Form Sr-2 - Application To Determine Liability - State Of Alabama

ADVERTISEMENT

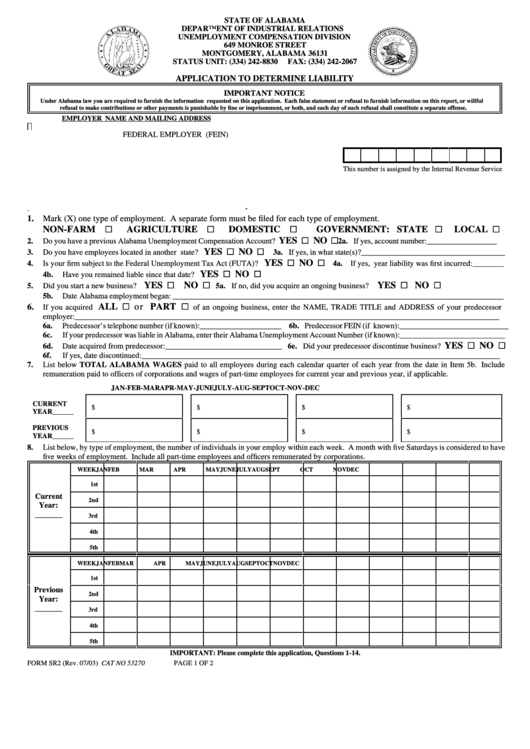

STATE OF ALABAMA

DEPARTMENT OF INDUSTRIAL RELATIONS

UNEMPLOYMENT COMPENSATION DIVISION

649 MONROE STREET

MONTGOMERY, ALABAMA 36131

STATUS UNIT: (334) 242-8830

FAX: (334) 242-2067

APPLICATION TO DETERMINE LIABILITY

IMPORTANT NOTICE

Under Alabama law you are required to furnish the information requested on this application. Each false statement or refusal to furnish information on this report, or willful

refusal to make contributions or other payments is punishable by fine or imprisonment, or both, and each day of such refusal shall constitute a separate offense.

EMPLOYER NAME AND MAILING ADDRESS

j

k

FEDERAL EMPLOYER I.D. NUMBER (FEIN)

This number is assigned by the Internal Revenue Service

.

-

1.

Mark (X) one type of employment. A separate form must be filed for each type of employment.

NON-FARM ~

AGRICULTURE ~

DOMESTIC ~

GOVERNMENT: STATE ~

LOCAL ~

YES ~ NO ~

2.

Do you have a previous Alabama Unemployment Compensation Account?

2a. If yes, account number:__________________

YES ~ NO ~

3.

Do you have employees located in another state?

3a. If yes, in what state(s)?_____________________________________

YES ~ NO ~

4.

Is your firm subject to the Federal Unemployment Tax Act (FUTA)?

4a. If yes, year liability was first incurred:________

YES ~ NO ~

4b.

Have you remained liable since that date?

YES ~ NO ~

YES ~ NO ~

5.

Did you start a new business?

5a. If no, did you acquire an ongoing business?

5b.

Date Alabama employment began: _____________________________________________________________________________________

ALL ~ or PART ~

6.

If you acquired

of an ongoing business, enter the NAME, TRADE TITLE and ADDRESS of your predecessor

employer:_____________________________________________________________________________________________________________

6a.

Predecessor’s telephone number (if known):_____________________ 6b. Predecessor FEIN (if known):____________________________

6c.

If your predecessor was liable in Alabama, enter their Alabama Unemployment Account Number (if known):___________________________

YES ~ NO ~

6d.

Date acquired from predecessor:______________________________ 6e. Did your predecessor discontinue business?

6f.

If yes, date discontinued:____________________________________________________________________________________________

7.

List below TOTAL ALABAMA WAGES paid to all employees during each calendar quarter of each year from the date in Item 5b. Include

remuneration paid to officers of corporations and wages of part-time employees for current year and previous year, if applicable.

JAN-FEB-MAR

APR-MAY-JUNE

JULY-AUG-SEPT

OCT-NOV-DEC

CURRENT

$

$

$

$

YEAR______

PREVIOUS

$

$

$

$

YEAR______

8.

List below, by type of employment, the number of individuals in your employ within each week. A month with five Saturdays is considered to have

five weeks of employment. Include all part-time employees and officers remunerated by corporations.

WEEK

JAN

FEB

MAR

APR

MAY

JUNE

JULY

AUG

SEPT

OCT

NOV

DEC

1st

Current

2nd

Year:

_______

3rd

4th

5th

WEEK

JAN

FEB

MAR

APR

MAY

JUNE

JULY

AUG

SEPT

OCT

NOV

DEC

1st

Previous

2nd

Year:

_______

3rd

4th

5th

IMPORTANT: Please complete this application, Questions 1-14.

FORM SR2 (Rev. 07/03) CAT NO 53270

PAGE 1 OF 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2