Rp Form 19-77 - Charitable & Miscellaneous Exemption - 2011

ADVERTISEMENT

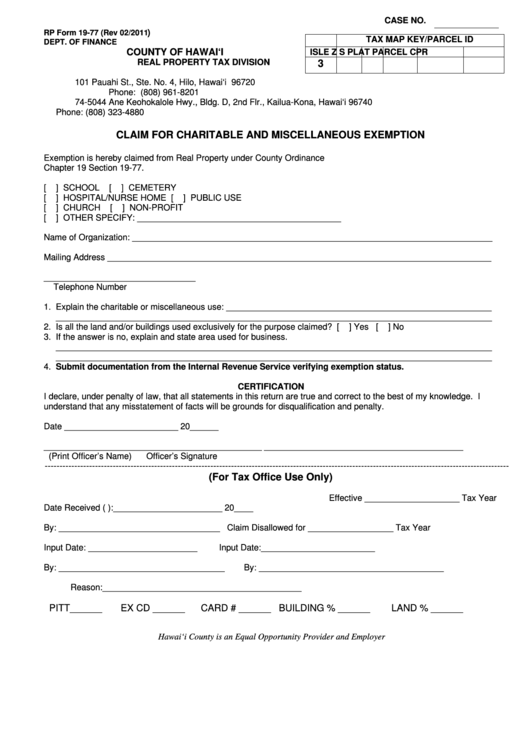

CASE NO.

)

RP Form 19-77 (Rev 02/2011

TAX MAP KEY/PARCEL ID

DEPT. OF FINANCE

COUNTY OF HAWAI‘I

ISLE

Z

S

PLAT

PARCEL

CPR

REAL PROPERTY TAX DIVISION

3

101 Pauahi St., Ste. No. 4, Hilo, Hawai‘i 96720

Phone: (808) 961-8201

74-5044 Ane Keohokalole Hwy., Bldg. D, 2nd Flr., Kailua-Kona, Hawai‘i 96740

Phone: (808) 323-4880

CLAIM FOR CHARITABLE AND MISCELLANEOUS EXEMPTION

Exemption is hereby claimed from Real Property under County Ordinance

Chapter 19 Section 19-77.

[

] SCHOOL

[

] CEMETERY

[

] HOSPITAL/NURSE HOME

[

] PUBLIC USE

[

] CHURCH

[

] NON-PROFIT

[

] OTHER SPECIFY: ___________________________________________

Name of Organization: ____________________________________________________________________________

Mailing Address _________________________________________________________________________________

________________________________

Telephone Number

1. Explain the charitable or miscellaneous use: ________________________________________________________

____________________________________________________________________________________________

2. Is all the land and/or buildings used exclusively for the purpose claimed? [

] Yes [

] No

3. If the answer is no, explain and state area used for business.

____________________________________________________________________________________________

____________________________________________________________________________________________

4. Submit documentation from the Internal Revenue Service verifying exemption status.

CERTIFICATION

I declare, under penalty of law, that all statements in this return are true and correct to the best of my knowledge. I

understand that any misstatement of facts will be grounds for disqualification and penalty.

Date ________________________ 20______

______________________________________________

__________________________________________

(Print Officer’s Name)

Officer’s Signature

-------------------------------------------------------------------------------------------------------------------------------------------------------------

(For Tax Office Use Only)

Effective ____________________ Tax Year

Date Received (U.S. Postmark):_______________________ 20____

By: __________________________________

Claim Disallowed for __________________ Tax Year

Input Date: _______________________

Input Date:________________________

By: ___________________________________

By: _______________________________________

Reason:__________________________________________

PITT______

EX CD ______

CARD # ______

BUILDING % ______

LAND % ______

Hawai‘i County is an Equal Opportunity Provider and Employer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1