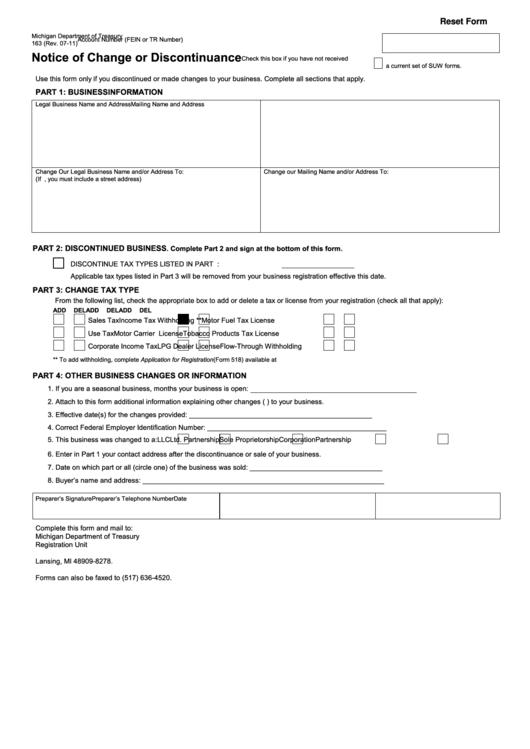

Reset Form

Michigan Department of Treasury

Account Number (FEIN or TR Number)

163 (Rev. 07-11)

Notice of Change or Discontinuance

Check this box if you have not received

a current set of SUW forms.

Use this form only if you discontinued or made changes to your business. Complete all sections that apply.

PART 1: BUSINESS INFORMATION

Legal Business Name and Address

Mailing Name and Address

Change Our Legal Business Name and/or Address To:

Change our Mailing Name and/or Address To:

(If P.O. Box Number, you must include a street address)

PART 2: DISCONTINUED BUSINESS

. Complete Part 2 and sign at the bottom of this form.

DISCONTINUE TAX TYPES LISTED IN PART 3.

Effective Date:

Applicable tax types listed in Part 3 will be removed from your business registration effective this date.

PART 3: CHANGE TAX TYPE

From the following list, check the appropriate box to add or delete a tax or license from your registration (check all that apply):

ADD

DEL

ADD

DEL

ADD

DEL

Sales Tax

Income Tax Withholding **

Motor Fuel Tax License

Use Tax

Motor Carrier License

Tobacco Products Tax License

Corporate Income Tax

LPG Dealer License

Flow-Through Withholding

** To add withholding, complete Application for Registration (Form 518) available at

PART 4: OTHER BUSINESS CHANGES OR INFORMATION

1. If you are a seasonal business, months your business is open:

2. Attach to this form additional information explaining other changes (e.g. mergers) to your business.

3. Effective date(s) for the changes provided: _______________________________________________

4. Correct Federal Employer Identification Number: ______________________________________________

5. This business was changed to a:

LLC

Ltd. Partnership

Sole Proprietorship

Corporation

Partnership

6. Enter in Part 1 your contact address after the discontinuance or sale of your business.

7. Date on which part or all (circle one) of the business was sold: __________________________________

8. Buyer’s name and address: ______________________________________________________________

Preparer’s Signature

Preparer’s Telephone Number

Date

Complete this form and mail to:

Michigan Department of Treasury

Registration Unit

P.O. Box 30778

Lansing, MI 48909-8278.

Forms can also be faxed to (517) 636-4520.

1

1