Form Pwr - Partnership E-File Waiver Request Instructions - 2014

ADVERTISEMENT

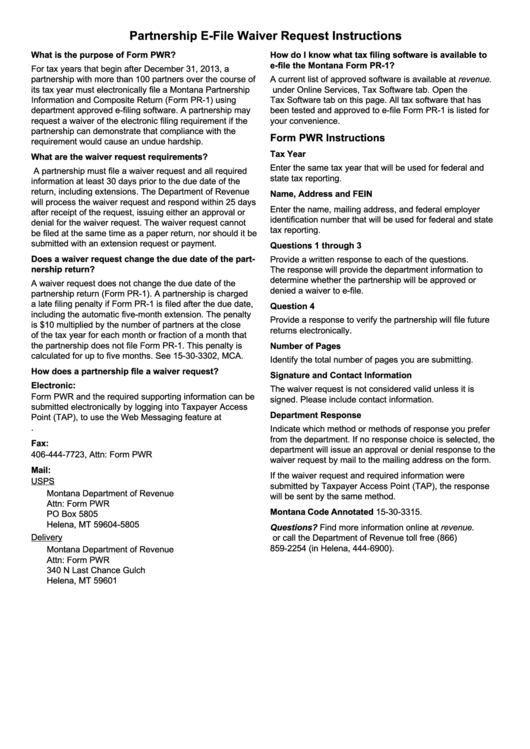

Partnership E-File Waiver Request Instructions

What is the purpose of Form PWR?

How do I know what tax filing software is available to

e-file the Montana Form PR-1?

For tax years that begin after December 31, 2013, a

partnership with more than 100 partners over the course of

A current list of approved software is available at revenue.

its tax year must electronically file a Montana Partnership

mt.gov under Online Services, Tax Software tab. Open the

Information and Composite Return (Form PR-1) using

Tax Software tab on this page. All tax software that has

department approved e-filing software. A partnership may

been tested and approved to e-file Form PR-1 is listed for

request a waiver of the electronic filing requirement if the

your convenience.

partnership can demonstrate that compliance with the

Form PWR Instructions

requirement would cause an undue hardship.

Tax Year

What are the waiver request requirements?

Enter the same tax year that will be used for federal and

A partnership must file a waiver request and all required

state tax reporting.

information at least 30 days prior to the due date of the

return, including extensions. The Department of Revenue

Name, Address and FEIN

will process the waiver request and respond within 25 days

Enter the name, mailing address, and federal employer

after receipt of the request, issuing either an approval or

identification number that will be used for federal and state

denial for the waiver request. The waiver request cannot

tax reporting.

be filed at the same time as a paper return, nor should it be

submitted with an extension request or payment.

Questions 1 through 3

Does a waiver request change the due date of the part-

Provide a written response to each of the questions.

nership return?

The response will provide the department information to

determine whether the partnership will be approved or

A waiver request does not change the due date of the

denied a waiver to e-file.

partnership return (Form PR-1). A partnership is charged

a late filing penalty if Form PR-1 is filed after the due date,

Question 4

including the automatic five-month extension. The penalty

Provide a response to verify the partnership will file future

is $10 multiplied by the number of partners at the close

returns electronically.

of the tax year for each month or fraction of a month that

the partnership does not file Form PR-1. This penalty is

Number of Pages

calculated for up to five months. See 15-30-3302, MCA.

Identify the total number of pages you are submitting.

How does a partnership file a waiver request?

Signature and Contact Information

Electronic:

The waiver request is not considered valid unless it is

Form PWR and the required supporting information can be

signed. Please include contact information.

submitted electronically by logging into Taxpayer Access

Department Response

Point (TAP), to use the Web Messaging feature at https://

tap.dor.mt.gov.

Indicate which method or methods of response you prefer

from the department. If no response choice is selected, the

Fax:

department will issue an approval or denial response to the

406-444-7723, Attn: Form PWR

waiver request by mail to the mailing address on the form.

Mail:

If the waiver request and required information were

USPS

submitted by Taxpayer Access Point (TAP), the response

Montana Department of Revenue

will be sent by the same method.

Attn: Form PWR

Montana Code Annotated 15-30-3315.

PO Box 5805

Helena, MT 59604-5805

Questions? Find more information online at revenue.

Delivery

mt.gov or call the Department of Revenue toll free (866)

859-2254 (in Helena, 444-6900).

Montana Department of Revenue

Attn: Form PWR

340 N Last Chance Gulch

Helena, MT 59601

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1