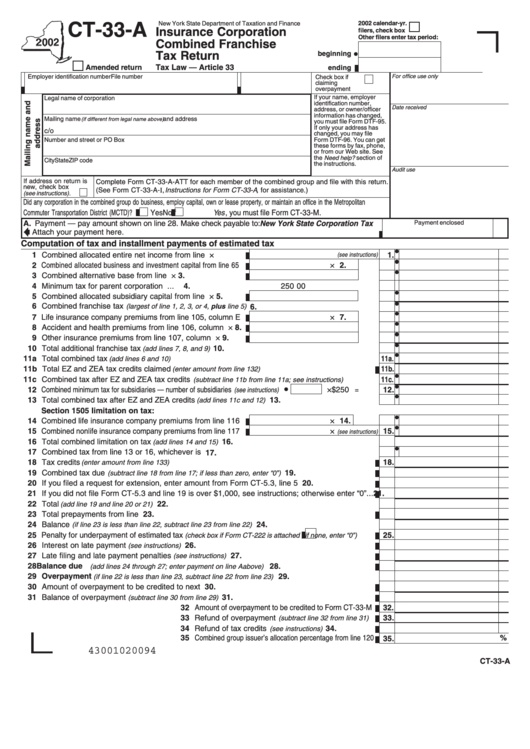

New York State Department of Taxation and Finance

2002 calendar-yr.

CT-33-A

Insurance Corporation

filers, check box

Other filers enter tax period:

Combined Franchise

Tax Return

beginning

Amended return

Tax Law — Article 33

ending

Employer identification number

File number

For office use only

Check box if

claiming

overpayment

If your name, employer

Legal name of corporation

identification number,

Date received

address, or owner/officer

information has changed,

Mailing name

and address

(if different from legal name above)

you must file Form DTF-95.

If only your address has

c/o

changed, you may file

Number and street or PO Box

Form DTF-96. You can get

these forms by fax, phone,

or from our Web site. See

the Need help? section of

City

State

ZIP code

the instructions.

Audit use

If address on return is

Complete Form CT-33-A-ATT for each member of the combined group and file with this return.

new, check box

(See Form CT-33-A-I, Instructions for Form CT-33-A , for assistance.)

(see instructions) .

Did any corporation in the combined group do business, employ capital, own or lease property, or maintain an office in the Metropolitan

Commuter Transportation District (MCTD)?

Yes

No

If Yes , you must file Form CT-33-M.

A. Payment — pay amount shown on line 28. Make check payable to: New York State Corporation Tax

Payment enclosed

..... Attach your payment here.

Computation of tax and installment payments of estimated tax

1 Combined allocated entire net income from line 95 ...........

×

1.

(see instructions)

2 Combined allocated business and investment capital from line 65

× .0016 ........

2.

3 Combined alternative base from line 101 ..........................

× .09

........

3.

4 Minimum tax for parent corporation only ...........................................................................................

4.

250 00

5 Combined allocated subsidiary capital from line 54 ...........

× .0008 ........

5.

6 Combined franchise tax

...........................................................

(largest of line 1, 2, 3, or 4, plus line 5)

6.

7 Life insurance company premiums from line 105, column E

× .007 ........

7.

8 Accident and health premiums from line 106, column E ....

× .01

........

8.

9 Other insurance premiums from line 107, column E ..........

× .013 ........

9.

10 Total additional franchise tax

............................................................................ 10.

(add lines 7, 8, and 9)

11a Total combined tax

.............................................................................................. 11a.

(add lines 6 and 10)

11b Total EZ and ZEA tax credits claimed

..................................................

11b.

(enter amount from line 132)

11c Combined tax after EZ and ZEA tax credits

.............. 11c.

(subtract line 11b from line 11a; see instructions)

12 Combined minimum tax for subsidiaries — number of subsidiaries

× $250

12.

= .........

(see instructions)

13 Total combined tax after EZ and ZEA credits

.................................................. 13.

(add lines 11c and 12)

Section 1505 limitation on tax:

14 Combined life insurance company premiums from line 116

× .02

........ 14.

15 Combined nonlife insurance company premiums from line 117

×

15.

(see instructions)

16 Total combined limitation on tax

........................................................................ 16.

(add lines 14 and 15)

17 Combined tax from line 13 or 16, whichever is less .......................................................................... 17.

18 Tax credits

............................................................................................

18.

(enter amount from line 133)

19 Combined tax due

........................................

19.

(subtract line 18 from line 17; if less than zero, enter “0”)

20 If you filed a request for extension, enter amount from Form CT-5.3, line 5 ..................................

20.

21 If you did not file Form CT-5.3 and line 19 is over $1,000, see instructions; otherwise enter “0” ...

21.

22 Total

...................................................................................................... 22.

(add line 19 and line 20 or 21)

23 Total prepayments from line 130 ....................................................................................................

23.

24 Balance

........................................................ 24.

(if line 23 is less than line 22, subtract line 23 from line 22)

25 Penalty for underpayment of estimated tax

25.

(check box if Form CT-222 is attached

; if none, enter “0”)

26 Interest on late payment

......................................................................................

26.

(see instructions)

27 Late filing and late payment penalties

.................................................................

27.

(see instructions)

28 Balance due

...............................................

28.

(add lines 24 through 27; enter payment on line A above)

29 Overpayment

...........................................

29.

(if line 22 is less than line 23, subtract line 22 from line 23)

30 Amount of overpayment to be credited to next period ...................................................................

30.

31 Balance of overpayment

.....................................................................

31.

(subtract line 30 from line 29)

32 Amount of overpayment to be credited to Form CT-33-M

32.

33 Refund of overpayment

33.

(subtract line 32 from line 31)

34 Refund of tax credits

.....................

34.

(see instructions)

35 Combined group issuer’s allocation percentage from line 120

%

35.

43001020094

CT-33-A

1

1 2

2 3

3 4

4 5

5 6

6