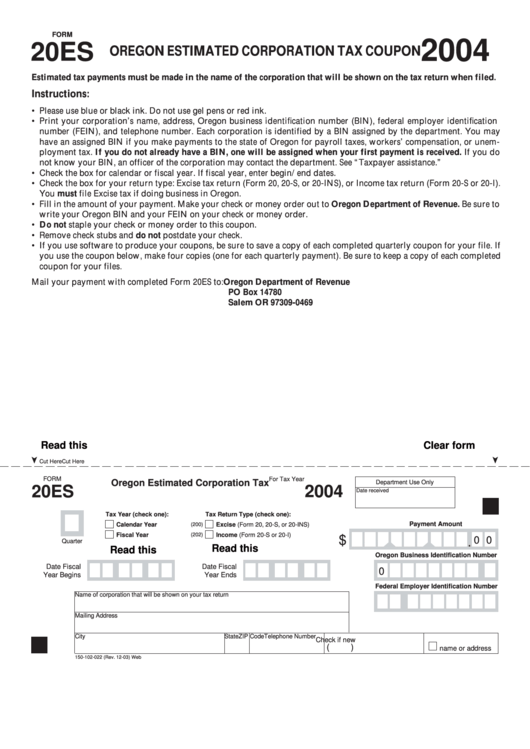

FORM

2004

20ES

OREGON ESTIMATED CORPORATION TAX COUPON

Estimated tax payments must be made in the name of the corporation that will be shown on the tax return when filed.

Instructions:

• Please use blue or black ink. Do not use gel pens or red ink.

• Print your corporation’s name, address, Oregon business identification number (BIN), federal employer identification

number (FEIN), and telephone number. Each corporation is identified by a BIN assigned by the department. You may

have an assigned BIN if you make payments to the state of Oregon for payroll taxes, workers’ compensation, or unem-

ployment tax. If you do not already have a BIN, one will be assigned when your first payment is received. If you do

not know your BIN, an officer of the corporation may contact the department. See “Taxpayer assistance.”

• Check the box for calendar or fiscal year. If fiscal year, enter begin/end dates.

• Check the box for your return type: Excise tax return (Form 20, 20-S, or 20-INS), or Income tax return (Form 20-S or 20-I).

You must file Excise tax if doing business in Oregon.

• Fill in the amount of your payment. Make your check or money order out to Oregon Department of Revenue. Be sure to

write your Oregon BIN and your FEIN on your check or money order.

• Do not staple your check or money order to this coupon.

• Remove check stubs and do not postdate your check.

• If you use software to produce your coupons, be sure to save a copy of each completed quarterly coupon for your file. If

you use the coupon below, make four copies (one for each quarterly payment). Be sure to keep a copy of each completed

coupon for your files.

Mail your payment with completed Form 20ES to: Oregon Department of Revenue

PO Box 14780

Salem OR 97309-0469

Read this

Clear form

Cut Here

Cut Here

FORM

For Tax Year

Oregon Estimated Corporation Tax

Department Use Only

20ES

2004

Date received

Tax Year (check one):

Tax Return Type (check one):

Payment Amount

Calendar Year

(200)

Excise (Form 20, 20-S, or 20-INS)

Fiscal Year

(202)

Income (Form 20-S or 20-I)

$

0 0

.

Quarter

Read this

Read this

Oregon Business Identification Number

Date Fiscal

Date Fiscal

0

Year Begins

Year Ends

Federal Employer Identification Number

Name of corporation that will be shown on your tax return

Mailing Address

City

State

ZIP Code

Telephone Number

Check if new

(

)

name or address

150-102-022 (Rev. 12-03) Web

1

1