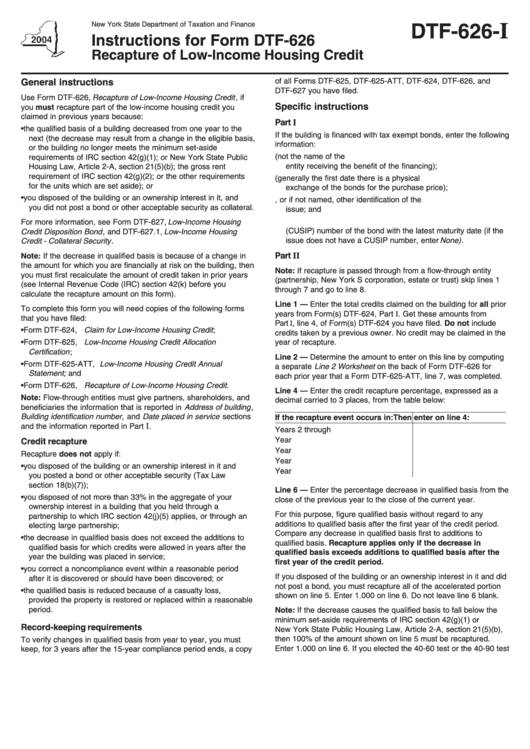

Instructions For Form Dtf-626 - Recapture Of Low-Income Housing Credit - New York State Department Of Taxation And Finance - 2004

ADVERTISEMENT

New York State Department of Taxation and Finance

I

DTF-626-

Instructions for Form DTF-626

Recapture of Low-Income Housing Credit

of all Forms DTF-625, DTF-625-ATT, DTF-624, DTF-626, and

General instructions

DTF-627 you have filed.

Use Form DTF-626, Recapture of Low-Income Housing Credit , if

Specific instructions

you must recapture part of the low-income housing credit you

claimed in previous years because:

Part I

• the qualified basis of a building decreased from one year to the

If the building is financed with tax exempt bonds, enter the following

next (the decrease may result from a change in the eligible basis,

information:

or the building no longer meets the minimum set-aside

1. name of the entity that issued the bond (not the name of the

requirements of IRC section 42(g)(1); or New York State Public

entity receiving the benefit of the financing);

Housing Law, Article 2-A, section 21(5)(b); the gross rent

requirement of IRC section 42(g)(2); or the other requirements

2. date of issue (generally the first date there is a physical

for the units which are set aside); or

exchange of the bonds for the purchase price);

• you disposed of the building or an ownership interest in it, and

3. name of the issue, or if not named, other identification of the

you did not post a bond or other acceptable security as collateral.

issue; and

4. Committee on Uniform Security Identification Procedures

For more information, see Form DTF-627, Low-Income Housing

(CUSIP) number of the bond with the latest maturity date (if the

Credit Disposition Bond , and DTF-627.1, Low-Income Housing

issue does not have a CUSIP number, enter None) .

Credit - Collateral Security .

Part II

Note: If the decrease in qualified basis is because of a change in

the amount for which you are financially at risk on the building, then

Note: If recapture is passed through from a flow-through entity

you must first recalculate the amount of credit taken in prior years

(partnership, New York S corporation, estate or trust) skip lines 1

(see Internal Revenue Code (IRC) section 42(k) before you

through 7 and go to line 8.

calculate the recapture amount on this form).

Line 1 — Enter the total credits claimed on the building for all prior

To complete this form you will need copies of the following forms

years from Form(s) DTF-624, Part I. Get these amounts from

that you have filed:

Part I, line 4, of Form(s) DTF-624 you have filed. Do not include

• Form DTF-624, Claim for Low-Income Housing Credit ;

credits taken by a previous owner. No credit may be claimed in the

• Form DTF-625, Low-Income Housing Credit Allocation

year of recapture.

Certification ;

Line 2 — Determine the amount to enter on this line by computing

• Form DTF-625-ATT, Low-Income Housing Credit Annual

a separate Line 2 Worksheet on the back of Form DTF-626 for

Statement; and

each prior year that a Form DTF-625-ATT, line 7, was completed.

• Form DTF-626, Recapture of Low-Income Housing Credit.

Line 4 — Enter the credit recapture percentage, expressed as a

Note: Flow-through entities must give partners, shareholders, and

decimal carried to 3 places, from the table below:

beneficiaries the information that is reported in Address of building ,

Building identification number, and Date placed in service sections

If the recapture event occurs in:

Then enter on line 4:

I

and the information reported in Part

.

Years 2 through 11 ...............................

.333

Year 12 .................................................

.267

Credit recapture

Year 13 .................................................

.200

Recapture does not apply if:

Year 14 .................................................

.133

• you disposed of the building or an ownership interest in it and

Year 15 .................................................

.067

you posted a bond or other acceptable security (Tax Law

section 18(b)(7));

Line 6 — Enter the percentage decrease in qualified basis from the

• you disposed of not more than 33% in the aggregate of your

close of the previous year to the close of the current year.

ownership interest in a building that you held through a

For this purpose, figure qualified basis without regard to any

partnership to which IRC section 42(j)(5) applies, or through an

additions to qualified basis after the first year of the credit period.

electing large partnership;

Compare any decrease in qualified basis first to additions to

• the decrease in qualified basis does not exceed the additions to

qualified basis. Recapture applies only if the decrease in

qualified basis for which credits were allowed in years after the

qualified basis exceeds additions to qualified basis after the

year the building was placed in service;

first year of the credit period.

• you correct a noncompliance event within a reasonable period

If you disposed of the building or an ownership interest in it and did

after it is discovered or should have been discovered; or

not post a bond, you must recapture all of the accelerated portion

• the qualified basis is reduced because of a casualty loss,

shown on line 5. Enter 1.000 on line 6. Do not leave line 6 blank.

provided the property is restored or replaced within a reasonable

period.

Note: If the decrease causes the qualified basis to fall below the

minimum set-aside requirements of IRC section 42(g)(1) or

Record-keeping requirements

New York State Public Housing Law, Article 2-A, section 21(5)(b),

then 100% of the amount shown on line 5 must be recaptured.

To verify changes in qualified basis from year to year, you must

Enter 1.000 on line 6. If you elected the 40-60 test or the 40-90 test

keep, for 3 years after the 15-year compliance period ends, a copy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2