Form 65-5300 - Employer'S Contribution & Payroll Report - State Of Iowa - 2000

ADVERTISEMENT

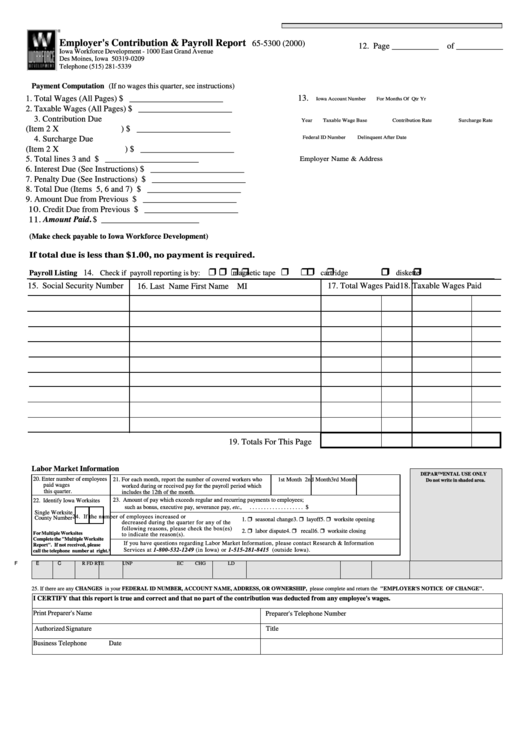

Employer's Contribution & Payroll Report

65-5300 (2000)

12. Page ___________ of ___________

Iowa Workforce Development - 1000 East Grand Avenue

Des Moines, Iowa 50319-0209

Telephone (515) 281-5339

Payment Computation (If no wages this quarter, see instructions)

13.

1. Total Wages (All Pages) ............................. $ ______________________

Iowa Account Number

For Months Of

Qtr Yr

2. Taxable Wages (All Pages) ......................... $ ______________________

3. Contribution Due

Year

Taxable Wage Base

Contribution Rate

Surcharge Rate

(Item 2 X

) ..................... $ ______________________

4. Surcharge Due

Federal ID Number

Delinquent After Date

(Item 2 X

) ................... $ ______________________

5. Total lines 3 and 4 ...................................... $ ______________________

Employer Name & Address

6. Interest Due (See Instructions) ................... $ ______________________

7. Penalty Due (See Instructions) ................... $ ______________________

8. Total Due (Items 5, 6 and 7) ..................... $ ______________________

9. Amount Due from Previous Quarter .......... $ ______________________

10. Credit Due from Previous Quarter ............. $ ______________________

11. Amount Paid. ............................................. $ _______________________

(Make check payable to Iowa Workforce Development)

If total due is less than $1.00, no payment is required.

14.

Payroll Listing

Check if payroll reporting is by:

magnetic tape

cartridge

diskette

15. Social Security Number

17. Total Wages Paid

18. Taxable Wages Paid

16. Last Name

First Name

MI

19. Totals For This Page

Labor Market Information

DEPARTMENTAL USE ONLY

20. Enter number of employees

21. For each month, report the number of covered workers who

1st Month

2nd Month

3rd Month

Do not write in shaded area.

paid wages

worked during or received pay for the payroll period which

this quarter.

includes the 12th of the month.

23. Amount of pay which exceeds regular and recurring payments to employees;

22. Identify Iowa Worksites

such as bonus, executive pay, severance pay, etc.,

. . . . . . . . . . . . . . . . . . . $

Single Worksite

24. If the number of employees increased or

County Number

1.

seasonal change

3.

layoff

5.

worksite opening

decreased during the quarter for any of the

following reasons, please check the box(es)

2.

labor dispute

4.

recall

6.

worksite closing

For Multiple Worksites

to indicate the reason(s).

Complete the "Multiple Worksite

If you have questions regarding Labor Market Information, please contact Research & Information

Report". If not received, please

Services at 1-800-532-1249 (in Iowa) or 1-515-281-8415 (outside Iowa).

call the telephone number at right.¹

F

E

C

R

FD

RTE

UNP

EC

CHG

LD

25. If there are any CHANGES in your FEDERAL ID NUMBER, ACCOUNT NAME, ADDRESS, OR OWNERSHIP, please complete and return the "EMPLOYER'S NOTICE OF CHANGE".

I CERTIFY that this report is true and correct and that no part of the contribution was deducted from any employee's wages.

Print Preparer's Name

Preparer's Telephone Number

Authorized Signature

Title

Business Telephone

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1