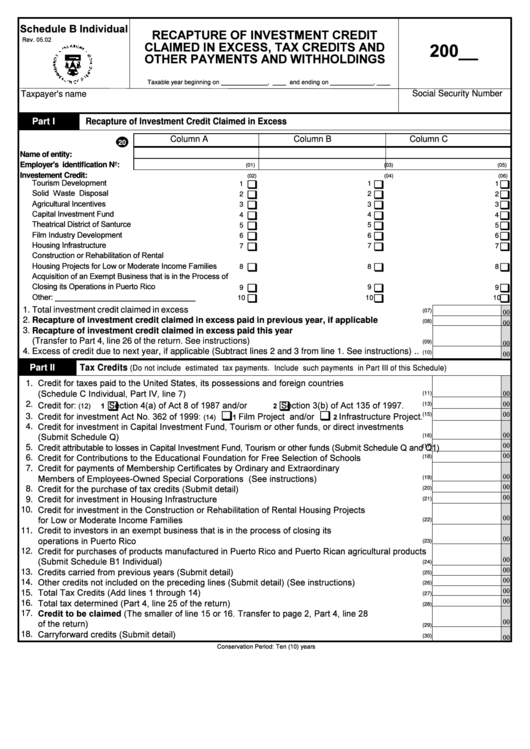

Schedule B Individual - Recapture Of Investment Credit Claimed In Excess, Tax Credits And Other Payment And Withholdings

ADVERTISEMENT

Schedule B Individual

RECAPTURE OF INVESTMENT CREDIT

Rev. 05.02

CLAIMED IN EXCESS, TAX CREDITS AND

200__

OTHER PAYMENTS AND WITHHOLDINGS

Taxable year beginning on ______________, ____ and ending on _____________, ____

Social Security Number

Taxpayer's name

Part I

Recapture of Investment Credit Claimed in Excess

Column A

Column B

Column C

20

Name of entity:

Employer's identification No:

(01)

(03)

(05)

Investement Credit:

(02)

(04)

(06)

;

;

;

Tourism Development ............................................................

.....................................................

.....................................................

1

1

1

;

;

;

.....................................................

Solid Waste Disposal ...........................................................

.....................................................

2

2

2

;

;

;

.....................................................

.....................................................

Agricultural Incentives ............................................................

3

3

3

;

;

;

.....................................................

.....................................................

Capital Investment Fund ........................................................

4

4

4

;

;

.....................................................

;

.....................................................

Theatrical District of Santurce ................................................

5

5

5

;

;

;

.....................................................

Film Industry Development ....................................................

.....................................................

6

6

6

;

;

;

.....................................................

Housing Infrastructure ............................................................

.....................................................

7

7

7

Construction or Rehabilitation of Rental

;

;

;

.....................................................

.....................................................

Housing Projects for Low or Moderate Income Families ......

8

8

8

Acquisition of an Exempt Business that is in the Process of

.....................................................

;

;

.....................................................

;

Closing its Operations in Puerto Rico ..................................

9

9

9

.....................................................

;

;

;

.....................................................

Other: _________________________________ ................

10

10

10

1.

Total investment credit claimed in excess .............................................................................................

00

(07)

2.

Recapture of investment credit claimed in excess paid in previous year , if applicable...............

00

(08)

3.

Recapture of investment credit claimed in excess paid this year

(Transfer to Part 4, line 26 of the return. See instructions) ....................................................................

00

(09)

4.

Excess of credit due to next year, if applicable (Subtract lines 2 and 3 from line 1. See instructions) ..

(10)

00

Part II

Tax Credits

(Do not include estimated tax payments. Include such payments in Part III of this Schedule)

1.

00

(11)

;

;

00

2.

(12)

1

2

(13)

;

;

00

(15)

3.

(14)

1

2

4.

00

(16)

00

(17)

5.

00

6.

(18)

7.

00

(19)

00

8.

(20)

00

9.

(21)

10.

00

(22)

11.

00

(23)

12.

00

(24)

00

13.

(25)

00

14.

(26)

00

15.

(27)

00

16.

(28)

Credit to be claimed

17.

00

(29)

18.

00

(30)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2