F

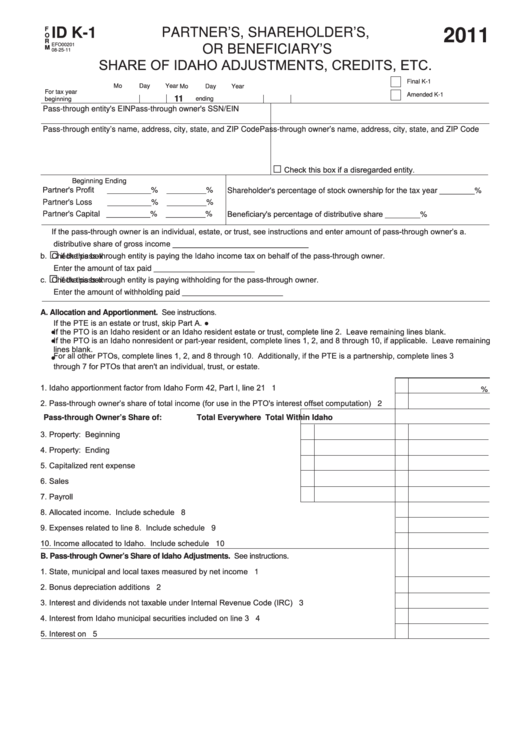

ID K-1

PARTNER’S, SHAREHOLDER’S,

2011

O

R

EFO00201

OR BENEFICIARY’S

M

08-25-11

SHARE OF IDAHO ADJUSTMENTS, CREDITS, ETC.

Final K-1

Mo

Day

Year

Mo

Day

Year

For tax year

Amended K-1

beginning

11

ending

Pass-through entity's EIN

Pass-through owner's SSN/EIN

Pass-through entity’s name, address, city, state, and ZIP Code

Pass-through owner’s name, address, city, state, and ZIP Code

□

Check this box if a disregarded entity.

Beginning

Ending

Partner's Profit

__________ %

_________%

Shareholder's percentage of stock ownership for the tax year ________%

Partner's Loss

__________ %

_________%

Beneficiary's percentage of distributive share ________ %

Partner's Capital __________ %

_________%

a.

If the pass-through owner is an individual, estate, or trust, see instructions and enter amount of pass-through owner’s

distributive share of gross income _______________________________

□

b.

Check this box

if the pass-through entity is paying the Idaho income tax on behalf of the pass-through owner.

Enter the amount of tax paid _______________________

□

c.

Check this box

if the pass-through entity is paying withholding for the pass-through owner.

Enter the amount of withholding paid _______________________

A. Allocation and Apportionment. See instructions.

●

If the PTE is an estate or trust, skip Part A.

●

If the PTO is an Idaho resident or an Idaho resident estate or trust, complete line 2. Leave remaining lines blank.

●

If the PTO is an Idaho nonresident or part-year resident, complete lines 1, 2, and 8 through 10, if applicable. Leave remaining

lines blank.

●

For all other PTOs, complete lines 1, 2, and 8 through 10. Additionally, if the PTE is a partnership, complete lines 3

through 7 for PTOs that aren't an individual, trust, or estate.

1. Idaho apportionment factor from Idaho Form 42, Part I, line 21 ......................................................

1

%

2. Pass-through owner’s share of total income (for use in the PTO's interest offset computation) ......

2

Pass-through Owner’s Share of:

Total Everywhere

Total Within Idaho

3. Property: Beginning ............................................................................. 3a

3b

4. Property: Ending .................................................................................. 4a

4b

5. Capitalized rent expense ...................................................................... 5a

5b

6. Sales ..................................................................................................... 6a

6b

7. Payroll ................................................................................................... 7a

7b

8. Allocated income. Include schedule ................................................................................................

8

9. Expenses related to line 8. Include schedule ..................................................................................

9

10. Income allocated to Idaho. Include schedule .................................................................................. 10

B. Pass-through Owner’s Share of Idaho Adjustments. See instructions.

1. State, municipal and local taxes measured by net income ..............................................................

1

2. Bonus depreciation additions ...........................................................................................................

2

3. Interest and dividends not taxable under Internal Revenue Code (IRC) .........................................

3

4. Interest from Idaho municipal securities included on line 3 .............................................................

4

5. Interest on U.S. Government obligations .........................................................................................

5

1

1 2

2