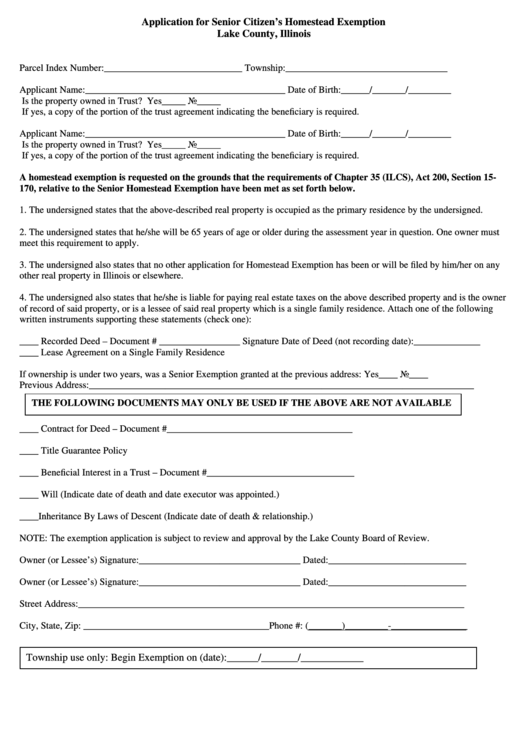

Application for Senior Citizen’s Homestead Exemption

Lake County, Illinois

Parcel Index Number:_____________________________ Township:__________________________________

Applicant Name:__________________________________________ Date of Birth:______/_______/_________

Is the property owned in Trust? Yes_____

No_____

If yes, a copy of the portion of the trust agreement indicating the beneficiary is required.

Applicant Name:__________________________________________ Date of Birth:______/_______/_________

Is the property owned in Trust? Yes_____

No_____

If yes, a copy of the portion of the trust agreement indicating the beneficiary is required.

A homestead exemption is requested on the grounds that the requirements of Chapter 35 (ILCS), Act 200, Section 15-

170, relative to the Senior Homestead Exemption have been met as set forth below.

1. The undersigned states that the above-described real property is occupied as the primary residence by the undersigned.

2. The undersigned states that he/she will be 65 years of age or older during the assessment year in question. One owner must

meet this requirement to apply.

3. The undersigned also states that no other application for Homestead Exemption has been or will be filed by him/her on any

other real property in Illinois or elsewhere.

4. The undersigned also states that he/she is liable for paying real estate taxes on the above described property and is the owner

of record of said property, or is a lessee of said real property which is a single family residence. Attach one of the following

written instruments supporting these statements (check one):

____ Recorded Deed – Document # _________________ Signature Date of Deed (not recording date):______________

____ Lease Agreement on a Single Family Residence

If ownership is under two years, was a Senior Exemption granted at the previous address: Yes____ No____

Previous Address:_________________________________________________________________________________

THE FOLLOWING DOCUMENTS MAY ONLY BE USED IF THE ABOVE ARE NOT AVAILABLE

____ Contract for Deed – Document #_______________________________________

____ Title Guarantee Policy

____ Beneficial Interest in a Trust – Document #_______________________________

____ Will (Indicate date of death and date executor was appointed.)

____Inheritance By Laws of Descent (Indicate date of death & relationship.)

NOTE: The exemption application is subject to review and approval by the Lake County Board of Review.

Owner (or Lessee’s) Signature:__________________________________ Dated:_____________________________

Owner (or Lessee’s) Signature:__________________________________ Dated:_____________________________

Street Address:_________________________________________________________________________________

City, State, Zip: _______________________________________Phone #: (_______)_________-________________

Township use only: Begin Exemption on (date):______/_______/____________

1

1