Form 54259 - Schedule In-2058sp - Nonresident Military Spouse Earned Income Deduction - 2013

ADVERTISEMENT

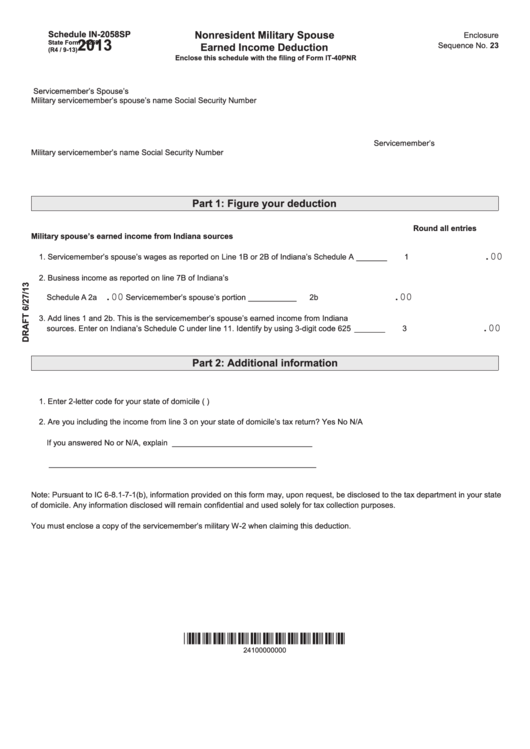

Schedule IN-2058SP

Nonresident Military Spouse

Enclosure

2013

State Form 54259

Sequence No. 23

Earned Income Deduction

(R4 / 9-13)

Enclose this schedule with the filing of Form IT-40PNR

Servicemember’s Spouse’s

Military servicemember’s spouse’s name

Social Security Number

Servicemember’s

Military servicemember’s name

Social Security Number

Part 1: Figure your deduction

Round all entries

Military spouse’s earned income from Indiana sources

.00

1. Servicemember’s spouse’s wages as reported on Line 1B or 2B of Indiana’s Schedule A _______

1

2. Business income as reported on line 7B of Indiana’s

.00

.00

Schedule A

2a

Servicemember’s spouse’s portion ___________

2b

3. Add lines 1 and 2b. This is the servicemember’s spouse’s earned income from Indiana

.00

sources. Enter on Indiana’s Schedule C under line 11. Identify by using 3-digit code 625 _______

3

Part 2: Additional information

1. Enter 2-letter code for your state of domicile (e.g. IN for Indiana)

2. Are you including the income from line 3 on your state of domicile’s tax return?

Yes

No

N/A

If you answered No or N/A, explain ________________________________

_____________________________________________________________

Note: Pursuant to IC 6-8.1-7-1(b), information provided on this form may, upon request, be disclosed to the tax department in your state

of domicile. Any information disclosed will remain confidential and used solely for tax collection purposes.

You must enclose a copy of the servicemember’s military W-2 when claiming this deduction.

*24100000000*

24100000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2