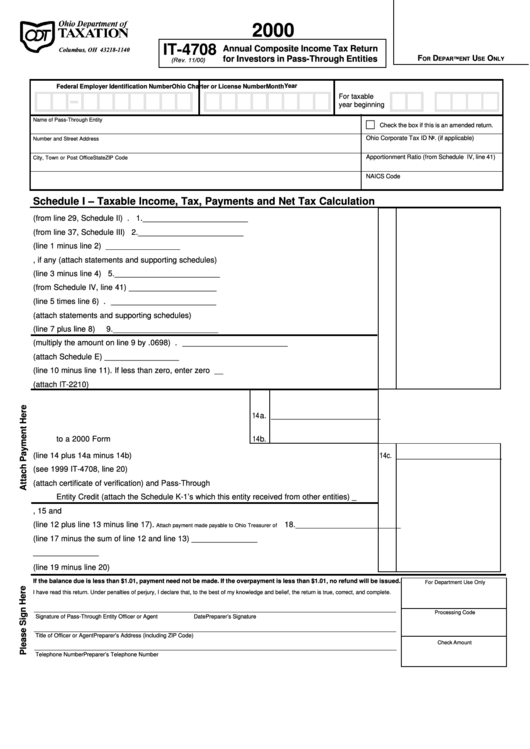

Form It-4708 - Annual Composite Income Tax Return For Investors In Pass-Through Entities 2000 - State Of Ohio

ADVERTISEMENT

2000

P.O. Box 181140

IT-4708

Annual Composite Income Tax Return

Columbus, OH 43218-1140

for Investors in Pass-Through Entities

F

D

U

O

(Rev. 11/00)

OR

EPARTMENT

SE

NLY

Year

Federal Employer Identification Number

Ohio Charter or License Number

Month

For taxable

year beginning

Name of Pass-Through Entity

c

Check the box if this is an amended return.

Ohio Corporate Tax ID No. (if applicable)

Number and Street Address

Apportionment Ratio (from Schedule IV, line 41)

City, Town or Post Office

State

ZIP Code

NAICS Code

Schedule I – Taxable Income, Tax, Payments and Net Tax Calculation

1.

Total Income (from line 29, Schedule II) .................................................................................... 1. ________________________

2.

Total Deductions (from line 37, Schedule III) ............................................................................. 2. ________________________

3.

Income to be allocated and apportioned (line 1 minus line 2) ................................................... 3. ________________________

4.

Net Allocable Income Everywhere, if any (attach statements and supporting schedules) ......... 4. ________________________

5.

Apportionable Income (line 3 minus line 4) ................................................................................ 5. ________________________

6.

Ohio Apportionment Ratio (from Schedule IV, line 41) .............................................................

6. ________________________

7.

Income Apportioned to Ohio (line 5 times line 6) ......................................................................

7. ________________________

8.

Net Income Allocated to Ohio (attach statements and supporting schedules) .........................

8. ________________________

9.

Ohio Taxable Income (line 7 plus line 8) ...................................................................................

9. ________________________

10.

Tax (multiply the amount on line 9 by .0698) ............................................................................. 10. ________________________

11.

Nonrefundable Business Credits (attach Schedule E) ............................................................... 11. ________________________

12.

Tax due after nonrefundable credits (line 10 minus line 11). If less than zero, enter zero ........ 12. ________________________

13.

Interest penalty on underpayment of tax (attach IT-2210) ......................................................... 13.

14.

IT-4708ES payments for 2000 .......................................

14. _________________________

14a. IT-1140ES payments for 2000 transferred to this form ... 14a. _________________________

14b. Deduct IT-4708ES payments for 2000 transferred

to a 2000 Form IT-1140 ................................................... 14b.

14c.

Total net Ohio estimated tax payments for 2000 (line 14 plus 14a minus 14b) ....................... 14c. ________________________

15.

Amount of 1999 overpayment credited to 2000 (see 1999 IT-4708, line 20) ........................... 15. ________________________

16.

Refundable Business Jobs Credit (attach certificate of verification) and Pass-Through

Entity Credit (attach the Schedule K-1’s which this entity received from other entities) ........... 16. ________________________

17.

Total of lines 14c, 15 and 16 ..................................................................................................... 17. ________________________

18.

Net Tax Due (line 12 plus line 13 minus line 17).

18. ________________________

Attach payment made payable to Ohio Treasurer of State ...........

19.

Overpayment (line 17 minus the sum of line 12 and line 13) .................................................... 19. ________________________

20.

Amount of line 19 to be CREDITED to year 2001 tax liability .................................................... 20. ________________________

21.

Amount of line 19 to be REFUNDED (line 19 minus line 20) ..................................................... 21.

If the balance due is less than $1.01, payment need not be made. If the overpayment is less than $1.01, no refund will be issued.

For Department Use Only

I have read this return. Under penalties of perjury, I declare that, to the best of my knowledge and belief, the return is true, correct, and complete.

Processing Code

Signature of Pass-Through Entity Officer or Agent

Date

Preparer’s Signature

Title of Officer or Agent

Preparer’s Address (including ZIP Code)

Check Amount

Telephone Number

Preparer’s Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3