High-Technology Investment Tax Credit Worksheet - 2012

ADVERTISEMENT

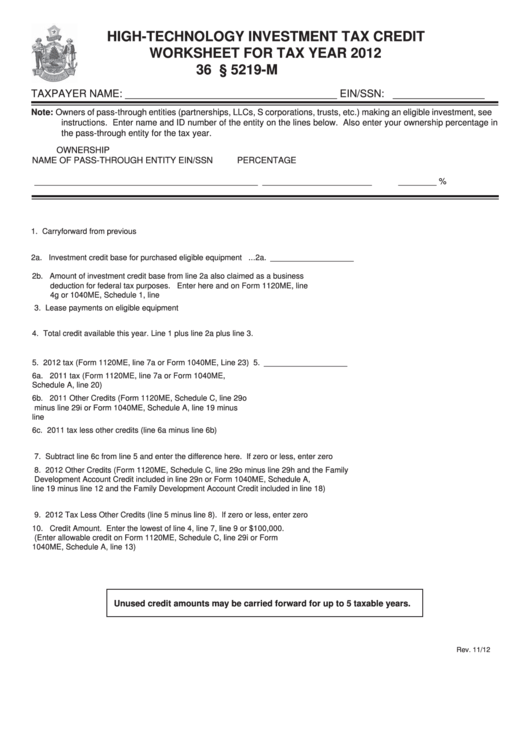

HIGH-TECHNOLOGY INVESTMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2012

36 M.R.S.A. § 5219-M

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible investment, see

instructions. Enter name and ID number of the entity on the lines below. Also enter your ownership percentage in

the pass-through entity for the tax year.

OWNERSHIP

NAME OF PASS-THROUGH ENTITY

EIN/SSN

PERCENTAGE

_______________________________________________

_______________________

________ %

1. Carryforward from previous year............................................................................................................. 1. ___________________

2a. Investment credit base for purchased eligible equipment .................................................................... 2a. ___________________

2b. Amount of investment credit base from line 2a also claimed as a business

deduction for federal tax purposes. Enter here and on Form 1120ME, line

4g or 1040ME, Schedule 1, line 1h................................................... 2b. ______________________

3. Lease payments on eligible equipment .................................................................................................. 3. ___________________

4. Total credit available this year. Line 1 plus line 2a plus line 3. ............................................................... 4. ___________________

5. 2012 tax (Form 1120ME, line 7a or Form 1040ME, Line 23) ..................................................................5. ___________________

6a. 2011 tax (Form 1120ME, line 7a or Form 1040ME,

Schedule A, line 20) .......................................................................... 6a. ______________________

6b. 2011 Other Credits (Form 1120ME, Schedule C, line 29o

minus line 29i or Form 1040ME, Schedule A, line 19 minus

line 14................................................................................................6b. ______________________

6c. 2011 tax less other credits (line 6a minus line 6b) ................................................................................ 6c. ___________________

7. Subtract line 6c from line 5 and enter the difference here. If zero or less, enter zero ............................ 7. ___________________

8. 2012 Other Credits (Form 1120ME, Schedule C, line 29o minus line 29h and the Family

Development Account Credit included in line 29n or Form 1040ME, Schedule A,

line 19 minus line 12 and the Family Development Account Credit included in line 18) ........................ 8. ___________________

9. 2012 Tax Less Other Credits (line 5 minus line 8). If zero or less, enter zero ........................................ 9. ___________________

10. Credit Amount. Enter the lowest of line 4, line 7, line 9 or $100,000.

(Enter allowable credit on Form 1120ME, Schedule C, line 29i or Form

1040ME, Schedule A, line 13) ............................................................................................................... 10. ___________________

Unused credit amounts may be carried forward for up to 5 taxable years.

Rev. 11/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1