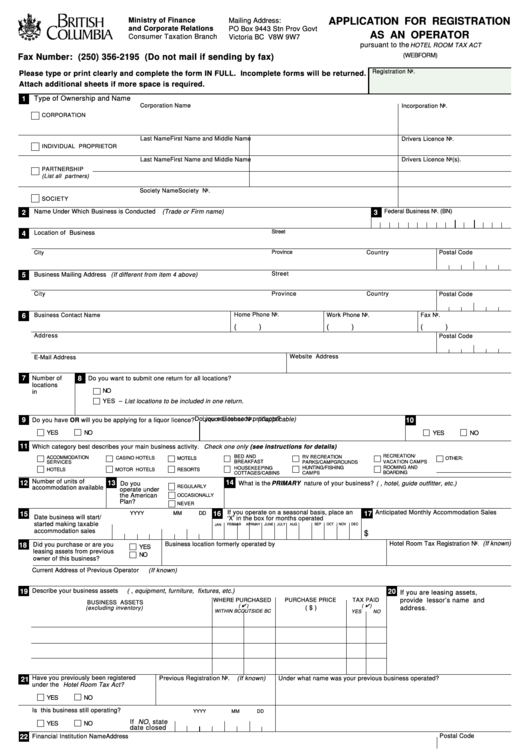

Form Fin 430 - Application For Registration As An Operator - British Columbia Ministry Of Finance And Corporate Relations

ADVERTISEMENT

Ministry of Finance

APPLICATION FOR REGISTRATION

Mailing Address:

and Corporate Relations

PO Box 9443 Stn Prov Govt

AS AN OPERATOR

Consumer Taxation Branch

Victoria BC V8W 9W7

pursuant to the

HOTEL ROOM TAX ACT

(WEBFORM)

Fax Number: (250) 356-2195 (Do not mail if sending by fax)

Registration No.

Please type or print clearly and complete the form IN FULL. Incomplete forms will be returned.

Attach additional sheets if more space is required.

Type of Ownership and Name

1

Corporation Name

Incorporation No.

CORPORATION

Last Name

First Name and Middle Name

Drivers Licence No.

INDIVIDUAL PROPRIETOR

Last Name

First Name and Middle Name

Drivers Licence No(s).

PARTNERSHIP

(List all partners)

Society Name

Society No.

SOCIETY

Federal Business No. (BN)

Name Under Which Business is Conducted (Trade or Firm name)

2

3

Street

Location of Business

4

Province

Country

City

Postal Code

Street

Business Mailing Address (If different from item 4 above)

5

City

Province

Country

Postal Code

Home Phone No.

6

Business Contact Name

Work Phone No.

Fax No.

(

)

(

)

(

)

Address

Postal Code

Website Address

E-Mail Address

7

8

Do you want to submit one return for all locations?

Number of

locations

NO

in B.C.

YES – List locations to be included in one return.

Liquor Licence No. (if applicable)

Do you sell tobacco products?

9

Do you have OR will you be applying for a liquor licence?

10

YES

NO

YES

NO

11

Which category best describes your main business activity. Check one only (see instructions for details)

RECREATION/

BED AND

RV RECREATION

ACCOMMODATION

CASINO HOTELS

MOTELS

OTHER:

BREAKFAST

PARKS/CAMPGROUNDS

VACATION CAMPS

SERVICES

ROOMING AND

HOUSEKEEPING

HUNTING/FISHING

HOTELS

MOTOR HOTELS

RESORTS

CAMPS

BOARDING

COTTAGES/CABINS

Number of units of

14

12

13

Do you

What is the PRIMARY nature of your business? (e.g., hotel, guide outfitter, etc.)

REGULARLY

accommodation available

operate under

the American

OCCASIONALLY

Plan?

NEVER

Anticipated Monthly Accommodation Sales

If you operate on a seasonal basis, place an

17

15

YYYY

MM

DD

16

Date business will start/

‘X’ in the box for months operated

started making taxable

FEB

MAR

APR

MAY

JUNE

JULY

AUG

SEP

OCT

NOV

DEC

JAN

accommodation sales

$

Hotel Room Tax Registration No.

(If known)

Business location formerly operated by

18

Did you purchase or are you

YES

leasing assets from previous

NO

owner of this business?

Current Address of Previous Operator (If known)

Describe your business assets (e.g., equipment, furniture, fixtures, etc.)

19

20

If you are leasing assets,

WHERE PURCHASED

PURCHASE PRICE

TAX PAID

provide lessor’s name and

BUSINESS ASSETS

(

)

(

)

( $ )

address.

(excluding inventory)

WITHIN BC OUTSIDE BC

YES

NO

Have you previously been registered

Previous Registration No. (If known)

Under what name was your previous business operated?

21

under the Hotel Room Tax Act?

YES

NO

Is this business still operating?

YYYY

MM

DD

If NO , state

YES

NO

date closed

Address

Postal Code

22

Financial Institution Name

23

Certification – The above statements are certified to be correct to the best knowledge and belief of the undersigned.

Signature

Date Signed

Title

Name – Please print

YYYY / MM / DD

FIN 430 Rev. 2000 / 9 / 18

ORIGINAL: MAIL OR FAX TO CONSUMER TAXATION BRANCH – DO NOT MAIL IF FAXED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1