of the 2009 Regular Session of the

Louisiana Legislature, the tax credit shall be calculated by applying the average of the quarterly ratios of qualified

Louisiana investments to total admitted assets to the tax reduction percentages in Table 1 below. (Attach Form

1068C for the December 31, 2011 amounts only)

As of September

As of

Average

As of March 31,

As of June 30,

30, 2011

December

Louisiana

2011

2011

31,2011

to Total

Classification

Amount

Amount

Amount

Amount

Louisiana Investments

832C(1)

Certificates of Deposit

$

$

$

$

832C(2)

Bonds

$

$

$

$

832C(3)

Mortgages

$

$

$

$

832C(4)

Real Property

$

$

$

$

832C(5)

Policy Loans

$

$

$

$

832C(6)

Stocks

$

$

$

$

832C(7)

Cash

$

$

$

$

1. Total Admitted Assets Invested in Qualifying

$

$

$

$

Louisiana Securities

2. Total Admitted Assets

$

$

$

$

. Louisiana to Total Assets Ratio (Line 1/Line 2)

(Round to 4 decimal places) Calculate the average

%

of the four quarter ending columns and enter resultin

Average column.

4. Tax Reduction Percentage Taken from Table 1

(below) applied to the Average Louisiana to Total

Assets Ratio. Enter result in Average Column and

%

also on Page 1, Item A, Line 2 and/or Page 1, Item

B, Line 2 as appropriate.

Tax

Reduction

Table 1

Louisiana to Total Admitted Assets Ratio

Percentage

Allowed

.1666 - .1999

66.67%

.2000 - .2499

75.00%

.2500 - .3332

85.00%

.3333 – 1.0000

95.00%

SCHEDULE E NOTICE:

ALL REMAINING LOUISIANA INSURANCE GUARANTY ASSOCIATION PREMIUM TAX CREDITS

WERE REFUNDED IN DECEMBER, 2009 BY THE GUARANTY ASSOCIATION. THERE ARE NO

AVAILABLE CREDITS TO CLAIM ON THE 2011 FORM 1061. SCHEDULE E HAS BEEN REMOVED.

Schedule F:

Louisiana Life and Health Insurance Guaranty Association Assessment Credit Schedule - Title 22 Chapter 10 Part 2

(A) Assessment Amount

(B) Maximum Annual Deduction

(C) Amount of Credit

Year of Assessment

Class B only

Percentage

[Column A x Column B]

2006

$

20%

$

2007

$

20%

$

2008

$

20%

$

2009

$

20%

$

2010

$

20%

$

A. TOTAL - Add Column C

$

Form 1061 (Revised 10-11)

THIS DOCUMENT IS EXEMPT FROM PUBLIC RECORDS LAW UNDER L.R.S. 44§4

Page 5 of 6

1

1 2

2 3

3 4

4 5

5 6

6