Quality Child-Care Investment Tax Credit Worksheet For Tax Year 2012

ADVERTISEMENT

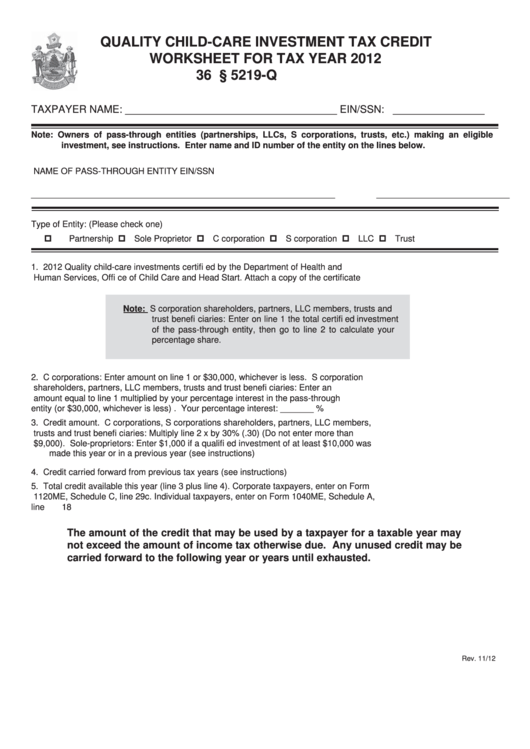

QUALITY CHILD-CARE INVESTMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2012

36 M.R.S.A. § 5219-Q

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

Type of Entity: (Please check one)

Partnership

Sole Proprietor

C corporation

S corporation

LLC

Trust

1.

2012 Quality child-care investments certifi ed by the Department of Health and

Human Services, Offi ce of Child Care and Head Start. Attach a copy of the certifi cate ........ 1. __________________

Note: S corporation shareholders, partners, LLC members, trusts and

trust benefi ciaries: Enter on line 1 the total certifi ed investment

of the pass-through entity, then go to line 2 to calculate your

percentage share.

2.

C corporations: Enter amount on line 1 or $30,000, whichever is less. S corporation

shareholders, partners, LLC members, trusts and trust benefi ciaries: Enter an

amount equal to line 1 multiplied by your percentage interest in the pass-through

entity (or $30,000, whichever is less) . Your percentage interest: _______ % ....................... 2. __________________

3.

Credit amount. C corporations, S corporations shareholders, partners, LLC members,

trusts and trust benefi ciaries: Multiply line 2 x by 30% (.30) (Do not enter more than

$9,000). Sole-proprietors: Enter $1,000 if a qualifi ed investment of at least $10,000 was

made this year or in a previous year (see instructions) ....................................................... 3. __________________

4.

Credit carried forward from previous tax years (see instructions) ........................................... 4. __________________

5.

Total credit available this year (line 3 plus line 4). Corporate taxpayers, enter on Form

1120ME, Schedule C, line 29c. Individual taxpayers, enter on Form 1040ME, Schedule A,

line 18 ...................................................................................................................................... 5. __________________

The amount of the credit that may be used by a taxpayer for a taxable year may

not exceed the amount of income tax otherwise due. Any unused credit may be

carried forward to the following year or years until exhausted.

Rev. 11/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1