Instructions For Wisconsin Real Estate Transfer Return

ADVERTISEMENT

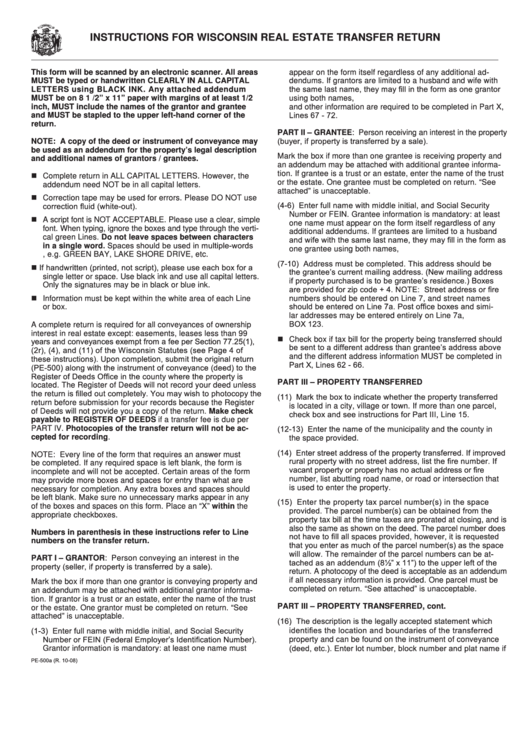

INSTRUCTIONS FOR WISCONSIN REAL ESTATE TRANSFER RETURN

This form will be scanned by an electronic scanner. All areas

appear on the form itself regardless of any additional ad-

MUST be typed or handwritten CLEARLY IN ALL CAPITAL

dendums. If grantors are limited to a husband and wife with

the same last name, they may fill in the form as one grantor

LETTERS using BLACK INK. Any attached addendum

MUST be on 8 1 /2” x 11” paper with margins of at least 1/2

using both names, e.g. JOHN AND JANE. Grantor address

inch, MUST include the names of the grantor and grantee

and other information are required to be completed in Part X,

Lines 67 - 72.

and MUST be stapled to the upper left-hand corner of the

return.

PART II – GRANTEE: Person receiving an interest in the property

(buyer, if property is transferred by a sale).

NOTE: A copy of the deed or instrument of conveyance may

be used as an addendum for the property’s legal description

Mark the box if more than one grantee is receiving property and

and additional names of grantors / grantees.

an addendum may be attached with additional grantee informa-

tion. If grantee is a trust or an estate, enter the name of the trust

n Complete return in ALL CAPITAL LETTERS. However, the

or the estate. One grantee must be completed on return. “See

addendum need NOT be in all capital letters.

attached” is unacceptable.

n Correction tape may be used for errors. Please DO NOT use

(4-6) Enter full name with middle initial, and Social Security

correction fluid (white-out).

Number or FEIN. Grantee information is mandatory: at least

n A script font is NOT ACCEPTABLE. Please use a clear, simple

one name must appear on the form itself regardless of any

font. When typing, ignore the boxes and type through the verti-

additional addendums. If grantees are limited to a husband

cal green Lines. Do not leave spaces between characters

and wife with the same last name, they may fill in the form as

in a single word. Spaces should be used in multiple-words

one grantee using both names, e.g. JOHN AND JANE.

, e.g. GREEN BAY, LAKE SHORE DRIVE, etc.

(7-10) Address must be completed. This address should be

n If handwritten (printed, not script), please use each box for a

the grantee’s current mailing address. (New mailing address

single letter or space. Use black ink and use all capital letters.

if property purchased is to be grantee’s residence.) Boxes

Only the signatures may be in black or blue ink.

are provided for zip code + 4. NOTE: Street address or fire

n Information must be kept within the white area of each Line

numbers should be entered on Line 7, and street names

should be entered on Line 7a. Post office boxes and simi-

or box.

lar addresses may be entered entirely on Line 7a, e.g. PO

BOX 123.

A complete return is required for all conveyances of ownership

interest in real estate except: easements, leases less than 99

n Check box if tax bill for the property being transferred should

years and conveyances exempt from a fee per Section 77.25(1),

be sent to a different address than grantee’s address above

(2r), (4), and (11) of the Wisconsin Statutes (see Page 4 of

and the different address information MUST be completed in

these instructions). Upon completion, submit the original return

Part X, Lines 62 - 66.

(PE-500) along with the instrument of conveyance (deed) to the

Register of Deeds Office in the county where the property is

PART III – PROPERTY TRANSFERRED

located. The Register of Deeds will not record your deed unless

the return is filled out completely. You may wish to photocopy the

(11) Mark the box to indicate whether the property transferred

return before submission for your records because the Register

is located in a city, village or town. If more than one parcel,

of Deeds will not provide you a copy of the return. Make check

check box and see instructions for Part III, Line 15.

payable to REGISTER OF DEEDS if a transfer fee is due per

(12-13) Enter the name of the municipality and the county in

PART IV. Photocopies of the transfer return will not be ac-

cepted for recording.

the space provided.

(14) Enter street address of the property transferred. If improved

NOTE: Every line of the form that requires an answer must

rural property with no street address, list the fire number. If

be completed. If any required space is left blank, the form is

vacant property or property has no actual address or fire

incomplete and will not be accepted. Certain areas of the form

number, list abutting road name, or road or intersection that

may provide more boxes and spaces for entry than what are

is used to enter the property.

necessary for completion. Any extra boxes and spaces should

be left blank. Make sure no unnecessary marks appear in any

(15) Enter the property tax parcel number(s) in the space

of the boxes and spaces on this form. Place an “X” within the

provided. The parcel number(s) can be obtained from the

appropriate checkboxes.

property tax bill at the time taxes are prorated at closing, and is

also the same as shown on the deed. The parcel number does

Numbers in parenthesis in these instructions refer to Line

not have to fill all spaces provided, however, it is requested

numbers on the transfer return.

that you enter as much of the parcel number(s) as the space

will allow. The remainder of the parcel numbers can be at-

PART I – GRANTOR: Person conveying an interest in the

tached as an addendum (8½” x 11”) to the upper left of the

property (seller, if property is transferred by a sale).

return. A photocopy of the deed is acceptable as an addendum

if all necessary information is provided. One parcel must be

Mark the box if more than one grantor is conveying property and

completed on return. “See attached” is unacceptable.

an addendum may be attached with additional grantor informa-

tion. If grantor is a trust or an estate, enter the name of the trust

PART III – PROPERTY TRANSFERRED, cont.

or the estate. One grantor must be completed on return. “See

attached” is unacceptable.

(16) The description is the legally accepted statement which

identifies the location and boundaries of the transferred

(1-3) Enter full name with middle initial, and Social Security

Number or FEIN (Federal Employer’s Identification Number).

property and can be found on the instrument of conveyance

(deed, etc.). Enter lot number, block number and plat name if

Grantor information is mandatory: at least one name must

PE-500a (R. 10-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4