Instructions For Form E-500 Sales And Use Tax Return

ADVERTISEMENT

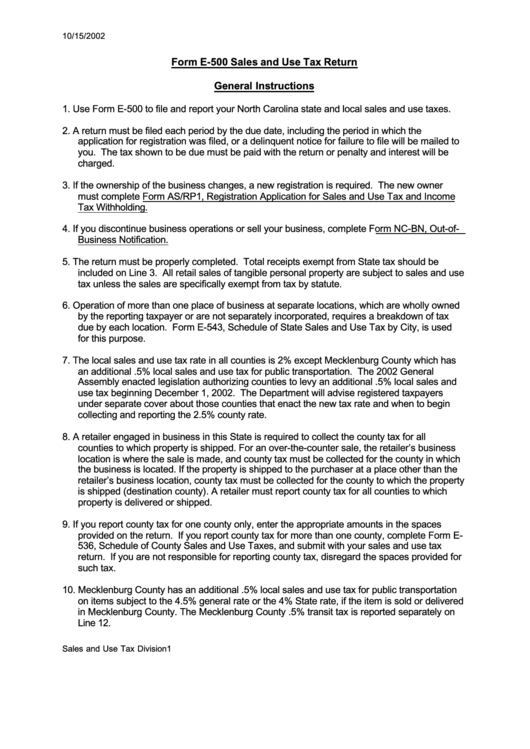

10/15/2002

Form E-500 Sales and Use Tax Return

General Instructions

1. Use Form E-500 to file and report your North Carolina state and local sales and use taxes.

2. A return must be filed each period by the due date, including the period in which the

application for registration was filed, or a delinquent notice for failure to file will be mailed to

you. The tax shown to be due must be paid with the return or penalty and interest will be

charged.

3. If the ownership of the business changes, a new registration is required. The new owner

must complete Form AS/RP1, Registration Application for Sales and Use Tax and Income

Tax Withholding.

4. If you discontinue business operations or sell your business, complete Form NC-BN, Out-of-

Business Notification.

5. The return must be properly completed. Total receipts exempt from State tax should be

included on Line 3. All retail sales of tangible personal property are subject to sales and use

tax unless the sales are specifically exempt from tax by statute.

6. Operation of more than one place of business at separate locations, which are wholly owned

by the reporting taxpayer or are not separately incorporated, requires a breakdown of tax

due by each location. Form E-543, Schedule of State Sales and Use Tax by City, is used

for this purpose.

7. The local sales and use tax rate in all counties is 2% except Mecklenburg County which has

an additional .5% local sales and use tax for public transportation. The 2002 General

Assembly enacted legislation authorizing counties to levy an additional .5% local sales and

use tax beginning December 1, 2002. The Department will advise registered taxpayers

under separate cover about those counties that enact the new tax rate and when to begin

collecting and reporting the 2.5% county rate.

8. A retailer engaged in business in this State is required to collect the county tax for all

counties to which property is shipped. For an over-the-counter sale, the retailer’s business

location is where the sale is made, and county tax must be collected for the county in which

the business is located. If the property is shipped to the purchaser at a place other than the

retailer’s business location, county tax must be collected for the county to which the property

is shipped (destination county). A retailer must report county tax for all counties to which

property is delivered or shipped.

9. If you report county tax for one county only, enter the appropriate amounts in the spaces

provided on the return. If you report county tax for more than one county, complete Form E-

536, Schedule of County Sales and Use Taxes, and submit with your sales and use tax

return. If you are not responsible for reporting county tax, disregard the spaces provided for

such tax.

10. Mecklenburg County has an additional .5% local sales and use tax for public transportation

on items subject to the 4.5% general rate or the 4% State rate, if the item is sold or delivered

in Mecklenburg County. The Mecklenburg County .5% transit tax is reported separately on

Line 12.

Sales and Use Tax Division

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6