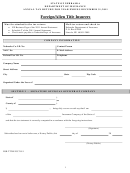

NAIC NUMBER:

COMPANY NAME:

Affidavit

State of

Parish or

County of

, Authorized Company Officer,

of (Company)

, being duly sworn, is the above

described officer of the said Company, and that the statement filed herewith is true and correct to the best of

his/her knowledge, information and belief.

Sworn to and subscribed this

day of

,

Company Officer

Notary Public

Title

Filing Instructions

Who Must File This Form?

All insurance companies required to pay a license tax by the Louisiana Insurance Code - Title 22 must file this

form and pay the appropriate taxes. This form is not applicable to surplus lines insurers or producers.

Due Date:

March 1, 2012

Late Filings:

Any annual tax payment not postmarked by March 1, 2012, will be penalized in accordance with L.R.S. 22§846.

Louisiana Revised Statutes 22§846 provides that a penalty of five percent (5%) per month shall be added to the

amount of tax due and payable to the Commissioner of Insurance unless evidence to his satisfaction is

submitted to him to show that the failure was due to some unforeseen or unavoidable reason, other than mere

neglect. In no event shall the penalty exceed twenty-five percent (25%) of the total amount of the tax due nor be

less than twenty-five dollars ($25). A penalty will be assessed if either of the following occurs:

a.

The U.S. Postal Service Postmark on the payment is after the due date; or,

b.

The date the payment is received by the Louisiana Department of Insurance is more than one day

after the due date, if sent through any carrier other than the U.S. Postal Service.

Filing Address:

Mail tax statement and all required attachments to the address listed on Page 1 of this form. Do not include

Tax Statements with your Annual Statement filing.

Property and Casualty companies are required to attach a copy of the 2011 Annual Statement Schedule T and

Required Attachments:

State Page 19. Life, Accident and Health companies are required to attach a copy of the 2011 Annual

Statement Schedule T and State Page 24. Health Maintenance Organizations are required to attach a copy of

the 2011 Annual Statement Schedule T and Page 29, Exhibit of Premiums, Enrollment and Utilization. Both

Property and Casualty and Life, Accident and Health insurers are required to attach Form 1076 unless no written

premiums were allocable to Louisiana in 2010. HMOs are exempt from filing Form 1076.

Payment Methods:

All payments must include the NAIC number and full name of the company. Payments may be made by

check, bank wire, or ACH credit. Checks must be made payable to Commissioner of Insurance, State of

Louisiana. Bank Wire payments may be sent to the Louisiana Department of Insurance - Revenue Account #

7900406317 at JPMorgan Chase Bank, National Association, ABA # 065400137. See special instructions for

the ACH credit method, Form LDOI-OMF-TD-EFT-Instructions for addenda record requirements. Payments

through an electronic funds transfer must be posted to the Department of Insurance’s account by Thursday,

March 1, 2012, to avoid late penalties. Do not consolidate tax payments into a single group payment for

companies within a group.

The Louisiana Department of Insurance may convert your payments by check to an electronic Automated

Payment Notice

Clearinghouse (ACH) debit transaction. This means that your account may be debited the day your check is

received by the Louisiana Department of Insurance. Although the debit transaction will appear on your bank

statement, your check will not be returned to your bank. If the electronic transfer cannot be processed for

technical reasons, you authorize us to process the copy of your check.

How to contact us:

You may call us at (225) 342-1012 or fax your request to (225) 342-9708. Also, visit our web site at

You may have to pay both Item A and Item B tax on Page 1. If you are a Property and Casualty company with a

Check your Certificate of Authority:

Louisiana Certificate of Authority to write Accident and Health, the Item 1 minimum tax of $140 is due for zero or

negative premiums (see Table 1062A-LA&H).

Form 1061 must be signed by an authorized officer of the company and notarized.

Affidavit:

Form 1061 (Revised 10-11)

THIS DOCUMENT IS EXEMPT FROM PUBLIC RECORDS LAW UNDER L.R.S. 44§4

Page 6 of 6

1

1 2

2 3

3 4

4 5

5 6

6