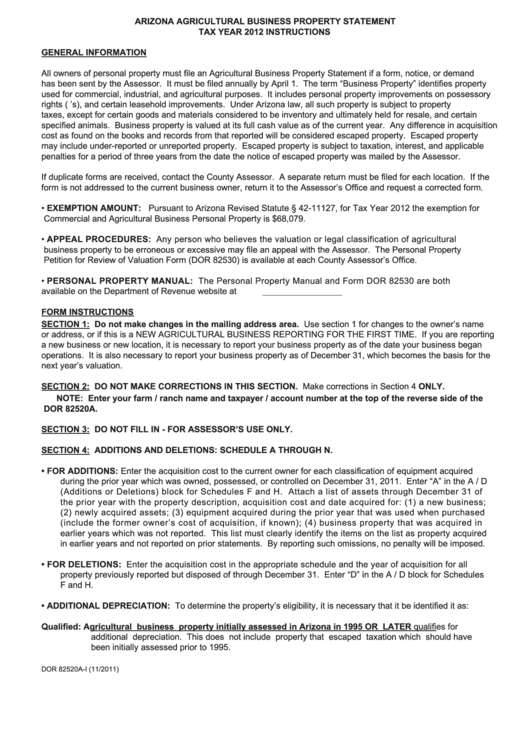

ARIZONA AGRICULTURAL BUSINESS PROPERTY STATEMENT

TAX YEAR 2012 INSTRUCTIONS

GENERAL INFORMATION

All owners of personal property must file an Agricultural Business Property Statement if a form, notice, or demand

has been sent by the Assessor. It must be filed annually by April 1. The term “Business Property” identifies property

used for commercial, industrial, and agricultural purposes. It includes personal property improvements on possessory

rights (I.P.R.’s), and certain leasehold improvements. Under Arizona law, all such property is subject to property

taxes, except for certain goods and materials considered to be inventory and ultimately held for resale, and certain

specified animals. Business property is valued at its full cash value as of the current year. Any difference in acquisition

cost as found on the books and records from that reported will be considered escaped property. Escaped property

may include under-reported or unreported property. Escaped property is subject to taxation, interest, and applicable

penalties for a period of three years from the date the notice of escaped property was mailed by the Assessor.

If duplicate forms are received, contact the County Assessor. A separate return must be filed for each location. If the

form is not addressed to the current business owner, return it to the Assessor’s Office and request a corrected form.

•

EXEMPTION AMOUNT: Pursuant to Arizona Revised Statute § 42-11127, for Tax Year 2012 the exemption for

Commercial and Agricultural Business Personal Property is $68,079.

•

APPEAL PROCEDURES: Any person who believes the valuation or legal classification of agricultural

business property to be erroneous or excessive may file an appeal with the Assessor. The Personal Property

Petition for Review of Valuation Form (DOR 82530) is available at each County Assessor’s Office.

•

PERSONAL PROPERTY MANUAL: The Personal Property Manual and Form DOR 82530 are both

available on the Department of Revenue website at

FORM INSTRUCTIONS

SECTION 1: Do not make changes in the mailing address area. Use section 1 for changes to the owner’s name

or address, or if this is a NEW AGRICULTURAL BUSINESS REPORTING FOR THE FIRST TIME. If you are reporting

a new business or new location, it is necessary to report your business property as of the date your business began

operations. It is also necessary to report your business property as of December 31, which becomes the basis for the

next year’s valuation.

SECTION 2: DO NOT MAKE CORRECTIONS IN THIS SECTION. Make corrections in Section 4 ONLY.

NOTE: Enter your farm / ranch name and taxpayer / account number at the top of the reverse side of the

DOR 82520A.

SECTION 3: DO NOT FILL IN - FOR ASSESSOR’S USE ONLY.

SECTION 4: ADDITIONS AND DELETIONS: SCHEDULE A THROUGH N.

•

FOR ADDITIONS: Enter the acquisition cost to the current owner for each classification of equipment acquired

during the prior year which was owned, possessed, or controlled on December 31, 2011. Enter “A” in the A / D

(Additions or Deletions) block for Schedules F and H. Attach a list of assets through December 31 of

the prior year with the property description, acquisition cost and date acquired for: (1) a new business;

(2) newly acquired assets; (3) equipment acquired during the prior year that was used when purchased

(include the former owner’s cost of acquisition, if known); (4) business property that was acquired in

earlier years which was not reported. This list must clearly identify the items on the list as property acquired

in earlier years and not reported on prior statements. By reporting such omissions, no penalty will be imposed.

•

FOR DELETIONS: Enter the acquisition cost in the appropriate schedule and the year of acquisition for all

property previously reported but disposed of through December 31. Enter “D” in the A / D block for Schedules

F and H.

•

ADDITIONAL DEPRECIATION: To determine the property’s eligibility, it is necessary that it be identified it as:

Qualified:

Agricultural business property initially assessed in Arizona in 1995 OR LATER qualifies for

additional depreciation. This does not include property that escaped taxation which should have

been initially assessed prior to 1995.

DOR 82520A-I (11/2011)

1

1 2

2 3

3 4

4