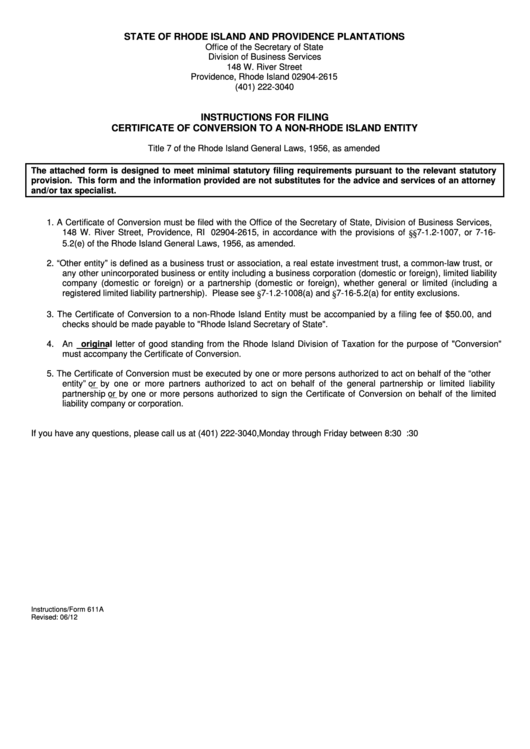

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

Office of the Secretary of State

Division of Business Services

148 W. River Street

Providence, Rhode Island 02904-2615

(401) 222-3040

INSTRUCTIONS FOR FILING

CERTIFICATE OF CONVERSION TO A NON-RHODE ISLAND ENTITY

Title 7 of the Rhode Island General Laws, 1956, as amended

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant statutory

provision. This form and the information provided are not substitutes for the advice and services of an attorney

and/or tax specialist.

1. A Certificate of Conversion must be filed with the Office of the Secretary of State, Division of Business Services,

148 W. River Street, Providence, RI 02904-2615, in accordance with the provisions of §§7-1.2-1007, or 7-16-

5.2(e) of the Rhode Island General Laws, 1956, as amended.

2. “Other entity” is defined as a business trust or association, a real estate investment trust, a common-law trust, or

any other unincorporated business or entity including a business corporation (domestic or foreign), limited liability

company (domestic or foreign) or a partnership (domestic or foreign), whether general or limited (including a

registered limited liability partnership). Please see §7-1.2-1008(a) and §7-16-5.2(a) for entity exclusions.

3. The Certificate of Conversion to a non-Rhode Island Entity must be accompanied by a filing fee of $50.00, and

checks should be made payable to "Rhode Island Secretary of State".

4. An original letter of good standing from the Rhode Island Division of Taxation for the purpose of "Conversion"

must accompany the Certificate of Conversion.

5. The Certificate of Conversion must be executed by one or more persons authorized to act on behalf of the “other

entity” or by one or more partners authorized to act on behalf of the general partnership or limited liability

partnership or by one or more persons authorized to sign the Certificate of Conversion on behalf of the limited

liability company or corporation.

If you have any questions, please call us at (401) 222-3040, Monday through Friday between 8:30 a.m. and 4:30 p.m.

Instructions/Form 611A

Revised: 06/12

1

1 2

2 3

3