*DF53013019999*

DELAWARE DIVISION OF REVENUE

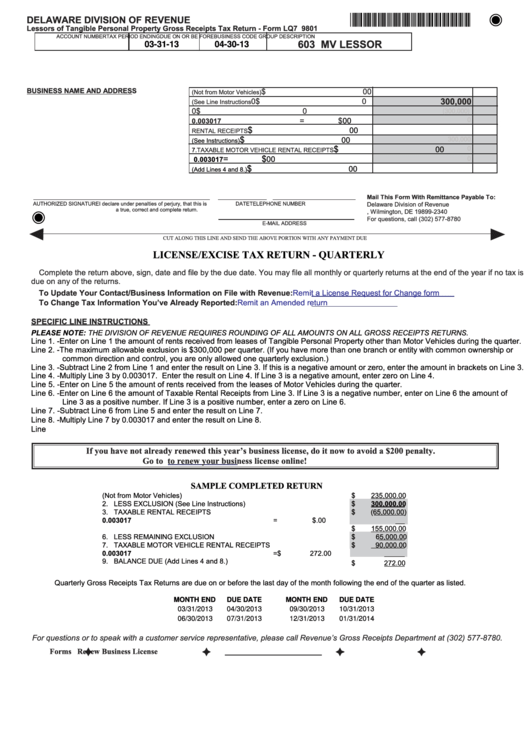

Lessors of Tangible Personal Property Gross Receipts Tax Return - Form LQ7 9801

ACCOUNT NUMBER

TAX PERIOD ENDING

DUE ON OR BE FORE

BUSINESS CODE GROUP DESCRIPTION

603 MV LESSOR

0-000000000-000

03-31-13

04-30-13

Reset

00280607000000000000003311304301300000000006030000000

Print Form

BUSINESS NAME AND ADDRESS

$

00

1. RENTAL RECEIPTS (Not from Motor Vehicles)

$

300,000

0

0

2. LESS EXCLUSION (See Line Instructions

$

0

0

3. TAXABLE RENTAL RECEIPTS

(300,000)

=

$

00

0.003017

4. LINE 3 X

0

$

00

5. MOTOR VEHICLE

RENTAL RECEIPTS

$

00

6. LESS REMAINING EXCLUSION (See Instructions)

300,000

$

00

7.

TAXABLE MOTOR VEHICLE RENTAL RECEIPTS

0

=

$

00

0.003017

8. LINE 7 X

0

$

00

9. BALANCE DUE (Add Lines 4 and 8.)

0

Mail This Form With Remittance Payable To:

AUTHORIZED SIGNATURE

I declare under penalties of perjury, that this is

DATE

TELEPHONE NUMBER

Delaware Division of Revenue

a true, correct and complete return.

P.O. Box 2340, Wilmington, DE 19899-2340

For questions, call (302) 577-8780

E-MAIL ADDRESS

CUT ALONG THIS LINE AND SEND THE ABOVE PORTION WITH ANY PAYMENT DUE

LICENSE/EXCISE TAX RETURN - QUARTERLY

Complete the return above, sign, date and file by the due date. You may file all monthly or quarterly returns at the end of the year if no tax is

due on any of the returns.

To Update Your Contact/Business Information on File with Revenue:

Remit a License Request for Change form

To Change Tax Information You’ve Already Reported:

Remit an Amended return

SPECIFIC LINE INSTRUCTIONS

PLEASE NOTE: THE DIVISION OF REVENUE REQUIRES ROUNDING OF ALL AMOUNTS ON ALL GROSS RECEIPTS RETURNS.

Line 1. - Enter on Line 1 the amount of rents received from leases of Tangible Personal Property other than Motor Vehicles during the quarter.

Line 2. - The maximum allowable exclusion is $300,000 per quarter. (If you have more than one branch or entity with common ownership or

common direction and control, you are only allowed one quarterly exclusion.)

Line 3. - Subtract Line 2 from Line 1 and enter the result on Line 3. If this is a negative amount or zero, enter the amount in brackets on Line 3.

Line 4. - Multiply Line 3 by 0.003017. Enter the result on Line 4. If Line 3 is a negative amount, enter zero on Line 4.

Line 5. - Enter on Line 5 the amount of rents received from the leases of Motor Vehicles during the quarter.

Line 6. - Enter on Line 6 the amount of Taxable Rental Receipts from Line 3. If Line 3 is a negative number, enter on Line 6 the amount of

Line 3 as a positive number. If Line 3 is a positive number, enter a zero on Line 6.

Line 7. - Subtract Line 6 from Line 5 and enter the result on Line 7.

Line 8. - Multiply Line 7 by 0.003017 and enter the result on Line 8.

Line 9.

Add together Lines 4 and 8 and enter the result on Line 9. This amount of tax is due and payable with the filing of this return.

If you have not already renewed this year’s business license, do it now to avoid a $200 penalty.

Go to

to renew your business license online!

SAMPLE COMPLETED RETURN

1. RENTAL RECEIPTS (Not from Motor Vehicles)

$

235,000.00

2. LESS EXCLUSION (See Line Instructions)

$

300,000.00

3. TAXABLE RENTAL RECEIPTS

$

(65,000.00)

4. LINE 3 X 0.003017

=

$

.00

5. MOTOR VEHICLE RENTAL RECEIPTS

$

155,000.00

6. LESS REMAINING EXCLUSION

$

65,000.00

7. TAXABLE MOTOR VEHICLE RENTAL RECEIPTS

$

90,000.00

8. LINE 7 X 0.003017

=

$

272.00

9. BALANCE DUE (Add Lines 4 and 8.)

$

272.00

Quarterly Gross Receipts Tax Returns are due on or before the last day of the month following the end of the quarter as listed.

MONTH END

DUE DATE

MONTH END

DUE DATE

03/31/2013

04/30/2013

09/30/2013

10/31/2013

06/30/2013

07/31/2013

12/31/2013

01/31/2014

For questions or to speak with a customer service representative, please call Revenue’s Gross Receipts Department at (302) 577-8780.

Forms

Renew Business License

.delaware.gov

File Online

Tax Tips

1

1 2

2