Form 92a936 - Election To Qualify Terminable Interest Property And/or Power Of Appointment Property - 2012

ADVERTISEMENT

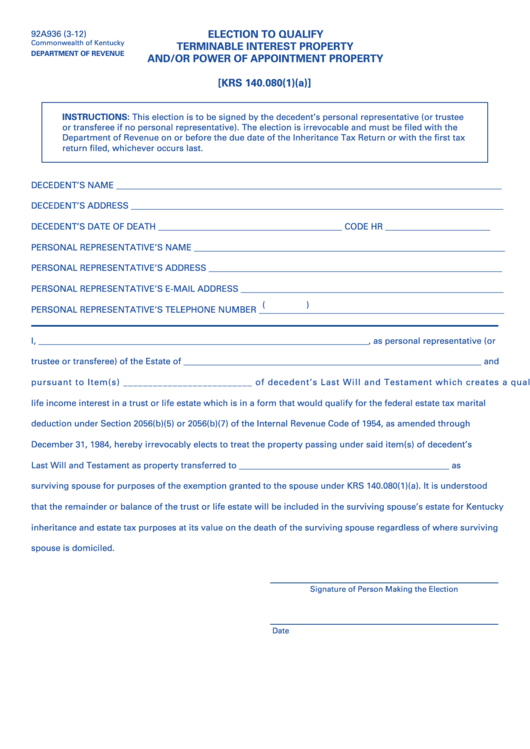

92A936 (3-12)

ELECTION TO QUALIFY

Commonwealth of Kentucky

TERMINABLE INTEREST PROPERTY

DEPARTMENT OF REVENUE

AND/OR POWER OF APPOINTMENT PROPERTY

[KRS 140.080(1)(a)]

INSTRUCTIONS: This election is to be signed by the decedent’s personal representative (or trustee

or transferee if no personal representative). The election is irrevocable and must be filed with the

Department of Revenue on or before the due date of the Inheritance Tax Return or with the first tax

return filed, whichever occurs last.

DECEDENT’S NAME ________________________________________________________________________________________

DECEDENT’S ADDRESS _____________________________________________________________________________________

DECEDENT’S DATE OF DEATH __________________________________________

CODE HR ________________________

PERSONAL REPRESENTATIVE’S NAME _______________________________________________________________________

PERSONAL REPRESENTATIVE’S ADDRESS ___________________________________________________________________

PERSONAL REPRESENTATIVE’S E-MAIL ADDRESS ____________________________________________________________

(

)

PERSONAL REPRESENTATIVE’S TELEPHONE NUMBER ________________________________________________________

I, ___________________________________________________________________________, as personal representative (or

trustee or transferee) of the Estate of ____________________________________________________________________ and

pursuant to Item(s) __________________________ of decedent’s Last Will and Testament which creates a qualifying

life income interest in a trust or life estate which is in a form that would qualify for the federal estate tax marital

deduction under Section 2056(b)(5) or 2056(b)(7) of the Internal Revenue Code of 1954, as amended through

December 31, 1984, hereby irrevocably elects to treat the property passing under said item(s) of decedent’s

Last Will and Testament as property transferred to ________________________________________________ as

surviving spouse for purposes of the exemption granted to the spouse under KRS 140.080(1)(a). It is understood

that the remainder or balance of the trust or life estate will be included in the surviving spouse’s estate for Kentucky

inheritance and estate tax purposes at its value on the death of the surviving spouse regardless of where surviving

spouse is domiciled.

Signature of Person Making the Election

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1