Employer-Assisted Day Care Tax Credit Worksheet For Tax Year 2012

ADVERTISEMENT

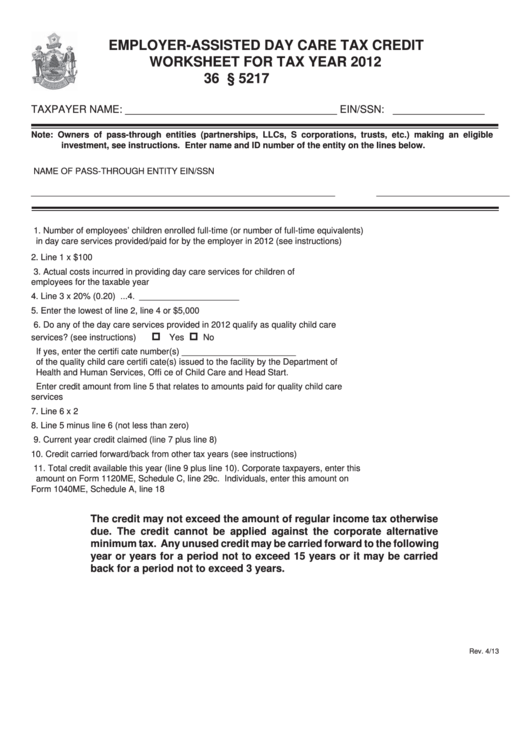

EMPLOYER-ASSISTED DAY CARE TAX CREDIT

WORKSHEET FOR TAX YEAR 2012

36 M.R.S.A. § 5217

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1. Number of employees’ children enrolled full-time (or number of full-time equivalents)

in day care services provided/paid for by the employer in 2012 (see instructions) ..........1. _____________________

2. Line 1 x $100 ...................................................................................................................2. _____________________

3. Actual costs incurred in providing day care services for children of

employees for the taxable year ........................................................................................3. _____________________

4. Line 3 x 20% (0.20) ..........................................................................................................4. _____________________

5. Enter the lowest of line 2, line 4 or $5,000 .......................................................................5. _____________________

6. Do any of the day care services provided in 2012 qualify as quality child care

Yes

services? (see instructions) ................................................................................................

No

If yes, enter the certifi cate number(s) ________________________

of the quality child care certifi cate(s) issued to the facility by the Department of

Health and Human Services, Offi ce of Child Care and Head Start.

Enter credit amount from line 5 that relates to amounts paid for quality child care

services ............................................................................................................................6. _____________________

7. Line 6 x 2 .........................................................................................................................7. _____________________

8. Line 5 minus line 6 (not less than zero) ...........................................................................8. _____________________

9. Current year credit claimed (line 7 plus line 8) .................................................................9. _____________________

10. Credit carried forward/back from other tax years (see instructions) ..............................10. _____________________

11. Total credit available this year (line 9 plus line 10). Corporate taxpayers, enter this

amount on Form 1120ME, Schedule C, line 29c. Individuals, enter this amount on

Form 1040ME, Schedule A, line 18 ............................................................................... 11. _____________________

The credit may not exceed the amount of regular income tax otherwise

due. The credit cannot be applied against the corporate alternative

minimum tax. Any unused credit may be carried forward to the following

year or years for a period not to exceed 15 years or it may be carried

back for a period not to exceed 3 years.

Rev. 4/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1