Instructions For Combined Report (Form Cr) - Maine Revenue Services

ADVERTISEMENT

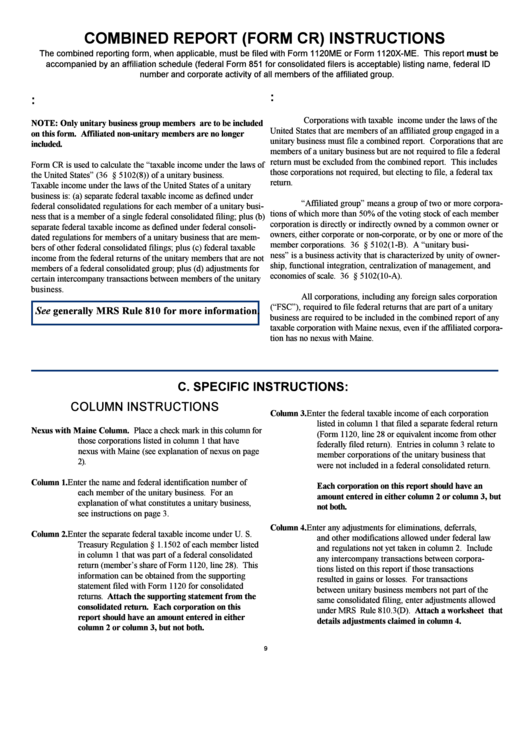

COMBINED REPORT (FORM CR) INSTRUCTIONS

The combined reporting form, when applicable, must be filed with Form 1120ME or Form 1120X-ME. This report must be

accompanied by an affiliation schedule (federal Form 851 for consolidated filers is acceptable) listing name, federal ID

number and corporate activity of all members of the affiliated group.

B.

COMBINED REPORTING:

A.

PURPOSE OF FORM:

Corporations with taxable income under the laws of the

NOTE: Only unitary business group members are to be included

United States that are members of an affiliated group engaged in a

on this form. Affiliated non-unitary members are no longer

unitary business must file a combined report. Corporations that are

included.

members of a unitary business but are not required to file a federal

return must be excluded from the combined report. This includes

Form CR is used to calculate the “taxable income under the laws of

those corporations not required, but electing to file, a federal tax

the United States” (36 M.R.S.A. § 5102(8)) of a unitary business.

return.

Taxable income under the laws of the United States of a unitary

business is: (a) separate federal taxable income as defined under

“Affiliated group” means a group of two or more corpora-

federal consolidated regulations for each member of a unitary busi-

tions of which more than 50% of the voting stock of each member

ness that is a member of a single federal consolidated filing; plus (b)

corporation is directly or indirectly owned by a common owner or

separate federal taxable income as defined under federal consoli-

owners, either corporate or non-corporate, or by one or more of the

dated regulations for members of a unitary business that are mem-

member corporations. 36 M.R.S.A. § 5102(1-B). A “unitary busi-

bers of other federal consolidated filings; plus (c) federal taxable

ness” is a business activity that is characterized by unity of owner-

income from the federal returns of the unitary members that are not

ship, functional integration, centralization of management, and

members of a federal consolidated group; plus (d) adjustments for

economies of scale. 36 M.R.S.A. § 5102(10-A).

certain intercompany transactions between members of the unitary

business.

All corporations, including any foreign sales corporation

(“FSC”), required to file federal returns that are part of a unitary

See generally MRS Rule 810 for more information.

business are required to be included in the combined report of any

taxable corporation with Maine nexus, even if the affiliated corpora-

tion has no nexus with Maine.

C. SPECIFIC INSTRUCTIONS:

COLUMN INSTRUCTIONS

Column 3.

Enter the federal taxable income of each corporation

listed in column 1 that filed a separate federal return

Nexus with Maine Column. Place a check mark in this column for

(Form 1120, line 28 or equivalent income from other

those corporations listed in column 1 that have

federally filed return). Entries in column 3 relate to

nexus with Maine (see explanation of nexus on page

member corporations of the unitary business that

2).

were not included in a federal consolidated return.

Column 1.

Enter the name and federal identification number of

Each corporation on this report should have an

each member of the unitary business. For an

amount entered in either column 2 or column 3, but

explanation of what constitutes a unitary business,

not both.

see instructions on page 3.

Column 4.

Enter any adjustments for eliminations, deferrals,

Column 2.

Enter the separate federal taxable income under U. S.

and other modifications allowed under federal law

Treasury Regulation § 1.1502 of each member listed

and regulations not yet taken in column 2. Include

in column 1 that was part of a federal consolidated

any intercompany transactions between corpora-

return (member’s share of Form 1120, line 28). This

tions listed on this report if those transactions

information can be obtained from the supporting

resulted in gains or losses. For transactions

statement filed with Form 1120 for consolidated

between unitary business members not part of the

returns. Attach the supporting statement from the

same consolidated filing, enter adjustments allowed

consolidated return. Each corporation on this

under MRS Rule 810.3(D). Attach a worksheet that

report should have an amount entered in either

details adjustments claimed in column 4.

column 2 or column 3, but not both.

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2