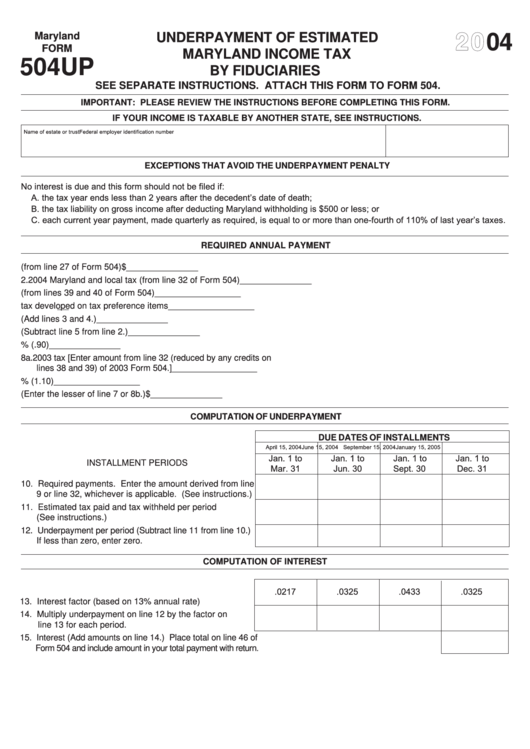

Maryland

UNDERPAYMENT OF ESTIMATED

2004

FORM

MARYLAND INCOME TAX

504UP

BY FIDUCIARIES

SEE SEPARATE INSTRUCTIONS. ATTACH THIS FORM TO FORM 504.

IMPORTANT: PLEASE REVIEW THE INSTRUCTIONS BEFORE COMPLETING THIS FORM.

IF YOUR INCOME IS TAXABLE BY ANOTHER STATE, SEE INSTRUCTIONS.

Name of estate or trust

Federal employer identification number

EXCEPTIONS THAT AVOID THE UNDERPAYMENT PENALTY

No interest is due and this form should not be filed if:

A. the tax year ends less than 2 years after the decedent’s date of death;

B. the tax liability on gross income after deducting Maryland withholding is $500 or less; or

C. each current year payment, made quarterly as required, is equal to or more than one-fourth of 110% of last year’s taxes.

REQUIRED ANNUAL PAYMENT

1. Total Maryland income (from line 27 of Form 504)

$ _______________

2. 2004 Maryland and local tax (from line 32 of Form 504)

_______________

3. Credits (from lines 39 and 40 of Form 504)

__________________

4. Total tax developed on tax preference items

__________________

5. Total (Add lines 3 and 4.)

_______________

6. Balance (Subtract line 5 from line 2.)

_______________

7. Multiply line 6 by 90% (.90)

_______________

8a. 2003 tax [Enter amount from line 32 (reduced by any credits on

lines 38 and 39) of 2003 Form 504.]

__________________

8b. Multiply line 8a by 110% (1.10)

__________________

9. Minimum withholding and/or estimated tax required (Enter the lesser of line 7 or 8b.)

$ _______________

COMPUTATION OF UNDERPAYMENT

DUE DATES OF INSTALLMENTS

April 15, 2004

June 15, 2004

September 15, 2004

January 15, 2005

Jan. 1 to

Jan. 1 to

Jan. 1 to

Jan. 1 to

INSTALLMENT PERIODS

Mar. 31

Jun. 30

Sept. 30

Dec. 31

10. Required payments. Enter the amount derived from line

9 or line 32, whichever is applicable. (See instructions.)

11. Estimated tax paid and tax withheld per period

(See instructions.)

12. Underpayment per period (Subtract line 11 from line 10.)

If less than zero, enter zero.

COMPUTATION OF INTEREST

.0217

.0325

.0433

.0325

13. Interest factor (based on 13% annual rate)

14. Multiply underpayment on line 12 by the factor on

line 13 for each period.

15. Interest (Add amounts on line 14.) Place total on line 46 of

Form 504 and include amount in your total payment with return.

1

1 2

2