Special Circumstance Form - 2016-2017

ADVERTISEMENT

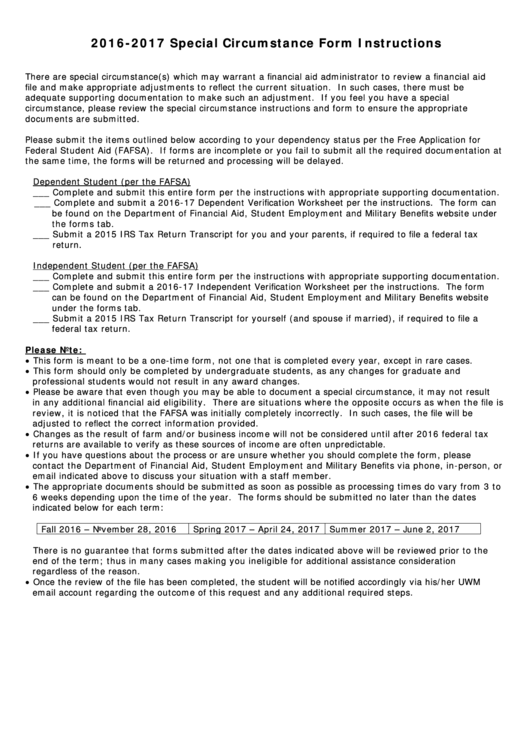

2016-2017 Special Circumstance Form Instructions

There are special circumstance(s) which may warrant a financial aid administrator to review a financial aid

file and make appropriate adjustments to reflect the current situation. In such cases, there must be

adequate supporting documentation to make such an adjustment. If you feel you have a special

circumstance, please review the special circumstance instructions and form to ensure the appropriate

documents are submitted.

Please submit the items outlined below according to your dependency status per the Free Application for

Federal Student Aid (FAFSA). If forms are incomplete or you fail to submit all the required documentation at

the same time, the forms will be returned and processing will be delayed.

Dependent Student (per the FAFSA)

___ Complete and submit this entire form per the instructions with appropriate supporting documentation.

___ Complete and submit a 2016-17 Dependent Verification Worksheet per the instructions. The form can

be found on the Department of Financial Aid, Student Employment and Military Benefits website under

the forms tab.

___ Submit a 2015 IRS Tax Return Transcript for you and your parents, if required to file a federal tax

return.

Independent Student (per the FAFSA)

___ Complete and submit this entire form per the instructions with appropriate supporting documentation.

___ Complete and submit a 2016-17 Independent Verification Worksheet per the instructions. The form

can be found on the Department of Financial Aid, Student Employment and Military Benefits website

under the forms tab.

___ Submit a 2015 IRS Tax Return Transcript for yourself (and spouse if married), if required to file a

federal tax return.

Please Note:

• This form is meant to be a one-time form, not one that is completed every year, except in rare cases.

• This form should only be completed by undergraduate students, as any changes for graduate and

professional students would not result in any award changes.

• Please be aware that even though you may be able to document a special circumstance, it may not result

in any additional financial aid eligibility. There are situations where the opposite occurs as when the file is

review, it is noticed that the FAFSA was initially completely incorrectly. In such cases, the file will be

adjusted to reflect the correct information provided.

• Changes as the result of farm and/or business income will not be considered until after 2016 federal tax

returns are available to verify as these sources of income are often unpredictable.

• If you have questions about the process or are unsure whether you should complete the form, please

contact the Department of Financial Aid, Student Employment and Military Benefits via phone, in-person, or

email indicated above to discuss your situation with a staff member.

• The appropriate documents should be submitted as soon as possible as processing times do vary from 3 to

6 weeks depending upon the time of the year. The forms should be submitted no later than the dates

indicated below for each term:

Fall 2016 – November 28, 2016

Spring 2017 – April 24, 2017

Summer 2017 – June 2, 2017

There is no guarantee that forms submitted after the dates indicated above will be reviewed prior to the

end of the term; thus in many cases making you ineligible for additional assistance consideration

regardless of the reason.

• Once the review of the file has been completed, the student will be notified accordingly via his/her UWM

email account regarding the outcome of this request and any additional required steps.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4